Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

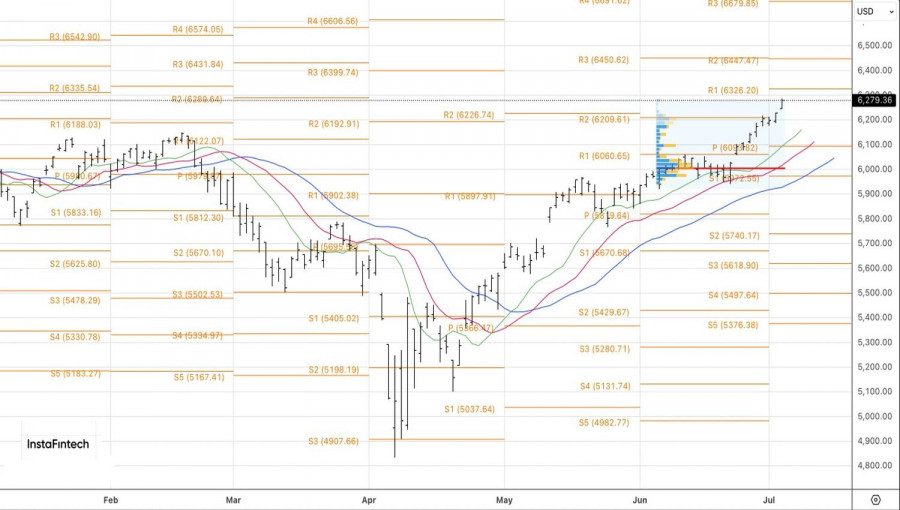

Financial markets responded positively to the release of U.S. employment statistics for June. Payrolls rose by 143,000, exceeding Bloomberg analysts' forecasts. April and May figures were revised upward, and the unemployment rate declined to 4.1%. After the first drop in ADP private sector employment since 2023, these numbers were seen as a true victory for the S&P 500. The stock index celebrated with yet another record high—its fourth in the last five days and the seventh since the start of the year.

CFRA raised its target levels for the broad stock index to 6,525 by year-end and 6,850 over the next 12 months—about 10% above current levels. The firm is impressed by the S&P 500's swift rebound following a 19% correction. It notes that typical post-correction equity gains since World War II average around 10%. The volatility index has dropped to a 4-month low, and financial advisors believe it's still not too late to buy equities.

VIX Volatility Index Dynamics

These views and CFRA's forecasts contrast with the latest MLIV Pulse survey results. Investors believe it will be difficult for the S&P 500 to stage another strong rally from current levels. Only 27% of the 168 respondents expect the index to be higher in a month, while 43% anticipate a decline.

Support for the stock market also came from Congress passing Donald Trump's "big and beautiful" $3.3 trillion tax cut bill. According to the White House, this legislation will boost the U.S. economy by 4.6–4.9% over the next four years—an outcome that would be excellent for equities. Skeptics disagree. Vanguard estimates the fiscal stimulus will add just 0.2–0.5 percentage points to GDP by 2026. Goldman Sachs expects an even lower impact, noting that tariffs will shave about 1 percentage point off GDP.

The bill is being described as a burden for future generations. It is projected to increase the national debt from the current 100% of GDP to 127% by 2034. Interestingly, Scott Bessent justifies the White House's strong-dollar mantra by pointing to the long-term strength of the U.S. economy. The argument is that the current administration must accelerate economic growth so that U.S. markets remain the most attractive for global investors going forward.

Meanwhile, rumors are circulating that Donald Trump may announce new tariffs before July 9. With markets currently closed, the U.S. president has a unique opportunity to avoid triggering a sell-off with negative news. If that happens, the likelihood of a gap down in the S&P 500 at next week's open increases.

Technically, on the daily chart, the S&P 500 rally is gaining momentum. Long positions opened from 6,051 appear to be a good trade, and the previously mentioned targets of 6,325 and 6,450 are getting closer. It makes sense to stick with a strategy of buying the S&P 500—unless, of course, the U.S. president derails it all.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.