The EUR/USD currency pair continued its downward movement throughout Monday. We discussed the key report of the day: the ISM Manufacturing Index for the US. This index indeed triggered a new strengthening of the American currency. The index unexpectedly rose from 47.9 to 52.6, which could not go unnoticed. This is not merely about exceeding forecasts; it's about nearly 5 points of growth and moving out of the negative zone. However, it should also be acknowledged that the dollar began to rise before the index was published, with the opening of the American trading session. Technically, the pair has consolidated below the ascending trend line, indicating the short-term trend has shifted to the downside. We still believe that there is currently a downward correction within a new upward trend. Therefore, we expect the upward trend to resume. However, this week will be filled with many news events, so theoretically, the dollar's growth is also possible.

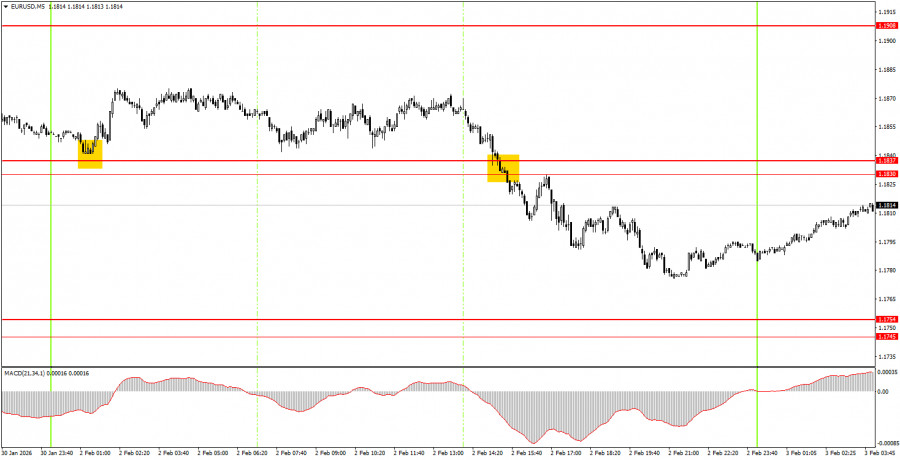

On the 5-minute timeframe, one trading signal was formed on Monday. The price broke through the area of 1.1830-1.1837 during the American session, allowing traders to open short positions. The target area of 1.1745-1.1754 was not reached, so the trade could have only been profitable if it had been manually closed.

The correction continues on the hourly timeframe. However, we should note that the flat movement lasting 7 months can be considered complete. If so, then the long-term upward trend has recovered, and we expect the dollar to decline in 2026. The fundamental background remains very challenging for the US currency; thus, we fully support further movement to the north.

On Tuesday, beginner traders can open new short positions if there is a rebound from the 1.1830-1.1837 area, targeting 1.1745-1.1754. A price consolidation above the 1.1830-1.1837 area will allow opening long positions with a target at 1.1908.

On the 5-minute timeframe, the following levels should be considered: 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527-1.1531, 1.1550, 1.1584-1.1591, 1.1655-1.1666, 1.1745-1.1754, 1.1830-1.1837, 1.1908, 1.1970-1.1988, 1.2044-1.2056, 1.2092-1.2104. Today, there are no important reports scheduled in Germany and the Eurozone, while in the US, the JOLTS report on job vacancies will be released. This report cannot be labeled significant, but it is part of the US labor market reports.

LINKS RÁPIDOS