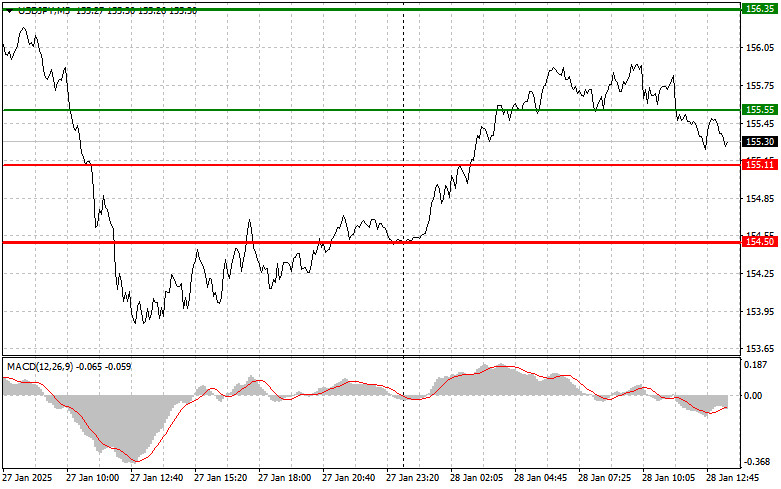

The 155.42 price test occurred at a time when the MACD indicator had moved significantly below the zero mark, which, in my opinion, limited the pair's downward potential. For this reason, I did not sell the dollar.

The yen has regained some ground against the dollar, but the market still favors USD/JPY buyers. In a recent interview, former Bank of Japan board member Sakurai stated that he expects a rate hike in June or July as Japan's economy recovers. Essentially, he reaffirmed the central bank's recently adopted course toward stabilizing monetary policy. Sakurai highlighted that Japan's improving economic conditions are tied to rising exports and increased consumer demand. These positive changes provide a foundation for revising the current interest rate policy, which has remained historically accommodative for several years. Sakurai emphasized that a rate hike would be an important step toward normalization, boosting investor confidence in the Japanese economy. However, he urged caution, pointing out that growth dynamics must remain sustainable. He also mentioned potential short-term impacts from global market slowdowns, which could pressure Japan, especially given the uncertainty surrounding Donald Trump's future policies.

Today, the US will release consumer confidence data, strong results of which could drive USD/JPY higher, as well as reports on durable goods orders and the Richmond Fed manufacturing index.

As for the intraday strategy, I will primarily rely on the implementation of Scenario #1 and Scenario #2 to continue the downward trend.

Buy Signal

Sell Signal

Scenario #2: Another selling opportunity will arise after two consecutive tests of the 155.55 level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. The expected decline will target 155.11 and 154.50.

Important: Beginner Forex traders must be cautious when making market entry decisions. Before the release of critical fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without Stop Losses, you can quickly lose your entire deposit, especially when trading large volumes without proper money management.

And remember: for successful trading, it is essential to have a clear trading plan, like the one provided above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

SZYBKIE LINKI