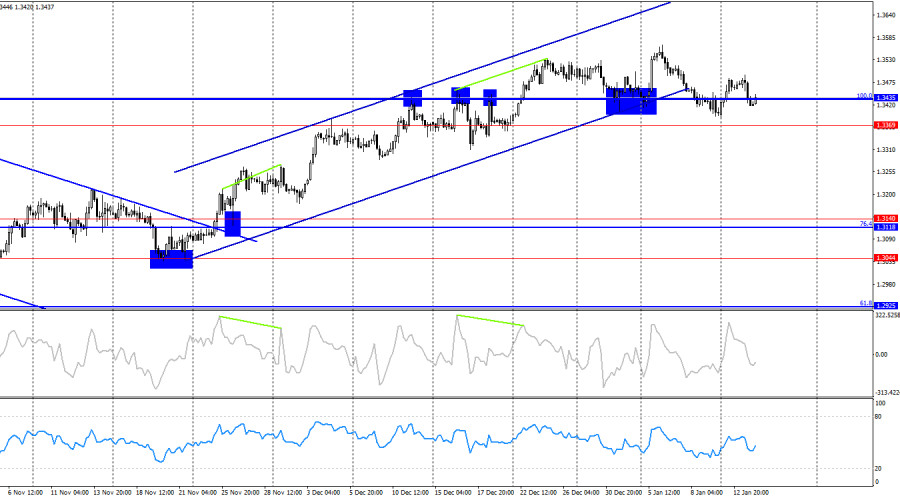

The wave situation remains "bullish." The last completed upward wave broke the previous peak, while the new downward wave broke the previous low by only a few points, which is not enough to cancel the trend. The news background for the pound has been weak in recent weeks, but the information backdrop in the U.S. also leaves much to be desired. Bears have been attacking over the past few days, but a break of the bullish trend will occur only below the 1.3403 level.

On Tuesday, the news background supported the bears only conditionally. First, the inflation report cannot be confidently counted in favor of the dollar. It may have been perceived positively by bears, but the report turned out to be mixed. Second, Donald Trump yesterday effectively announced strikes on Iran in support of protesters against the state regime. The U.S. president wrote on the Truth Social network that "help is already on the way," addressing the "patriots of Iran." Trump also called on the Iranian population to continue protesting and to seize institutions of power across the country. The geopolitical situation in the Middle East is deteriorating again, which could be used by traders as a reason to buy the dollar. However, this conclusion is also quite controversial. In my view, traders themselves do not fully understand how to interpret the latest news, especially geopolitical developments. Can the dollar be considered a "safe haven" under current circumstances, when the main instigator of conflicts is the United States?

On the 4-hour chart, the pair has returned to the support level of 1.3369–1.3435. A rebound from this zone would once again work in favor of the pound and a resumption of growth toward the next Fibonacci level of 127.2% at 1.3795. A consolidation below the 1.3369–1.3435 level would allow traders to expect a reversal in favor of the U.S. dollar and a decline toward the support level of 1.3118–1.3140. No emerging divergences are observed today.

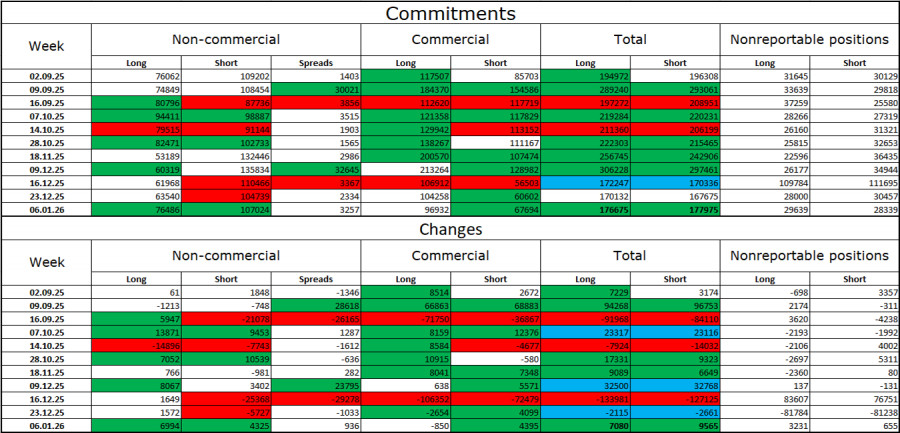

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" category of traders became more bullish over the latest reporting week. The number of long positions held by speculators increased by 6,994, while the number of short positions rose by 4,325. The gap between long and short positions currently stands at roughly 76,000 versus 107,000 and is narrowing rapidly. Bears have dominated in recent months, but the pound appears to have largely exhausted its downward potential. At the same time, the situation with euro contracts is the opposite. I still do not believe in a bearish trend for the pound.

In my opinion, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may enjoy periodic demand in the market, but not in the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed has been forced to ease monetary policy to stop the rise in unemployment and stimulate job creation. U.S. military aggression also does not add optimism for dollar bulls.

News calendar for the U.S. and the U.K.:

On January 14, the economic calendar contains three entries, none of which are particularly significant. The impact of the news background on market sentiment on Wednesday will be present in the second half of the day, but it will be weak.

GBP/USD forecast and trading advice:

Selling the pair is possible today on a rebound from the 1.3437–1.3470 level on the hourly chart from below, with a target of 1.3352–1.3362. Buying can be considered today if the price consolidates above the 1.3437–1.3470 level on the hourly chart, with a target of 1.3526–1.3539.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

SZYBKIE LINKI