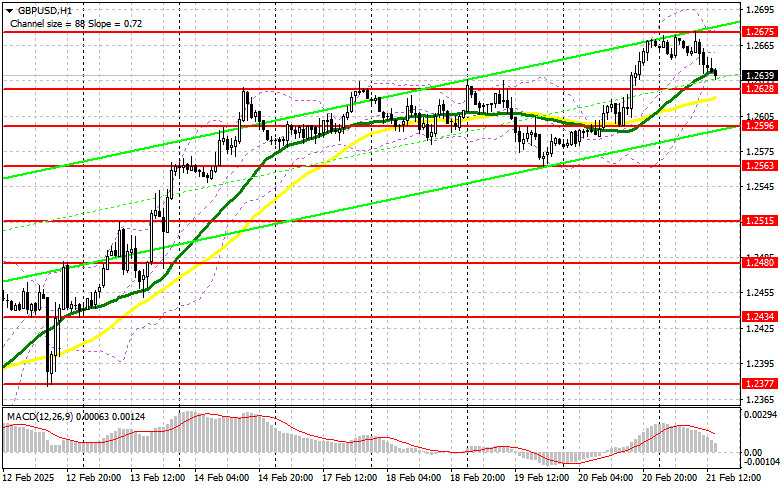

In my morning forecast, I focused on the 1.2640 level as a key decision point. Looking at the 5-minute chart, a false breakout at this support level provided a solid entry for long positions. However, after a 15-point increase, bearish pressure returned to the pound, prompting a revision of the technical outlook for the second half of the day.

The pound fell following weak PMI data, which missed economists' expectations and remained below the 50-point threshold. With several U.S. economic releases scheduled for the second half of the day, selling pressure on GBP/USD could persist. Strong readings for the Manufacturing and Services PMI could strengthen the dollar, weighing further on the pound. Additionally, reports on existing home sales and the University of Michigan Consumer Sentiment Index will play a role in market sentiment.

If negative market reaction follows, buyers will need to defend the 1.2628 support, where the pair is currently heading. I will consider long positions only after a false breakout at this level, targeting a rise toward 1.2675, the weekly high. A break and retest of this range from above would confirm an entry, setting the stage for an advance to 1.2718, strengthening the bullish outlook. The final target is 1.2761, where I plan to take profits.

If GBP/USD declines further and buyers fail to hold 1.2628, downward pressure will intensify toward the week's end. In this scenario, I will look for a false breakout around 1.2596 as a condition to initiate long positions. Alternatively, I will enter long positions on an immediate rebound from 1.2563, expecting a 30-35 point intraday correction.

Sellers have taken advantage of weak PMI data, but further declines will depend entirely on the upcoming U.S. releases, as recent buyers have not yet exited the market. If the PMI data disappoints, a failed breakout at 1.2675 could serve as a strong short entry signal, targeting a drop toward 1.2628, where the moving averages currently favor buyers.

A break and retest of 1.2628 from below would confirm further downside, opening the way toward 1.2596. The final target is 1.2563, where I will take profits.

If demand for the pound returns in the second half of the day and sellers fail to defend 1.2675, the pair could continue to rise. In that case, I will wait for a failed breakout at 1.2718 to initiate short positions. If downward movement does not develop there, I will look for short opportunities at 1.2761, anticipating a 30-35 point correction.

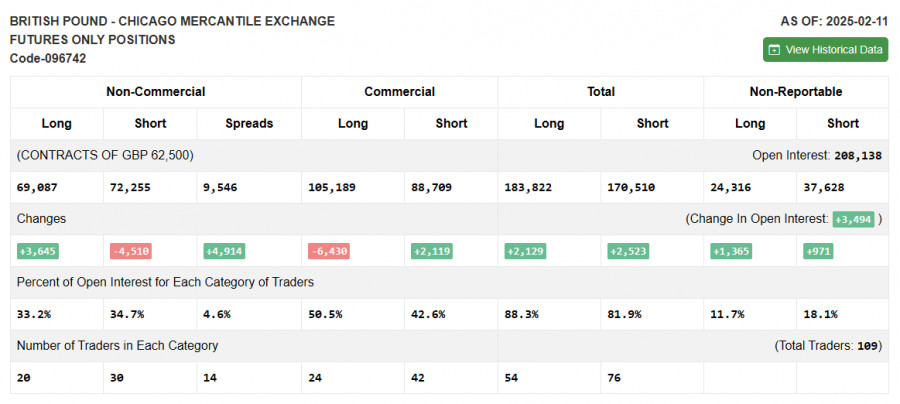

The Commitments of Traders (COT) report from February 11 indicated a decline in both long and short positions, with a notable increase in demand for the pound. However, it is important to note that this data does not account for the recent conversation between Putin and Trump, which could have shifted market sentiment toward risk assets.

For now, U.S. dollar weakness persists, especially in comparison to recent lackluster U.S. economic data. The latest COT report shows long non-commercial positions increased by 3,645 to 69,087, while short non-commercial positions declined by 4,510 to 72,255. As a result, the gap between long and short positions widened by 4,914.

Indicator Signals

Moving AveragesGBP/USD is trading above the 30 and 50-day moving averages, indicating a bullish trend.

Bollinger BandsIf the pair declines further, support is expected near the lower Bollinger Band at 1.2530.

Indicator Overview

LINKS RÁPIDOS