Praha – Meziroční růst maloobchodních tržeb v březnu zrychlil na 3,4 procenta z únorových revidovaných 3,2 procenta. V meziměsíčním srovnání tržby obchodníků stouply o 0,6 procenta. V prvním čtvrtletí letošního roku se dařilo také turistice a službám. České hotely, penziony a kempy ubytovaly 4,1 milionu turistů, meziročně 1,4 procenta více. Tržby za služby se oproti stejnému období loni zvýšily o tři procenta. O výsledcích maloobchodu, turistiky a služeb informoval Český statistický úřad (ČSÚ).

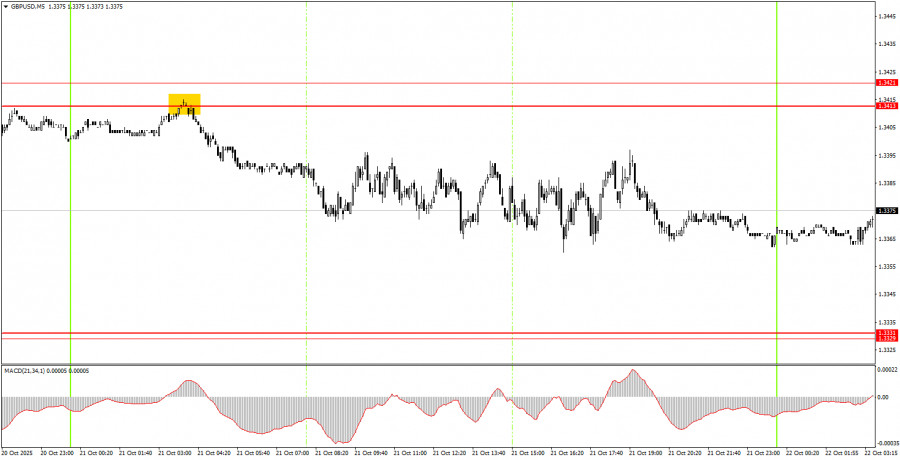

On Tuesday, the GBP/USD pair continued its slow, downward drift for most of the day. While the British pound has been falling more moderately compared to the euro in recent sessions, both moves appear illogical and lack clear fundamental backing. The recent mild strengthening of the U.S. dollar can be explained only by technical factors. It's important to recall that both the euro and the pound are trading within well-defined sideways ranges on the daily timeframe, which allows for arbitrary, random price moves within those bounds. On the hourly chart, the pair appeared to initiate a new upward trend, which may now be undergoing a technical pullback.

Starting today, traders will begin to receive impactful macroeconomic updates, which may affect market sentiment, although it remains difficult to predict how traders will respond in advance. Our view remains that global macro fundamentals continue to support the euro and the pound over the dollar.

On the 5-minute chart, a single sell signal was generated on Tuesday, just like in EUR/USD—during the overnight session. Traders who acted on the signal had the opportunity to gain around 35 pips. However, movements in GBP/USD remain erratic and low in volatility, something that all traders should keep in mind.

On the hourly chart, GBP/USD appears to be forming a new bullish trend, which may become the next upward leg in the broader 2025 rally. As noted before, there are currently no sustainable macroeconomic reasons supporting long-term strength in the U.S. dollar. Therefore, over the mid-term horizon, we expect continued gains toward the upside. Still, market volatility remains extremely low, and the pair has yet to show any momentum to the upside.

On Wednesday, the pair may attempt to resume its upward movement, as the trend structure has shifted to bullish. However, to initiate long positions, the price must first consolidate above the 1.3413–1.3421 zone. Alternatively, bullish entries may follow a rebound from the 1.3329–1.3331 area, though this setup implies a continuation of current bearish pressure before potential reversal.

On the 5-minute chart, you can now trade at levels 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3682, and 1.3763. On Wednesday, the UK will release its September consumer inflation report—one of the first meaningful economic releases of the week. This report could trigger sharp market reactions. Inflation in the United Kingdom has been rising steadily for a year now, and the Bank of England is unlikely to lower interest rates in the near term. This remains a fundamentally positive factor for the pound.

Important Note for Beginners

Trading during major news events (as listed on the calendar) can significantly impact price movement. During such times, trade cautiously or step out of the market entirely to avoid a sharp reversal against your position.

Beginners must remember that not every trade can be profitable. The key to long-term success in forex is maintaining a consistent strategy, reinforcing discipline, controlling risk, and following sound money management principles.

SZYBKIE LINKI