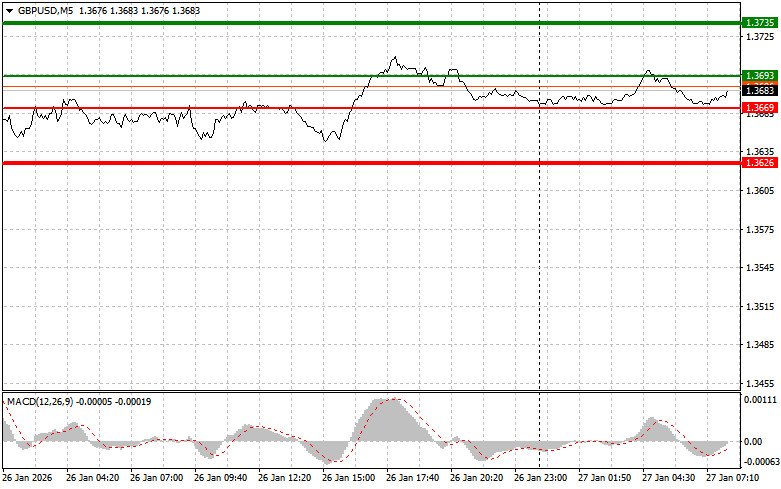

The price test at 1.3682 occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound.

The pound continued to rise despite a rise in US durable goods orders, as speculation about possible US assistance to Japan in stabilizing the yen kept pressure on the dollar. There are market rumors suggesting the possibility of the US intervening or coordinating with the Japanese central bank to strengthen the yen. However, given the current state of the American economy, with its inflation risks and desire for moderate economic growth, participating in supporting the yen appears to be a challenging task. Any steps in this direction would require careful analysis of the potential consequences for the US economy and monetary policy.

Today, there are no fundamental data from the UK in the first half of the day. The absence of economic data leaves traders room to maneuver, relying on current market sentiments and technical indicators. In recent days, the pound has shown resilience, and in the absence of fundamental drivers, technical analysis takes the forefront. Key resistance and support levels will determine the direction of the pound's movement against the dollar.

Regarding the intraday strategy, I will primarily focus on implementing scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3693 (the green line on the chart), targeting a move to 1.3735 (the thicker green line on the chart). At the 1.3735 level, I plan to exit the market and open short positions immediately in the opposite direction, anticipating a move of 30-35 pips from the entry level. Growth in the pound today can be anticipated as the trend continues. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting its ascent from there.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3669 when the MACD indicator is in oversold territory. This will limit the pair's downside potential and lead to an upward market reversal. A rise can be anticipated toward opposing levels of 1.3693 and 1.3735.

Scenario #1: I plan to sell the pound today after the level at 1.3669 (the red line on the chart) is reached, which will trigger a rapid decline in the pair. The key target for sellers will be the level of 1.3626, where I intend to exit my shorts and buy immediately in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). Sellers of the pound are unlikely to make a strong showing. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting its descent from there.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3693 when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward opposite levels of 1.3669 and 1.3626.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

LINKS RÁPIDOS