Brusel – Evropská unie v úterý představí plán, jak hodlá postupně ukončit veškerý dovoz ruských fosilních paliv. Ukončit smlouvy s Moskvou o dovozu plynu ale nebude pro nakupující země jednoduché, uvedla agentura Reuters. Plán, který zveřejní Evropská komise (EK), přichází v době, kdy Spojené státy tlačí Rusko k mírové dohodě s Ukrajinou. Pokud by bylo dohody dosaženo, ruská energetika by mohla mít v Evropě opět své místo a mohlo by také být zmírněny sankce vůči Moskvě, dodala agentura.

On Thursday, the EUR/USD pair continued to trade very calmly, without sharp moves or significant volatility. Once again, the first week of the new month is proving to be dreadfully dull. As a reminder, the first week of each month usually brings important U.S. macroeconomic data. However, in recent months, despite genuinely interesting and high-impact releases—particularly labor market reports—we increasingly observe extremely low market interest in immediately pricing in this information.

This week also seems quiet on the surface, although its events are far from ordinary. The U.S. ADP employment report turned out to be "below the floor," quite literally—if we consider the zero level to be that floor. Previously, the U.S. labor market showed weak numbers; now it shows negative ones.

Additionally, the U.S. entered yet another government shutdown this week. In reality, shutdowns don't happen very often, but even once every 5–6 years is hardly insignificant. Interestingly, shutdowns have occurred only under Trump's presidency in recent years. The first one became the longest in U.S. history, and the current one could be very painful for the country.

A shutdown is not just a "forced vacation." Many government agencies cease operations, and these agencies have a significant impact not only on public institutions but also on private businesses and legal entities tied to government contracts. Moreover, up to 1 million federal employees could be furloughed simultaneously, with some potentially being permanently dismissed.

This means up to 1 million people will stop working indefinitely and will not receive salaries during this time. Naturally, their spending will decline sharply, which will affect the broader U.S. economy, growth rates, and other macroeconomic indicators. Against this backdrop, the dollar's weak decline this week looks quite surprising. Even in recent weeks, when the greenback seemed relatively stable, there were already plenty of reasons for a stronger sell-off.

The 4-hour chart does not look encouraging. In recent days, the pair has failed to either hold above the moving average or bounce from it. The market is stuck in uncertainty, as Friday's NonFarm Payrolls and unemployment data will likely not be published this time. If so, conclusions about the labor market will rely solely on the ADP report, and expectations of further deterioration will grow due to the 1 million federal employees who have been furloughed or dismissed. Thus, with each passing day, the fundamental backdrop for the dollar worsens.

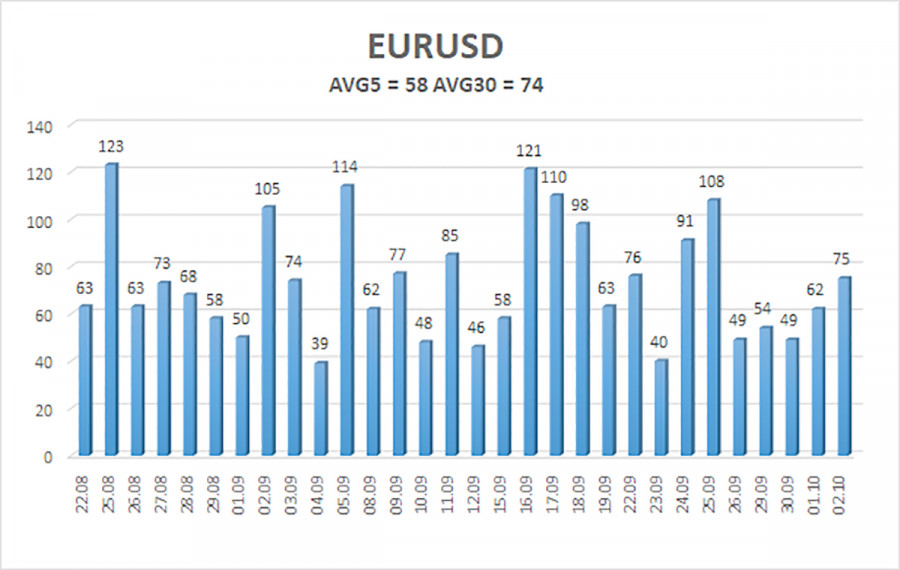

The average EUR/USD volatility over the past five trading days (as of October 3) is 58 pips, classified as "average." We expect movement between 1.1649 and 1.1765 on Friday. The higher linear regression channel is pointing upward, confirming the prevailing uptrend. The CCI entered the overbought zone, which triggered another corrective move.

Nearest support levels:

Nearest resistance levels:

EUR/USD continues to correct, but the uptrend is intact across all timeframes. The U.S. dollar remains heavily pressured by Donald Trump's policies, which show no sign of stopping. The dollar strengthened for as long as it could (an entire month), but it now seems ready for a new prolonged decline.

If the price stays below the moving average, small short positions may be considered with targets at 1.1658 and 1.1597 (purely technical setup). If the price moves above the moving average, long positions remain relevant with targets at 1.1841 and 1.1902 in continuation of the trend.

LINKS RÁPIDOS