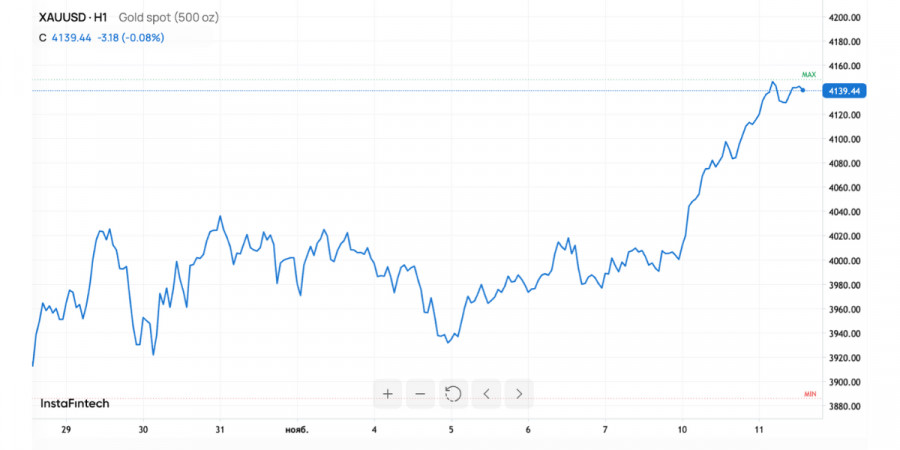

O mercado global de ouro volta a demonstrar força. No início de novembro, o preço do metal precioso disparou quase 3%, consolidando-se acima de US$ 4.100 por onça e atingindo a máxima de duas semanas.

A razão é clara: os investidores intensificaram as discussões sobre os iminentes cortes de juros pelo Federal Reserve. Diante dos dados econômicos fracos dos Estados Unidos, o ouro reafirma seu papel como porto seguro para quem busca estabilidade em meio à turbulência econômica.

A alta nos preços do ouro em novembro não representa um lampejo isolado de otimismo, mas sim o reflexo de tendências estruturais na economia global. As estatísticas recentes dos Estados Unidos vieram piores do que o esperado: em outubro, o número de empregos caiu, especialmente nos setores público e de varejo.

Ao mesmo tempo, o sentimento do consumidor recuou, e as famílias passaram a adotar uma postura mais cautelosa em relação à renda e aos gastos futuros. Esses dados sinalizam aos mercados que a economia dos EUA está perdendo fôlego, o que sugere que o Federal Reserve pode não apenas interromper seu ciclo de aperto monetário, mas também iniciar cortes de juros já em dezembro.

Atualmente, a probabilidade de um corte é estimada em aproximadamente 64%, subindo para 77% em janeiro. Esse cenário cria um ambiente favorável para o ouro: quando os rendimentos de ativos em dólar diminuem, os investidores buscam alternativas, e o metal precioso — que não oferece cupons nem dividendos — torna-se a escolha natural.

Um aspecto importante é o sentimento dos investidores. Após vários meses de alta volatilidade no mercado de ações, o ouro voltou a ser visto como um porto seguro. Quanto mais tempo persistirem a incerteza política e econômica, maior tende a ser a demanda por ativos de "valor sólido".

A paralisação do governo federal dos Estados Unidos, que já chega ao 40º dia, intensificou ainda mais essa percepção de instabilidade. Mesmo a notícia de um possível acordo no Senado não foi suficiente para alterar o sentimento do mercado. No momento, com o fluxo de dados econômicos limitado, os participantes baseiam suas decisões mais em expectativas do que em fatos concretos — e essas expectativas têm favorecido o ouro.

A alta do metal é acompanhada por aumentos em outros ativos preciosos. A prata subiu 4,5%, para US$ 50,46 por onça, a platina 2,4% e o paládio 3,1%. Isso indica uma ampla reavaliação do setor de metais preciosos, à medida que os investidores migram para classes de ativos mais defensivas.

Se o momento atual se mantiver, o ouro poderá testar a faixa de US$ 4.200–4.300 por onça até o final do ano, e um avanço em direção a US$ 5.000 não pode ser descartado no primeiro trimestre do próximo ano. Tudo dependerá da rapidez e da determinação com que o Federal Reserve avançar nos cortes de juros.

No entanto, há um outro lado nessa perspectiva. Caso a economia dos Estados Unidos mostre sinais consistentes de recuperação e o dólar se fortaleça, a alta do ouro poderá perder força. Por ora, os riscos geopolíticos, a instabilidade no mercado de títulos e as potenciais crises orçamentárias em Washington continuam a sustentar o interesse pelo metal precioso.

O ouro vem recuperando seu status como principal beneficiário da incerteza nos mercados. Dados econômicos fracos nos Estados Unidos, expectativas de cortes nas taxas de juros e conflitos políticos internos criaram condições ideais para o avanço do metal precioso.

Os investidores apostam cada vez mais que a era do "dinheiro caro" está chegando ao fim, e o ouro reafirma seu papel como instrumento universal de proteção. Mais do que simplesmente subir de valor, o metal reflete o clima desta fase do mercado — exaustão em relação ao risco, medo do futuro e o desejo de preservar o valor real em um mundo em que a confiança está se dissipando.

LINKS RÁPIDOS