Will the news background have any real significance in the upcoming week? In my opinion, the market seems largely uninterested in economic and fundamental data. Consider this: major events like the European Central Bank and Federal Reserve meetings were ignored, and U.S. labor market and unemployment data failed to trigger a meaningful reaction. What are the chances that reports on Germany's industrial production or inflation will cause a market reaction? I believe the market is focused solely on Donald Trump and his trade war. Although the U.S. president hasn't introduced any new tariffs recently, the market can't move on from this topic because the final resolution is still far off.

Therefore, listing all the economic reports for the coming week seems pointless. There won't be any major reports in Europe anyway. The GDP for Q1 will be released as a second estimate, Germany's inflation data will also be released in its final version, and the industrial production report is not particularly important, especially now.

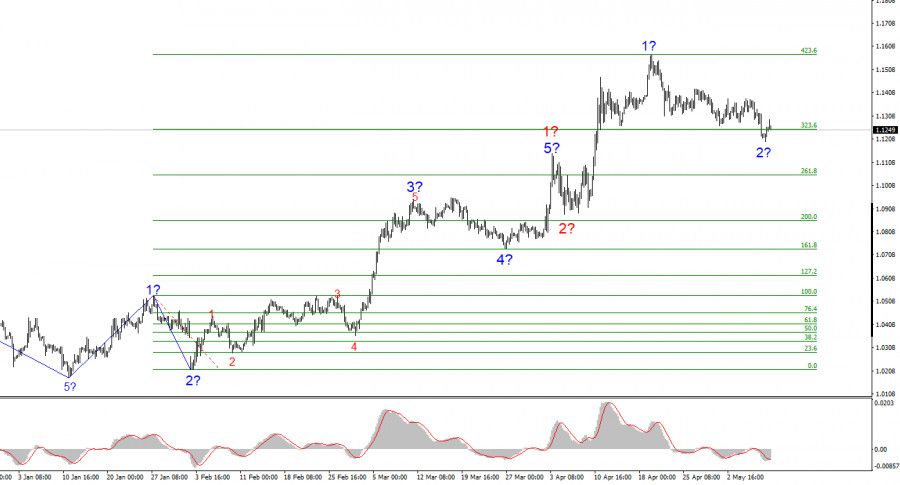

Based on all this, the fate of the EUR/USD pair next week will depend on Trump's mood. If the market does not see new tariffs, the U.S. dollar may continue its weak recovery. Although the current wave structure implies forming a third upward wave, this structure still takes a back seat now. With a single statement, Trump can reverse all trends, so relying on wave theory alone is almost a crime.

If Trump imposes new tariffs or raises existing ones, demand for the U.S. dollar will drop again. Therefore, for the current wave pattern to hold together, we need new destructive actions from Trump. A failed attempt to break above 1.1211, which corresponds to the 100.0% Fibonacci level, may indicate the end of corrective wave 2 within wave 3.

Based on the analysis of EUR/USD, the instrument is continuing to build an upward trend segment. In the near term, the wave structure will entirely depend on the stance and actions of the U.S. president. This should be kept in mind at all times. The formation of wave 3 of the upward trend has begun, and its targets may stretch as far as the 1.25 area. Reaching those levels depends solely on Trump's policies. At the moment, wave 2 within wave 3 appears near completion. Therefore, I am considering long positions with targets above 1.1572, corresponding to the 423.6% Fibonacci level.

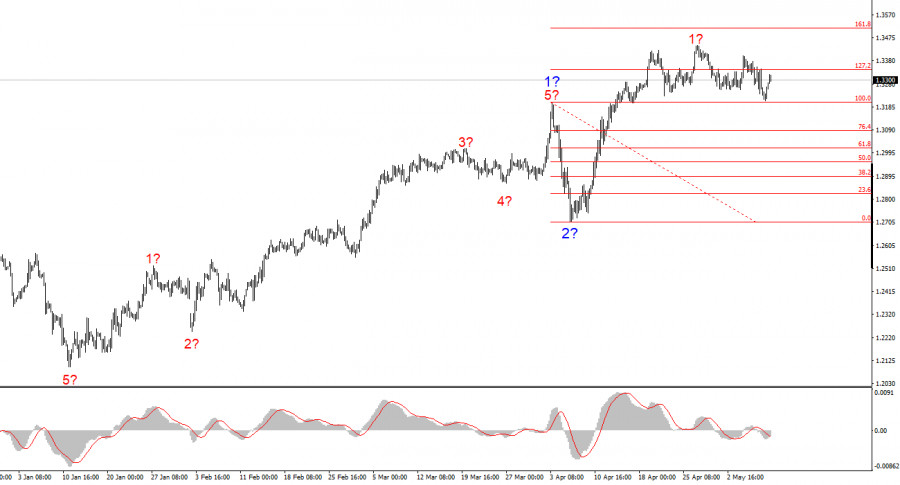

The wave pattern of GBP/USD has transformed. We are now dealing with a bullish, impulsive section of the trend. Unfortunately, under Trump, the markets may face many shocks and reversals that defy wave structure and any form of technical analysis. The formation of upward wave 3 continues with nearby targets at 1.3541 and 1.3714. Ideally, we would like to see a solid corrective wave 2 within wave 3, but it seems the dollar cannot afford such a luxury right now.

Core Principles of My Analysis:

SZYBKIE LINKI