A test of the 1.1692 level occurred just as the MACD indicator began moving up from the zero line, confirming a good entry point for buying euros. As a result, the pair rose by more than 50 pips.

The US Consumer Price Index increased, but the growth was relatively modest. The actual increase was 0.4% versus an expected 0.3%. This put moderate pressure on the dollar and boosted demand for the euro. Evidently, August's CPI rise in the US was minor, which could push the Federal Reserve to lower interest rates at its next meeting. The released figures suggest inflationary pressures are slowing, giving the Fed more flexibility. Economists believe the Fed can use this situation to pursue an easier monetary policy to support economic growth in the near future. Rate cuts can stimulate consumer demand and investment activity, which will have a positive effect on the US economy's overall prospects.

Still, some experts urge caution and moderation in expectations. They emphasize that August's figures may be temporary and that further inflation dynamics need to be watched closely. Also, Fed rate cuts could weaken the dollar, raising the cost of imports and thus potentially spurring price growth.

Today, during the first half of the day, we'll get new CPI data from Germany and France, Italy's unemployment rate, and a public speech from Bundesbank head Joachim Nagel. If the reported inflation figures come in above forecasts, the European Central Bank could be pushed to end its rate-cutting cycle, as Christine Lagarde mentioned in her speech just yesterday.

Italy's unemployment rate is unlikely to be scrutinized closely. Still, any signs of deterioration here could negatively impact the euro and complicate the ECB's efforts to stimulate an economic recovery. Bundesbank President Nagel's speech will also get special attention. His comments on current economic conditions and the outlook for monetary policy could heavily shape market expectations—and therefore drive the euro. Traders will closely analyze any hints regarding the ECB's plans.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

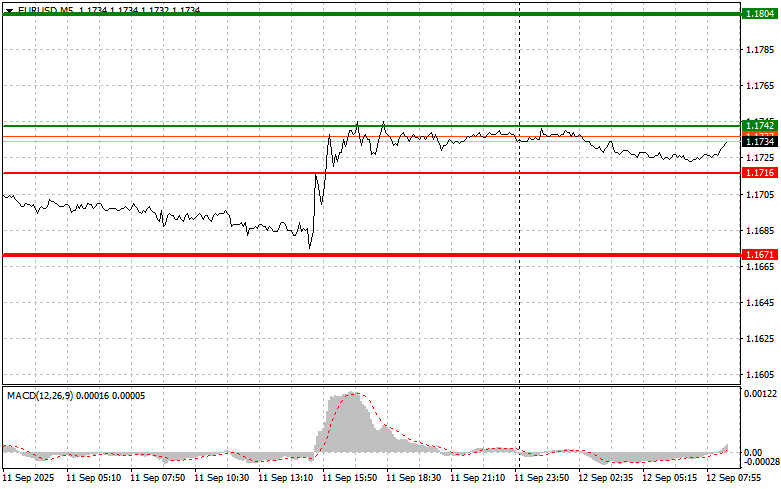

Scenario 1: Today, you can buy the euro if the price reaches the 1.1742 area (the green line on the chart), with a target of rising to 1.1804. At 1.1804, I plan to exit the market and sell euros in the opposite direction, aiming for a 30–35 pip move from entry. Consider buying euros only after strong data. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise.

Scenario 2: I also plan to buy euros if there are two consecutive tests of the 1.1716 level when the MACD is in oversold territory. This will limit further downside for the pair and could trigger a sharp upside reversal. A move to 1.1742 and 1.1804 can be expected.

Scenario 1: I plan to sell euros after a move to the 1.1716 level (the red line on the chart). The target is 1.1671, where I will close out and immediately buy in the opposite direction (expecting a 20–25 pip move back from this level). Pressure on the pair today will return on weaker-than-expected data. Important! Before selling, ensure the MACD indicator is below zero and beginning to decline.

Scenario 2: I will also plan to sell euros if there are two consecutive tests of the 1.1742 level when the MACD is in overbought territory. This will limit any upward moves and could trigger a sharp downside reversal. A move lower to 1.1716 and 1.1671 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

QUICK LINKS