The test of the 147.04 price level occurred at a time when the MACD indicator had already moved significantly below the zero line, which limited the pair's bearish potential. For that reason, I did not initiate a sell trade. However, the bounce buy from 146.66 yielded about 40 pips in profit.

A strong sell-off in the U.S. dollar occurred yesterday after the ADP report showed a drop of 32,000 in U.S. employment, signaling a potential need for further interest rate cuts by the Federal Reserve. This sudden employment data miss triggered a chain reaction in currency markets. Investors quickly reevaluated their expectations for the Fed's monetary policy, pricing in more aggressive interest rate cuts. Demand for safe-haven assets, such as the Japanese yen, surged sharply, strengthening the yen against the dollar.

Today, Japan released data showing a rise in the Consumer Confidence Index to 35.3 points, which allowed yen buyers to maintain market control. This unexpected surge in consumer optimism became the spark that supported a new round of yen appreciation. Investors interpreted the news as a green light, actively buying yen and reclaiming previously lost ground. However, it's worth remembering that one positive data point is not a guarantee of long-term growth. The Japanese economy continues to face serious challenges, including trade tariffs, low inflation, and weak domestic demand. For the yen to strengthen sustainably, more fundamental changes in economic policy and structural reforms are needed to create conditions for consistent growth and prosperity.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

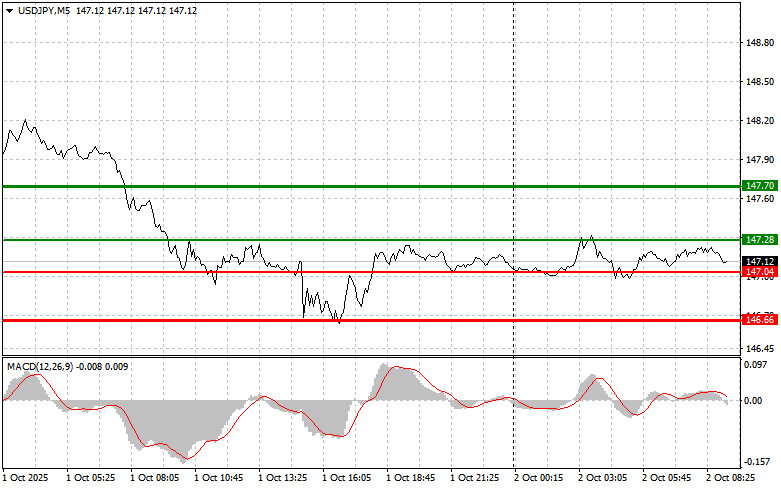

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 147.28 (green line on the chart), targeting a rise to 147.70 (thicker green line on the chart). Around the 147.70 level, I plan to exit long positions and open shorts in the opposite direction (expecting a 30–35 pip correction from the level). It is better to return to buying the pair on pullbacks and significant dips in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today, in case of two consecutive tests of the 147.04 level, when the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a reversal to the upside. A rise toward the opposite levels of 147.28 and 147.70 can be expected.

Scenario #1: I plan to sell USD/JPY today only after a breakout below the 147.04 level (red line on the chart), which would likely trigger a quick decline in the pair. The key target for sellers will be the 146.66 level, where I plan to exit short positions and also immediately open long trades in the opposite direction (expecting a 20–25 pip bounce from the level). It's best to sell from as high a point as possible. Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 147.28 level when the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a market reversal to the downside. A decline toward the opposite levels of 147.04 and 146.66 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

LINKS RÁPIDOS