Turecko, které má po Spojených státech druhou největší armádu v NATO, by se mohlo podílet na případné mírové misi na Ukrajině, uvedl ve středu zdroj z tureckého ministerstva obrany.

„Otázka přispění do mise bude zvážena, pokud bude považována za nezbytnou pro nastolení stability a míru v regionu, a bude vzájemně posouzena se všemi příslušnými stranami,“ řekl zdroj novinářům v Ankaře.

Hlavní evropské vojenské mocnosti Británie a Francie již jednaly o nasazení vojáků v případných silách pro monitorování příměří na Ukrajině po uzavření budoucí mírové dohody, zatímco Washington prohlásil, že Američany nepošle.

Ukrajina tvrdí, že jakákoli mírová dohoda by vyžadovala silné pozemní síly, které by poskytovaly bezpečnostní záruky; Moskva jakékoli nasazení sil členských států NATO odmítá, ačkoli americký prezident Donald Trump tvrdí, že věří, že by Rusko mohlo souhlasit.

Turecký zdroj, který si přál zůstat v anonymitě, uvedl, že diskuse o tureckém nasazení zůstávají koncepční a zatím nebylo přijato žádné konkrétní rozhodnutí.

„Koncepce zatím nebyla jasně definována.“

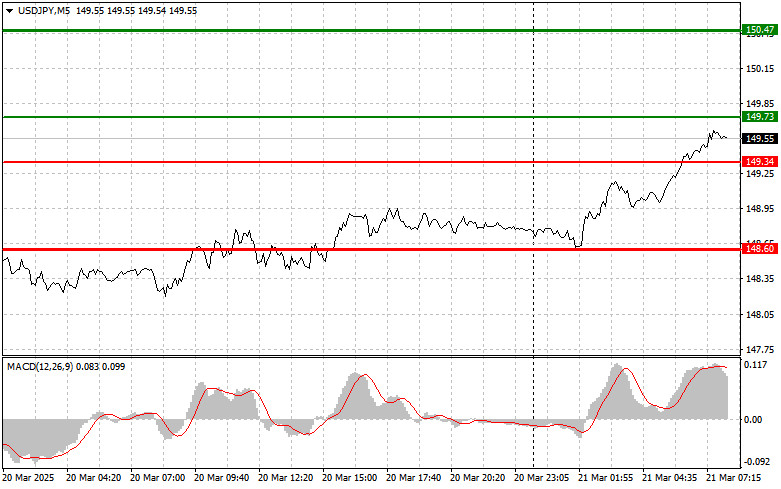

The price test at 148.81 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the dollar. The second test of 148.81 happened while the MACD was declining from the overbought area, which triggered the execution of Sell Scenario #2. However, as you can see on the chart, the pair never developed any strong downward movement.

Today's news is that Japan's Consumer Price Index growth slowed and came in below economists' expectations, which weakened the yen and led to a rise in the U.S. dollar. Slowing inflation in Japan may indicate lingering economic challenges despite the government's efforts to stimulate growth. This, in turn, reduces the yen's appeal, prompting investors to shift back to the dollar. The likelihood that the Bank of Japan will continue to raise interest rates actively has also decreased following the decline in inflationary pressure. Core indicators, excluding volatile categories, also point to easing inflation, giving the BOJ more flexibility in its policy decisions. Unlike many countries where central banks are actively fighting inflation, the Japanese central bank can afford a more measured approach.

Furthermore, any sharp increase in interest rates could negatively affect Japan's public debt burden, which is already among the highest in the world. Considering all these factors, the prospects for further aggressive rate hikes in Japan appear increasingly unlikely.

For intraday strategy, I will primarily rely on Buy and Sell Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today if the price reaches the entry point around 149.73 (green line on the chart), with a target of 150.47 (thicker green line). Near 150.47, I plan to exit the buy position and open a sell trade in the opposite direction, targeting a move of 30–35 pips down from the level. It's best to return to buying the pair on pullbacks and significant corrections in USD/JPY. Important: before buying, ensure the MACD indicator is above the zero line and starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 149.34 level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and lead to a reversal to the upside. A rise toward the opposing levels of 148.60 and 149.73 can be expected.

Scenario #1: I plan to sell USD/JPY today only after the price breaks below 149.34 (red line on the chart), which could lead to a sharp decline. The main target for sellers will be 148.60, where I intend to exit the sell trade and immediately open a buy position in the opposite direction, aiming for a 20–25 pip rebound. Pressure on the pair may return at any moment. Important: before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 149.73 level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and trigger a reversal to the downside. A drop toward the opposing levels of 149.34 and 148.60 can be expected.

SZYBKIE LINKI