Wells Fargo ve čtvrtek snížila hodnocení akcií MongoDB (NASDAQ:MDB) z Overweight na Equal Weight a snížila cílovou cenu z 365 USD na 225 USD poté, co společnost předložila odhad tržeb a provozní marže na fiskální rok 2026 (FY26) výrazně pod očekáváním.

Akcie výrobce databázového softwaru se v předobchodní fázi čtvrtečního obchodování propadly o více než 18 % kvůli neuspokojivému výhledu.

Společnost MongoDB vykázala solidní výsledky za čtvrté čtvrtletí, ale vydala odhad růstu tržeb na rok 26 pouze ve výši 11,6-13,6 % meziročně, což je výrazně méně než konsenzuální odhad 17,5 %.

Nižší výhled společnost přičítá menšímu počtu víceletých smluv s firmou Enterprise Advanced (EA), s výjimkou Atlas (NYSE:ATCO), její cloudové databázové služby.

V důsledku toho se nyní očekává, že segment EA bez Atlasu zaznamená v roce 26 vysoký jednociferný pokles, což kontrastuje s předchozím konsenzuálním odhadem 5% meziročního nárůstu.

Ve čtvrtém čtvrtletí se dařilo cloudové databázové službě Atlas společnosti MongoDB, jejíž tržby dosáhly 389 milionů USD, čímž překonaly konsenzuální odhad ve výši 373,5 milionu USD. Tržby vzrostly meziročně o 24 % a nyní představují 71 % celkových tržeb společnosti MongoDB.

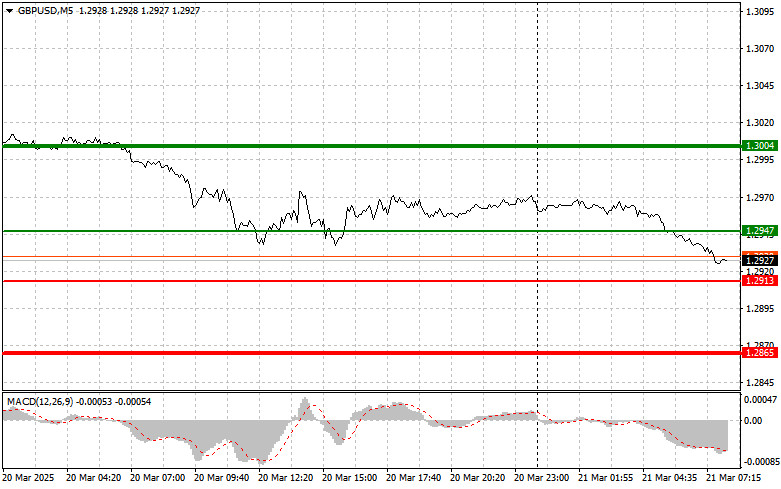

The price test at 1.2965 occurred when the MACD indicator moved significantly above the zero mark, limiting the pair's upside potential. For this reason, I did not buy the pound.

Following the meeting of the Monetary Policy Committee, where the majority vote of 8 to 1 supported keeping the base interest rate at 4.5%, the British pound showed an upward trend, but it didn't last long. Notably, even those committee members who previously favored a more dovish monetary policy refrained from calling for further rate cuts, and Bank of England Governor Andrew Bailey urged his colleagues to remain cautious. Against this backdrop, pressure on the pound returned, and the correction in the pair continued. Concerns about the economy outweighed the central bank's more cautious stance.

Today, data on the UK's net public sector borrowing and the industrial orders index from the Confederation of British Industry will be released. Economic indicators reflecting the state of the national economy typically have a notable impact on the currency. If the figures come in worse than expected, this could point to negative trends in the UK economy. Weak data on borrowing and orders will likely lead to a decline in the pound.

For intraday strategy, I will primarily rely on Buy and Sell Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today if the price reaches the entry point around 1.2947 (green line on the chart), with a target of rising to 1.3004 (thicker green line on the chart). Near 1.3004, I plan to exit the buy position and open a short in the opposite direction, targeting a move of 30–35 pips down from the level. A pound rally can only be expected after strong data. Important: before buying, ensure the MACD indicator is above the zero line and starting to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the 1.2913 price level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and lead to an upward reversal. A rise toward the opposing levels of 1.2947 and 1.3004 can be expected.

Scenario #1: I plan to sell the pound today after a break below the 1.2913 level (red line on the chart), which could trigger a sharp decline in the pair. The key target for sellers will be 1.2865, where I intend to exit the sell trade and immediately open a buy position in the opposite direction, targeting a 20–25 pip rebound. It is best to sell the pound as high as possible. Important: before selling, make sure the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2947 price level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and lead to a downward reversal. A drop toward the opposing levels of 1.2913 and 1.2865 can be expected.

LINKS RÁPIDOS