na základě plného zředění v rámci své rozšířené primární emise akcií v USA, což podtrhuje rostoucí dynamiku na trhu stablecoinů.

Rozšířená primární emise akcií svědčí o silném zájmu investorů o kryptoměnové společnosti. Americký prezident Donald Trump nejen slíbil příznivější regulaci tohoto sektoru, ale také vyvolal obavy ze střetu zájmů v souvislosti s několika kryptoměnovými projekty, které jsou s ním spojeny.

„Otázky týkající se humbuku kolem memecoinů a konkrétně Trumpových podniků v oblasti kryptoměn by neměly mít přímý vliv na výhled stablecoinů krytých tvrdou měnou,“ uvedl Michael Ashley Schulman, investiční ředitel společnosti Running Point Capital.

Stablecoiny jsou navrženy tak, aby si udržovaly konstantní hodnotu, obvykle v poměru 1:1 k dolaru, a jsou běžně používány obchodníky s kryptoměnami k převodu prostředků mezi tokeny.

The GBP/USD currency pair also traded quite calmly on Monday. Let's begin with the technical picture, as it continues to guide traders effectively on where the price will move next. Recall that the new upward trend for the British pound started in January of last year, immediately after Donald Trump's arrival in office. Markets were very pleased with the fact that a new-old leader would be president of the United States for the next four years, and over the year, the US dollar depreciated by approximately 11%. Remember, the dollar is not Bitcoin, which can lose 50% in four months. We are talking about the most popular currency in the world, the currency most often used for settlements and as reserves. An 11% drop in a year is significant for the dollar. Over the last three full years, the British pound has appreciated by 32%. If anyone does not recall, in 2022, the GBP/USD pair fell to an all-time low of about 1.04 USD. Then, as inflation in the US began to slow down, the Fed started preparing to ease monetary policy, and the dollar began to fall. As we can see, Trump's arrival has only exacerbated the situation for the American currency.

One of the pressing issues at the moment is Iran. Donald Trump has sent several aircraft carriers to the Persian Gulf and the Strait of Hormuz, fully combat-ready. The already complicated relations between Tehran and Washington have escalated to the limit in 2026 due to the Iranian government's mass killings of protesters and demonstrators against that very same government. Trump promised to help and support the brave Iranian people while also forcing Iran to sign a nuclear disarmament deal once again.

As always, Iran has rejected the unrealistic offer that leaves the country under global sanctions and in total poverty. The Supreme Leader of the country, Ayatollah Ali Khamenei, stated that any US attack on Iran would provoke a new war in the region. Trump himself mentioned over the weekend that negotiations with Tehran continue and are encouraging, but the objective reality shows that Tehran is unwilling to make any concessions. In our view, a new strike against Iran is inevitable. Against this backdrop, the dollar may rise slightly, but it overall is no longer the "safe haven" it once was—especially under Trump.

It is also worth noting that this week the Bank of England will hold a meeting, which could elicit mixed feelings. On the one hand, the British central bank is inclined towards continued monetary easing, but on the other hand, inflation remains well above the target level, and the latest report showed an acceleration. Thus, a pause could be extended, which would be a fairly positive news for the British pound. We continue to believe the dollar is primarily declining, and this trend will persist across almost any scenario. Much to the delight of the White House.

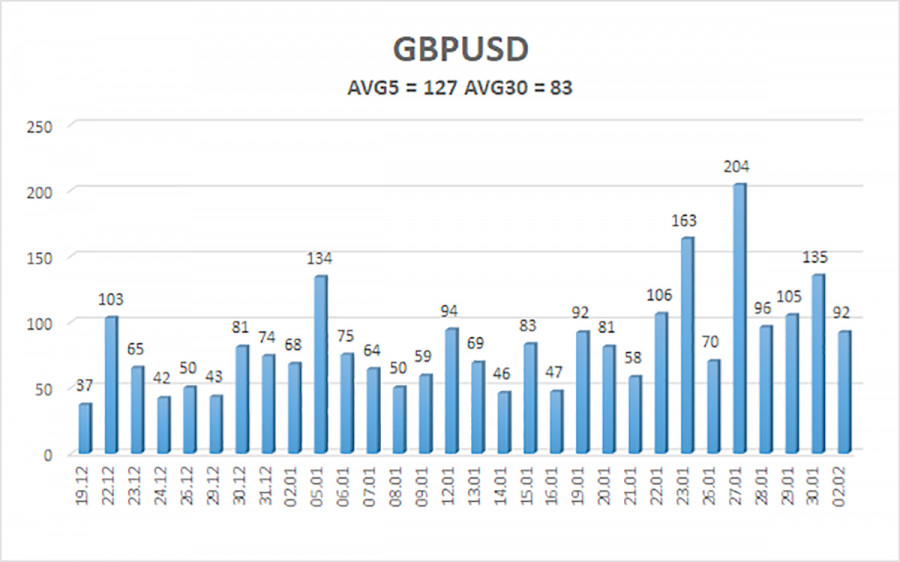

The average volatility of the GBP/USD pair over the last five trading days is 127 pips, which is considered "high" for the pound/dollar pair. On February 3, we expect the pair to move within the range defined by levels 1.3527 and 1.3781. The higher linear regression channel points upward, indicating a recovery trend. The CCI indicator has entered the oversold area 6 times in recent months and has formed numerous "bullish" divergences, continuously warning traders of an impending resumption of the upward trend. The entry into the overbought area warned of a correction.

S1 – 1.3550

S2 – 1.3428

S3 – 1.3306

R1 – 1.3672

R2 – 1.3794

R3 – 1.3916

The GBP/USD currency pair is poised to continue its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the US economy, so we do not expect the US dollar to grow in 2026. Even its status as a "reserve currency" no longer holds significance for traders. Thus, long positions with targets of 1.3916 and higher remain relevant for the near term when the price is above the moving average. If the price is below the moving average line, small short positions can be considered with a target of 1.3550 on technical (corrective) grounds. From time to time, the American currency shows corrections (in a global perspective), but for trend growth, it requires global positive factors.

SZYBKIE LINKI