According to RealClearPolitics data as of February 2026, the Democrats have a 5.2% advantage in the "overall ballot," which practically guarantees a shift in power in the House of Representatives. Experts note that independent voters, who secured Trump's victory in 2024, are increasingly turning away from him due to harsh immigration policies and radical tariffs. Additionally, political analysts highlight 18 strategically important historically Republican states where support for the Republicans is currently very low. Consequently, the speaker of the House of Representatives may be from the Democratic faction after the elections.

According to a Harvard Caps/Harris Poll report, 55% of Americans view the results of the tariff policy negatively, considering them unsatisfactory as they only increase household expenses. A Third Way study shows a large gap among voters aged 18-29, with Democrats leading by 30%. All this data suggests that Republicans could lose around 30 seats in the House of Representatives.

What advantages remain for Donald Trump and his party? The Republicans have an edge in border security and crime fighting. In both areas, their advantage over the Democrats is estimated at about 13-14%. Political analysts also emphasize the significant advantage Trump's team has in financing. Republicans have accumulated several billion dollars for campaign slogans and candidate advertising, which may ensure victory in the information war. Additionally, a majority of Americans generally approve of the current government's direction regarding tax cuts, reduced government spending, and fighting against "wasteful spending" on unnecessary programs and projects.

However, the Democrats are likely to lose the Senate battle. Out of the 33 seats in the upper chamber that are subject to re-election, Republicans have an advantage in 20 districts, while Democrats have only 13. Thus, the task for the Democratic Party in the Senate appears as follows: protect all 13 of their districts while winning in 4 Republican ones. The most likely scenario for the upcoming elections is a loss of at least one chamber by the Republicans, after which Trump will no longer be able to pass his legislative acts. If Republicans lose both chambers, Trump should prepare for impeachment.

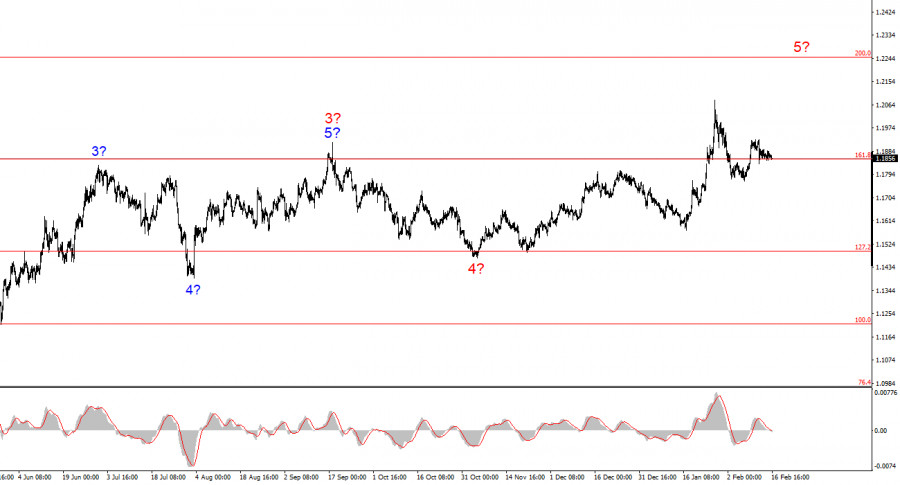

Based on the analysis of EUR/USD, I conclude that the instrument is continuing to build an upward phase of the trend. The policies of Trump and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the U.S. currency. The targets for the current segment of the trend may reach up to 25,000. At this moment, I believe that the instrument remains within the framework of a global wave 5, so I expect prices to rise in the first half of 2026. However, in the near future, the instrument may construct another downward wave within the correction. I find it sensible to search for areas and levels for new purchases with targets around the marks of 1.2195 and 1.2367, corresponding to the 161.8% and 200.0% Fibonacci.

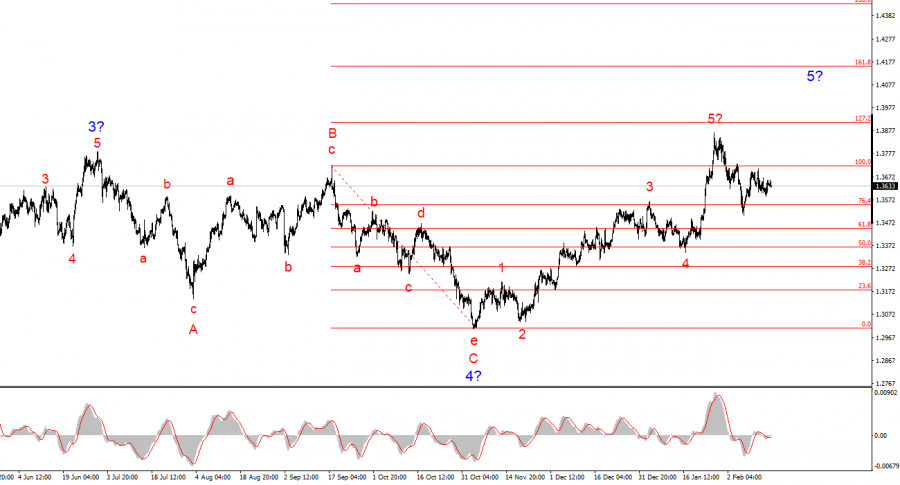

The wave picture of the GBP/USD instrument is quite clear. The five-wave upward structure has completed its formation, but the global wave 5 may take a much more extended form. I believe that in the near future, we may observe the construction of a corrective set of waves, after which the upward trend will resume. Therefore, in the coming weeks, I advise looking for opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of rising to $1.45-1.50. Trump himself welcomes the decline of the dollar, and the Fed has the opportunity to lower rates again at the next meeting.