The euro and pound have only slightly decreased against the dollar, but overall, trading has remained within sideways channels, from which the trading instruments have been unable to escape for a whole week.

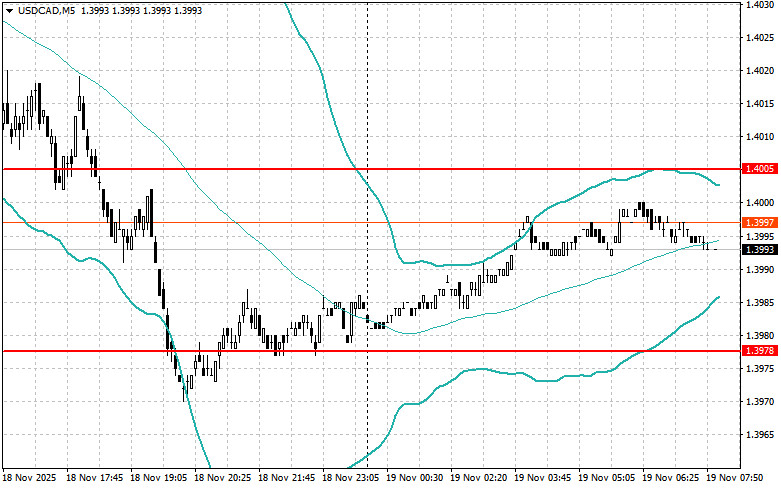

Positive data on U.S. industrial orders and cautious statements from Federal Reserve officials supported the dollar. Positive macroeconomic indicators, particularly the increase in industrial orders, signal a recovery in the industrial sector and strengthening economic growth. This, in turn, reduces the necessity for aggressive interest rate cuts from the Fed, as reflected in recent comments from the central bank. The Fed's cautious rhetoric, emphasizing that future decisions will depend on incoming data, also contributes to the strengthening of the dollar.

Today, pressure on the euro may increase as Eurozone inflation data is expected in the first half of the day. The core prices will also be published. These figures will serve as key indicators of inflation trends in the region and will directly affect the euro exchange rate. If the data indicate higher inflation rates than expected, it could strengthen speculation about a potential complete abandonment of the European Central Bank's soft monetary policy.

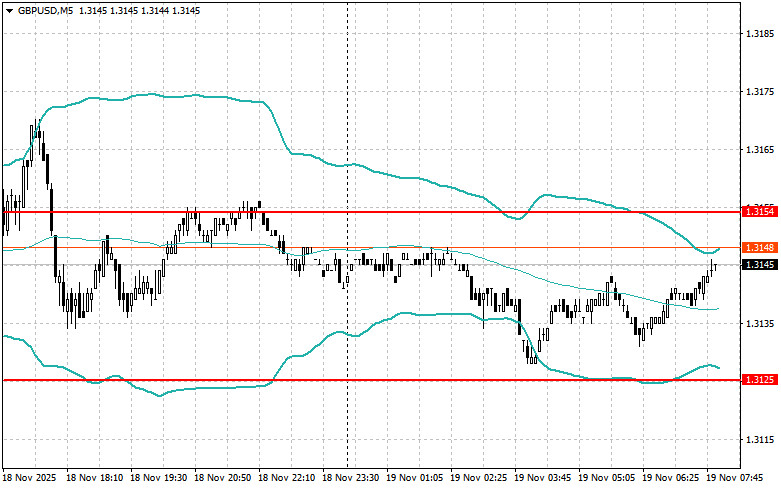

Regarding the pound, inflation data for the UK and the core consumer price index are also expected in the first half of the day. The situation with prices is much worse there than in the Eurozone. Economists predict that price pressures may increase again, which could strengthen the British pound. However, this optimism should be approached with caution, considering the challenging situation surrounding the British economy. The strengthening of the pound, driven by the potential rise in inflation, has a dual nature. On one hand, it could lower import costs, which may help restrain further price increases in the long run. On the other hand, it would make British exports less competitive in global markets, which could negatively affect the country's trade balance. Additionally, the Bank of England is likely to be forced to continue its policy of high interest rates to curb inflation, which may put pressure on economic growth.

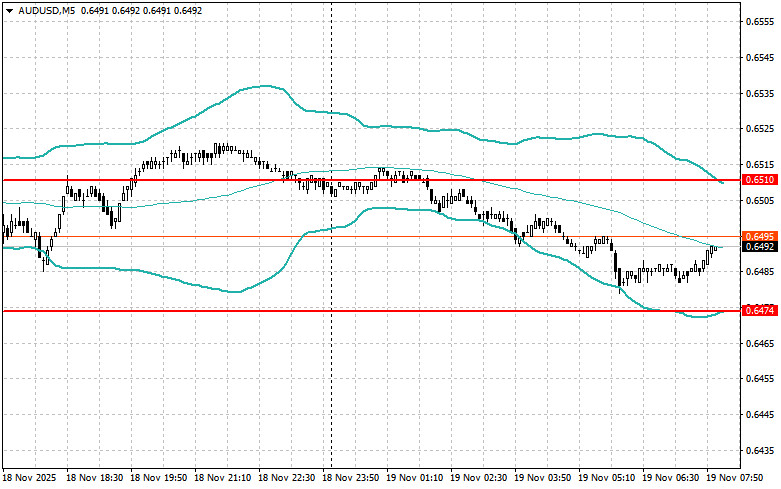

If the data aligns with economists' expectations, it would be advisable to act based on the Mean Reversion strategy. If the data turns out to be significantly above or below economists' expectations, the Momentum strategy would be the best approach.

SZYBKIE LINKI