The test of the price at 1.3152 occurred when the MACD indicator had moved significantly below the zero mark, which limited the pair's potential for further decline. For this reason, I did not sell the pound. The second test at 1.3152 shortly thereafter coincided with the MACD being in the oversold area, prompting the execution of Scenario #2: a buy. As a result, the pair rose by 30 pips.

The British pound hardly reacted to the news that the U.S. Senate approved a bill aimed at stopping the shutdown. This bill is now headed to the House of Representatives for a vote scheduled for Wednesday. Any positive data concerning the British economy will now support the pound. In the first half of the day, data will be released regarding the number of unemployment benefit claims, the current unemployment rate, and changes in average wages. Traders will pay particular attention to average earnings data, as these impact inflation. Steady wage growth can signal persistent inflationary pressures, forcing the Bank of England to maintain a restrictive policy. This could help lift the pound's exchange rate. Conversely, an unexpected jump in unemployment benefit claims, an increase in unemployment, or a slowdown in wage growth could negatively affect the pound's exchange rate. Such information may be viewed as signs of deteriorating conditions in the British economy and a reduced likelihood of future high interest rates.

Regarding the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

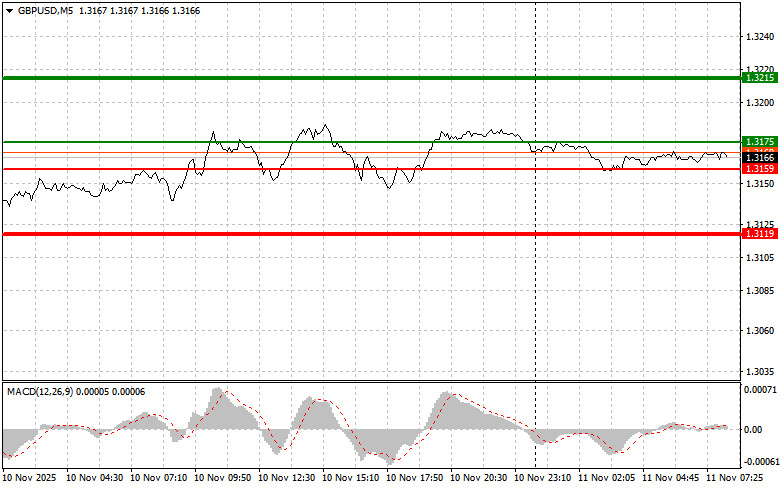

Scenario #1: I plan to buy the pound today if it reaches an entry point around 1.3175 (the green line on the chart), targeting a move to 1.3125 (the thicker green line on the chart). At the 1.3125 level, I intend to exit the market and sell immediately in the opposite direction, expecting a movement of 30-35 pips back from this level. We can only anticipate growth in the pound today after strong data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I will also consider buying the pound today if there are two consecutive tests of 1.3159 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to opposite levels of 1.3175 and 1.3215 can be expected.

Scenario #1: I plan to sell the pound today after the price updates to 1.3159 (the red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3119 level, where I intend to exit the short positions and buy immediately in the opposite direction (expecting a 20-25-pip move back from this level). Pound sellers will only return with very weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I will also consider selling the pound today if there are two consecutive tests of 1.3175 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.3159 and 1.3119 can be expected.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

LINKS RÁPIDOS