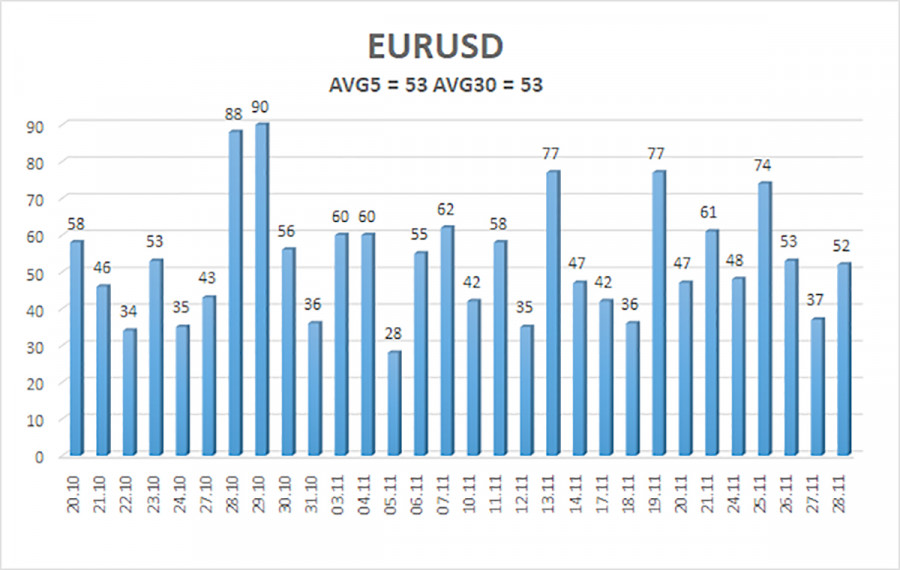

The EUR/USD currency pair showed no interesting "movements" on Friday. Four trading days this week had volatility below 53 pips. The average volatility over the past month and week is also 53 pips. Thus, it can be confidently stated that the market continues to rest and prepare for a trend, while movements remain extremely weak.

Can we expect any changes in the upcoming week? It is essential to remind traders that any flat period typically ends abruptly and unexpectedly. Many traders are waiting for a significant event that will shake the market and prompt more active trading. However, in reality, a flat can conclude on an empty day. A flat is merely a period during which market makers establish new positions and distribute old ones. Once this process is completed, the trend will begin—not necessarily after the Federal Reserve meeting or the publication of Nonfarm Payrolls. This flat has been ongoing for 5 months on the daily timeframe.

There are hardly any significant events in the Eurozone this week. Yes, on Tuesday, the November inflation data will be released, but it is largely irrelevant at this point. First, inflation has stabilized around 2%, so the European Central Bank does not need to intervene. Secondly, its fluctuations in recent months have been minimal. This means that the indicator is not straying far from the ECB's target level, either up or down. The projected November inflation rate is 2.1% to 2.2%. Even if the actual figure comes in at 2.3%, would the ECB rush to tighten monetary policy?

The other macroeconomic reports hold even less significance. The business activity indices in the services and manufacturing sectors will be published as second estimates for November, which are typically ignored. The third-quarter GDP report will be released in its third estimate, which is unlikely to differ from the first two. Thus, the retail sales report will effectively be the most significant. Naturally, one should not expect a strong market reaction to this report.

Christine Lagarde's Speech: First, the head of the ECB has been speaking with alarming frequency in recent months. Therefore, she physically cannot share any important information with the market at every appearance. Secondly, there have been no notable reports in the Eurozone recently that would require a response from the ECB. What are traders expecting from the central bank's head speeches if not hints at future changes in monetary policy?

The ECB has completed the cycle of lowering the key interest rate, so as long as inflation remains around 2%, the central bank will not even consider changing the parameters of monetary policy. Consequently, Lagarde, by the very nature of the current circumstances, cannot share anything significant with the market.

The average volatility of the EUR/USD currency pair over the last five trading days as of December 1 is 53 pips, characterized as "medium-low." We expect the pair to move between levels 1.1546 and 1.1652 on Monday. The upper channel of the linear regression is directed downward, signaling a bearish trend, but in fact, a flat continues on the daily timeframe. The CCI indicator has entered the oversold area twice in October (!!!), which could provoke a new upward trend for 2025.

The EUR/USD pair remains below the moving average, but an upward trend persists on all higher timeframes, while a flat has been ongoing on the daily timeframe for several months. The global fundamental background still holds significant importance for the market. We see that recently the dollar has risen, but only within a sideways channel. There is no fundamental basis for long-term growth. With the price below the moving average, small short positions may be considered, with targets of 1.1536 and 1.1505, purely on technical grounds. Above the moving average, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

SZYBKIE LINKI