The Japanese yen remains under pressure against the US dollar, with the USD/JPY pair targeting the 156.00 level today.

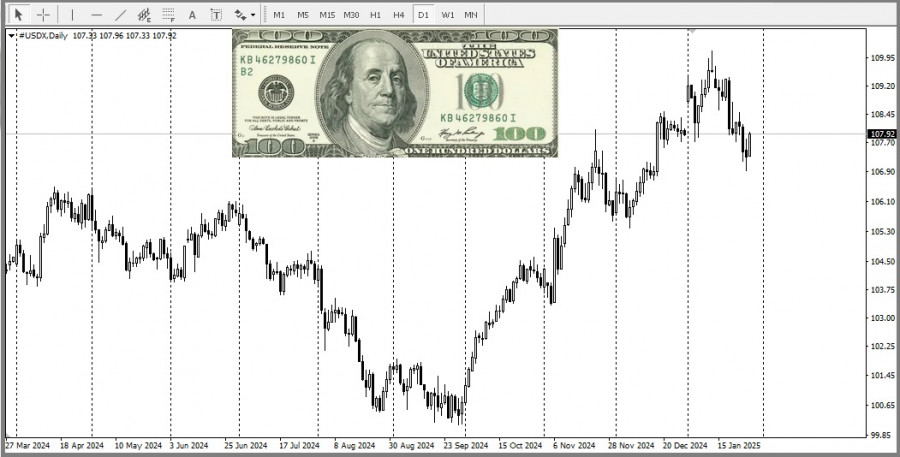

The yen continues to face downward pressure against the dollar as US President Donald Trump reaffirms his intention to raise tariffs, which could spark new inflationary pressures in the US. This, in turn, supports a modest recovery in US Treasury yields, reducing the appeal of the low-yielding yen and increasing demand for the dollar.The US Dollar Index (DXY), which tracks the dollar's performance against a basket of currencies, is showing a solid rebound from its monthly low—the lowest level since December 18—recorded on Monday. This provides an additional boost to the USD/JPY pair.

However, diverging expectations regarding the monetary policies of the Bank of Japan (BoJ) and the Federal Reserve (Fed) may limit yen losses and cap the dollar's gains. Market participants should also keep an eye on today's release of US macroeconomic data, which could provide additional momentum for the pair ahead of the two-day FOMC meeting starting today.

Yesterday's sustained break below the multi-month upward trend channel support was seen as a key trigger for bears. However, oscillators on the daily chart remain mixed, suggesting caution for both buyers and sellers when opening new directional positions.

On the other hand, the psychological level of 155.00 acts as immediate support, ahead of the horizontal zone at 154.45, which coincides with today's opening level, and the round figure of 154.00. A sustained break below these levels would confirm a short-term bearish outlook, potentially dragging the USD/JPY pair toward intermediate support at 153.30 and then to the next key level of 153.00.

Key resistance levels to watch include 156.00 and further upside targets, which depend on broader risk sentiment and the outcome of upcoming US economic reports and Federal Reserve communications.

TAUTAN CEPAT