The EUR/USD currency pair traded relatively calmly on Monday, as we had warned. There were no macroeconomic events scheduled for the first trading day of the week, but two news items emerged from the White House in the morning. First, Donald Trump promised to distribute $2,000 to all Americans as dividends from the new trade policy, and then he reported on the Senate's exit from the crisis. Before we delve into these two events, we want to remind you that Trump's words should always be divided by eight, or ideally by sixteen.

So, Donald Trump promised to distribute $2,000 to all Americans as "helicopter money." Why? Let's remember that all the trade tariffs will ultimately be paid by the Americans themselves. And they will end up paying much more than $2,000. Thus, Trump primarily aims to alleviate the dissatisfaction of the American people regarding his trade policy. Already, many Americans are complaining about sharp price increases, even though official inflation is only 3%. However, we should also remember that the dollar lost at least 10-15% of its value against its main competitors in 2025. This means the dollar's purchasing power has also decreased. In addition, the Trump administration has raised many government payments, rents are rising, and prices for basic food items are increasing. Therefore, promises to distribute free money are, firstly, pure populism, and secondly, one might ask where Trump will get this money? The tariffs were clearly not collected just to be distributed later.

If you multiply $2,000 by the number of eligible Americans, you end up with hundreds of billions of dollars. So, Trump, who in 2025 calls for cuts in all areas, including social payments and healthcare, is going to give away hundreds of billions of dollars for free? What sense and logic does this make? It is clear that "helicopter money" will contribute to economic growth and increased consumer spending. But this is a one-time event, not an addition to the monthly budget of every American household.

It is clear that "helicopter money" will increase demand and drive inflation, which suggests a significantly smaller rate cut from the Fed than Trump requires. Where is the logic in this? Trump, it seems, is undermining efforts to control inflation and is pushing for a more stringent monetary policy from the Fed. We believe that there will be no $2,000 "dividends," inflation in America will continue to rise, and Trump will keep trying to exert complete control over the Fed, determining borrowing costs independently of inflation. Therefore, these three points are not interconnected, as most experts believe. Yes, maybe some Americans will receive the $2,000, but Trump gives with one hand and takes with the other. This means there will be more tariffs, further increases in government service costs, and other types of levies and taxes. Money does not come from thin air unless you are the central bank. And the dollar is poised to fall, which is again highly favorable for Trump.

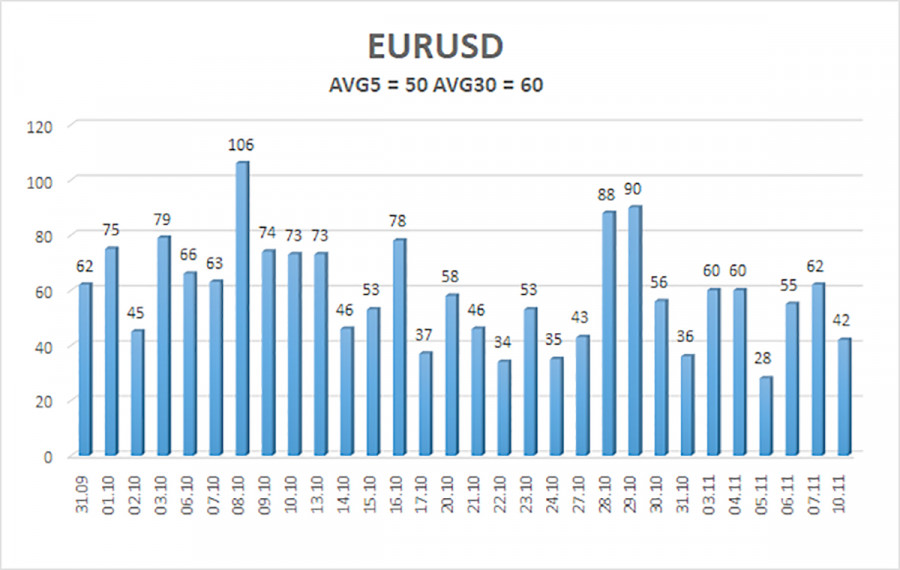

The average volatility of the EUR/USD currency pair over the last five trading days as of November 11 is 50 pips, which is considered "low." We expect the pair to trade between 1.1498 and 1.1597 on Tuesday. The upper linear regression channel is pointing downwards, signaling a downward trend, but a flat condition persists on the daily timeframe. The CCI indicator entered the oversold area twice in October, which may provoke a new upward trend in 2025.

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

The EUR/USD pair has once again consolidated above the moving average. The upward trend remains on all higher timeframes, while a flat condition has persisted on the daily timeframe for several months. The U.S. currency continues to be strongly influenced by the global fundamental background. Recently, the dollar has risen, but the reasons for this movement may be purely technical. If the price is located below the moving average, small shorts can be considered with targets at 1.1498 and 1.1475 based on purely technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

LINKS RÁPIDOS