The euro and the pound remained under pressure following the U.S. Federal Reserve meeting, where markets saw neither the expected active rate cuts nor hints of them.

The strengthening of the dollar put additional strain on the European currency, which is already facing challenges due to the energy crisis and fears of recession. Traders will likely continue rebalancing their positions in favor of safer assets—especially considering that the euro and the pound are currently overbought. However, in the long term, the dollar's resilience will depend on the Federal Reserve's ability to control inflation and sustain economic growth.

Today, data are expected on the European Central Bank's current account balance and the eurozone consumer confidence index. While this data isn't particularly impactful, any signals pointing to a further economic slowdown in the eurozone—or, conversely, signs of stabilization—should be closely monitored.

The effect of this data on the euro will depend on how much the actual figures deviate from forecasts. A significant deterioration could trigger another wave of selling in the European currency, while unexpectedly positive results could support the euro and halt the ongoing correction.

Today, data on the UK's net public sector borrowing and industrial order balance will also be released. Economic indicators reflecting the domestic economy's health always substantially impact the currency market. If the published data comes in weaker than expected, it may signal problems in the UK economy, further pressure the pound.

If the data aligns with economists' expectations, the best approach is to trade based on the Mean Reversion strategy. However, the Momentum strategy is preferable if the data significantly exceeds or falls short of expectations.

Buying on a breakout above 1.0840 could lead to a rise toward 1.0870 and 1.0910.

Selling on a breakout below 1.0805 could lead to a drop toward 1.0770 and 1.0740.

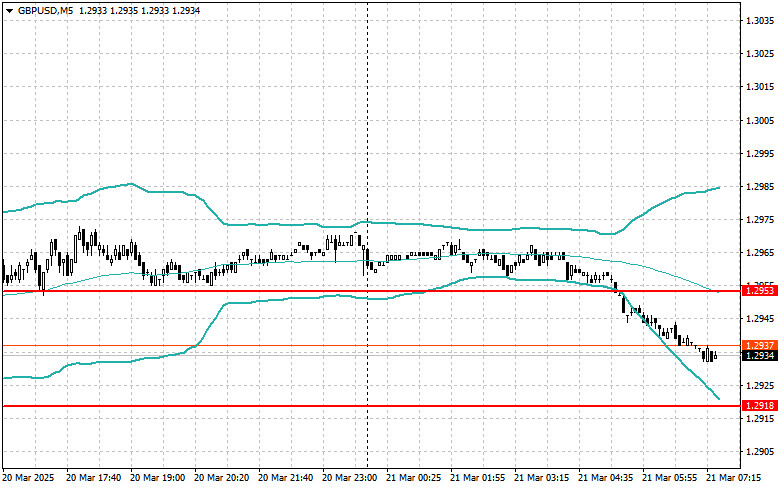

Buying on a breakout above 1.2935 could lead to a rise toward 1.2975 and 1.3010.

Selling on a breakout below 1.2910 could lead to a decline toward 1.2875 and 1.2841.

Buying on a breakout above 149.62 could push the dollar toward 149.92 and 150.10.

Selling on a breakout below 149.32 could send the dollar lower toward 148.97 and 148.58.

Look to sell after a failed breakout above 1.0871 and a return below that level.

Look to buy after a failed breakout below 1.0812 and a return above that level.

Look to sell after a failed breakout above 1.2953 and a return below that level.

Look to buy after a failed breakout below 1.2918 and a return above that level.

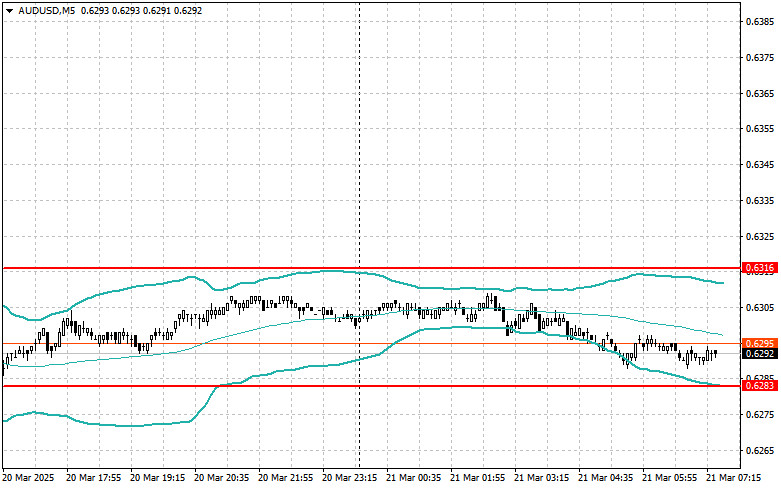

Look to sell after a failed breakout above 0.6316 and a return below that level.

Look to buy after a failed breakout below 0.6283 and a return above that level.

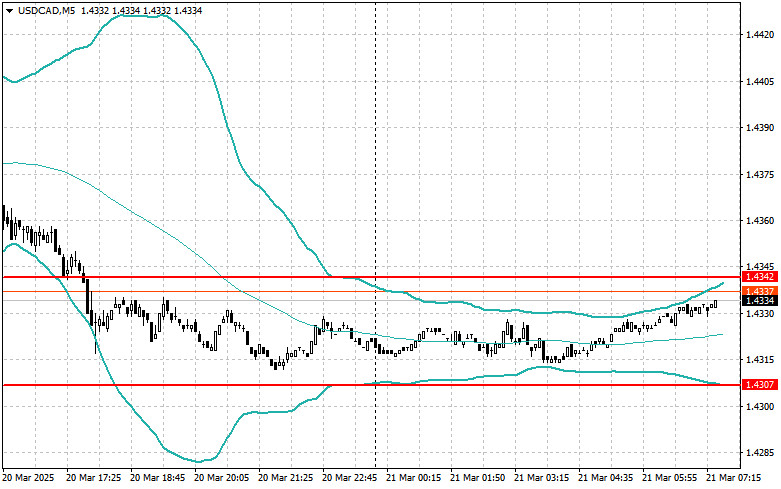

Look to sell after a failed breakout above 1.4342 and a return below that level.

Look to buy after a failed breakout below 1.4307 and a return above that level.

SZYBKIE LINKI