The test of the 1.2459 price level earlier today coincided with the MACD indicator already significantly above the zero line, limiting the pair's upward potential. In this bearish market, I decided not to buy the pound.

UK data released earlier did not diminish the demand for the pound in the first half of the day, leaving focus on similar data from the U.S. The U.S. Services PMI, due in the second half of the day, is a crucial indicator reflecting the economy's health, especially in service-oriented economies like the U.S. If the data falls below expectations, it could heighten concerns about slowing economic growth, negatively impacting the U.S. dollar and further strengthening the pound. Additionally, FOMC member Lisa D. Cook's speech will draw attention, as her comments on the Fed's future monetary policy could influence the dollar. A cautious stance on further easing might support the dollar, particularly amid weak economic data.

For intraday strategies, I will focus on implementing Scenario #1 and Scenario #2.

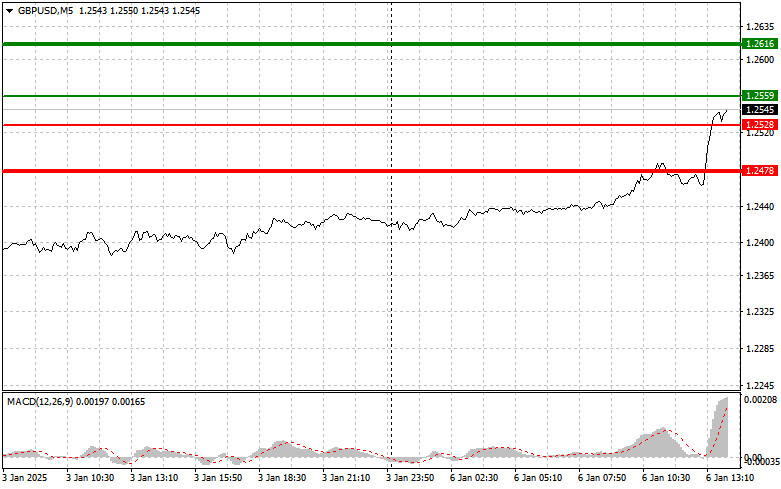

Scenario #1: Buy the pound at approximately 1.2559 (green line on the chart) with a target of 1.2616 (thick green line on the chart). At 1.2616, I plan to exit the market and initiate sell positions for a 30–35-point pullback. Pound strength today can be anticipated as a continuation of the bullish trend, particularly if the Fed adopts a dovish stance.Important: Before buying, ensure the MACD indicator is above the zero line and just beginning its upward movement.

Scenario #2: Buy the pound after two consecutive tests of the 1.2528 level when the MACD indicator is in the oversold zone. This will cap the pair's downward potential and could reverse the market upward. Targets would be 1.2559 and 1.2616.

Sell Signal

Scenario #1: Plan to sell the pound after the 1.2528 level is breached (red line on the chart), triggering a rapid decline in the pair. The key target for sellers will be 1.2478, where I plan to exit the market and initiate buy positions for a 20–25-point rebound. Sellers may reassert dominance if U.S. data is strong and the Fed maintains a hawkish stance.Important: Before selling, ensure the MACD indicator is below the zero line and just beginning its downward movement.

Scenario #2: Sell the pound after two consecutive tests of the 1.2559 level when the MACD indicator is in the overbought zone. This will cap the pair's upward potential and likely reverse the market downward. Expect a decline toward 1.2528 and 1.2478.

SZYBKIE LINKI