The test of the 1.3525 level occurred when the MACD indicator was starting to move upward from the zero line, confirming a good entry point for buying the pound. As a result, the pair rose to the target area around 1.3582.

US inflation data once again weakened the dollar and led to growth in the British pound. Investors welcomed the slowdown in US consumer price growth, which increased the likelihood of Federal Reserve rate cuts. This weakened the US dollar and provided significant support to the pound.

A lot of important data for the UK is expected out this morning. Economists and analysts will closely watch the numbers to assess the British economy's resilience amid global headwinds. GDP data will be a key indicator of the overall economic picture, allowing assessment of growth or slowdown. Special attention will be paid to GDP breakdown by services, industry, and construction. Changes in industrial production volumes are important for gauging the competitiveness of British industry. Output growth can indicate rising overseas demand for British goods as well as domestic investment in production upgrades. Declines could point to sector problems such as labor shortages, high production costs, or lower export demand. Finally, UK goods trade balance figures will help assess the balance between exports and imports, which is important for currency stability and the current account. A trade deficit may weigh on the pound, while a surplus could support it.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

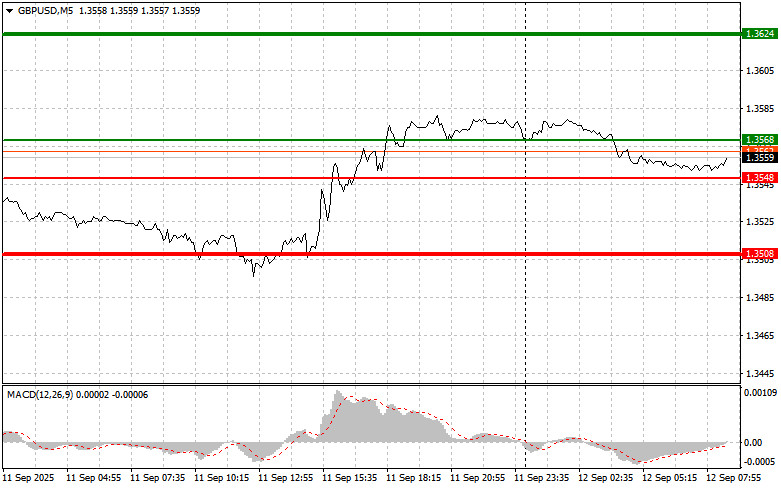

Scenario 1: I plan to buy the pound today if the entry area near 1.3568 (green line on the chart) is reached, targeting growth to 1.3624 (the thicker green line). Around 1.3624, I plan to take profit and open short positions in the opposite direction, expecting a 30–35 pip pullback from that level. Counting on a strong rally in the pound today is unlikely. Important! Before buying, make sure the MACD is above zero and just beginning to rise.

Scenario 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3548 level when the MACD is in oversold territory. This will limit the pair's downside and may trigger a sharp upward reversal. A move toward 1.3568 and 1.3624 can be expected.

Scenario 1: I plan to sell the pound today after breaking below the 1.3548 level (red line on the chart), which would lead to a quick drop in the pair. The sellers' key target will be 1.3508, where I will take profit and then open long positions, expecting a 20–25 pip rebound from that level. Pound sellers may show up at any moment today. Important! Before selling, ensure the MACD is below zero and beginning to decline.

Scenario 2: I also plan to sell the pound today, should there be two consecutive tests of the 1.3568 level when the MACD is in overbought territory. This will limit the pair's upward potential and may lead to a reversal downward. A drop toward the 1.3548 and 1.3508 levels can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

SZYBKIE LINKI