(Reuters) – Čínský velvyslanec ve Spojených státech Xie Feng vyzval Washington, aby hledal společnou řeč s Pekingem a usiloval o mírové soužití, a zároveň varoval, že Čína je připravena na odvetu v eskalující obchodní válce.

V sobotním projevu na veřejné akci ve Washingtonu, jehož podrobnosti byly zveřejněny na internetových stránkách čínského velvyslanectví, Xie uvedl, že cla by zničila světovou ekonomiku, a poukázal na paralelu mezi Velkou hospodářskou krizí a cly, které USA zavedly v roce 1930.

S odkazem na pojmy tradiční čínské medicíny, jako je potřeba vyvážit protichůdné síly jin a jang, Xie řekl, že vztahy mezi dvěma největšími světovými ekonomikami by se měly řídit harmonií.

„Dobrý recept tradiční čínské medicíny obvykle kombinuje mnoho různých složek, které se vzájemně posilují a vytvářejí nejlepší léčebný účinek,“ řekl.

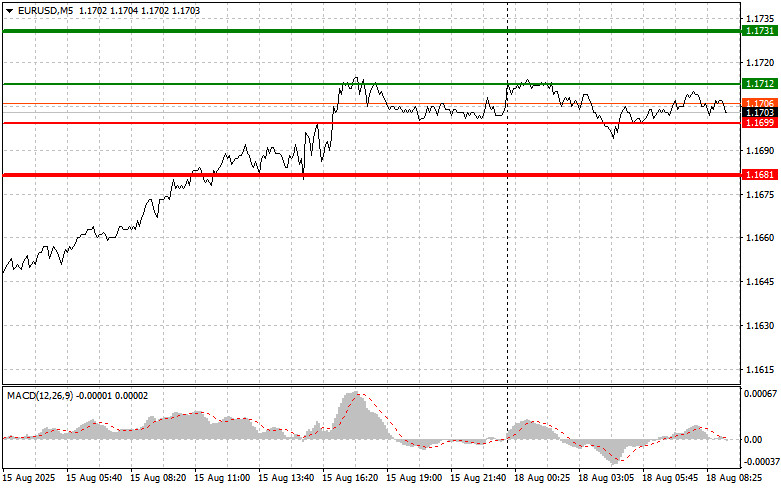

The test of 1.1698 occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro.

The published U.S. retail sales data turned out weaker than expected, failing to meet even the modest forecasts of analysts. This raises concerns about the sustainability of consumer activity, which until recently played a key role in supporting the U.S. economy. The slowdown in retail sales growth may be due to several factors, including inflationary pressure. The psychological aspect should not be overlooked either. Uncertainty about future economic development, linked to geopolitical tensions and recession risks, may prompt households to be more cautious with spending and to postpone major purchases. In the coming months, inflation dynamics, labor market conditions, and the Federal Reserve's policy will be decisive. If the pace of price growth continues to decline, the Fed will resort to lowering interest rates, which will stimulate consumer confidence.

Today, only the eurozone trade balance data is expected, so there are chances for EUR/USD to continue its upward trend. However, building forecasts based solely on one indicator would be reckless. The euro can be strengthened not only by a trade surplus, but also by the overall stability of the European economy. Many investors are now paying attention to inflation figures, employment levels, and consumer sentiment. If these parameters show positive dynamics, interest in European assets will increase, supporting EUR/USD. The actions of the European Central Bank should also not be forgotten. Its policy on interest rates plays a key role in shaping the exchange rate. Clear signals of the ECB's readiness to further ease monetary policy can strengthen the euro's position.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario 1: Buy the euro today at around 1.1712 (green line on the chart) with a target at 1.1731. At 1.1731, I plan to exit the market and also sell the euro in the opposite direction, aiming for a move of 30–35 points from the entry point. The expectation of euro growth fits within the observed upward trend.

Important! Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario 2: I also plan to buy the euro today in the event of two consecutive tests of 1.1699, when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a reversal upward. Growth toward the opposite levels of 1.1712 and 1.1731 can be expected.

Scenario 1: I plan to sell the euro after it reaches 1.1699 (red line on the chart). The target will be 1.1681, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move upward from that level). Strong pressure on the pair is unlikely today.

Important! Before selling, make sure the MACD indicator is below the zero line and only starting to decline from it.

Scenario 2: I also plan to sell the euro today if it tests 1.1712 consecutively, at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.1699 and 1.1681 can be expected.

LINKS RÁPIDOS