Akcie LVMH v úterý klesly poté, co největší světová luxusní skupina vykázala v prvním čtvrtletí tržby, které zaostaly za očekáváním.

Akcie LVMH v úvodu seance klesly o 5,2 % a stáhly dolů akcie konkurenčních společností vyrábějících luxusní zboží, jako jsou Kering a Hermes.

V pondělí LVMH vykázala 3% pokles tržeb za první čtvrtletí, což bylo výrazně pod očekáváním analytiků, kteří předpokládali 2% růst, a dalo to první signál, že luxusní společnosti by mohl čekat další těžký rok po nedávných oznámeních prezidenta Donalda Trumpa o clech, která vyvolala obavy z recese.

The euro was effectively traded using the Mean Reversion strategy, while the Japanese yen and the British pound followed the Momentum strategy.

The eurozone and UK manufacturing PMI indices were revised downward, which prevented both the euro and the pound from showing any growth even in the first half of the day. Weak data from Europe intensified concerns about slowing economic growth in the region. Investors are increasingly worried that the European Central Bank's decision to hold off on rate cuts could push the economy toward recession. The same applies to the UK, where the central bank is hesitant to ease policy, fearing another surge in inflation triggered by Trump's tariffs.

In the second half of the day, the market will receive U.S. data on nonfarm payrolls, the unemployment rate, and average hourly earnings. This data package, known as the Nonfarm Payrolls, traditionally has a strong impact on currency markets, and today is unlikely to be an exception.

The employment change figure will be especially important, as it provides insight into the pace of job creation. Strong job growth may indicate a healthy economy and support the Fed in maintaining interest rates, which would benefit the dollar. The unemployment rate is another key indicator, reflecting overall labor market conditions. A decline in unemployment is typically seen as a positive sign, indicating more people are finding work.

Average hourly earnings serve as an indicator of inflationary pressure. Rising wages can stimulate consumer spending and lead to higher prices. If wage growth exceeds expectations, the Fed may adopt a more aggressive stance to contain inflation, once again supporting the dollar.

In case of strong data, I will focus on implementing the Momentum strategy. If the market does not react to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

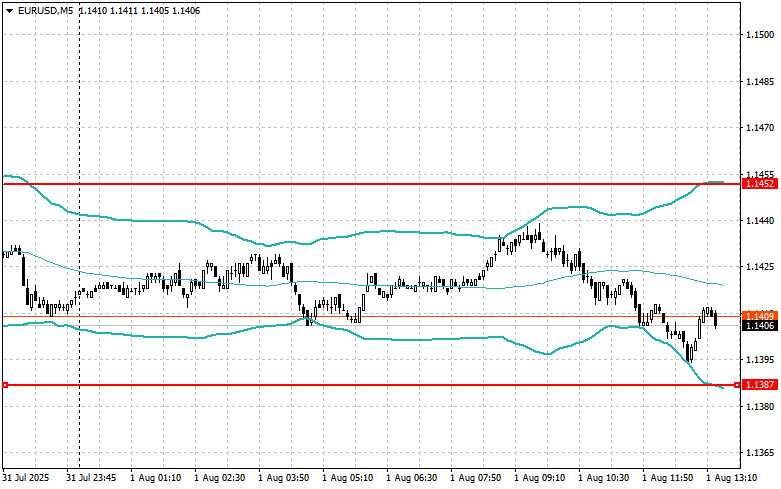

EUR/USD

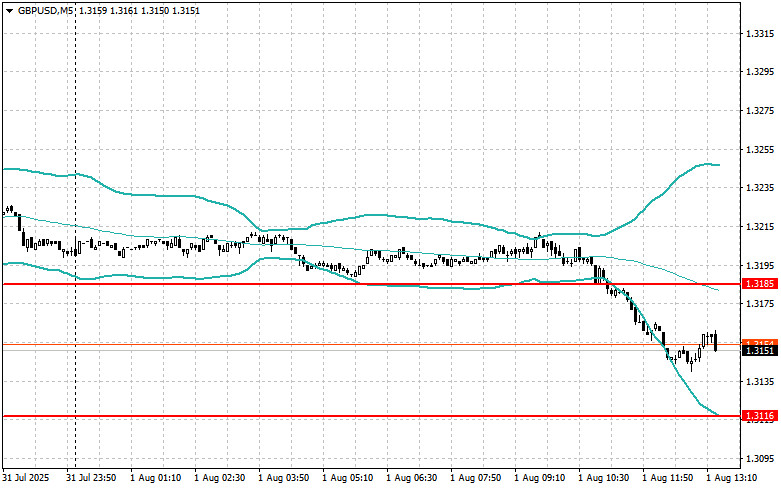

GBP/USD

USD/JPY

Mean Reversion Strategy (Pullback) for the Second Half of the Day:

EUR/USD

GBP/USD

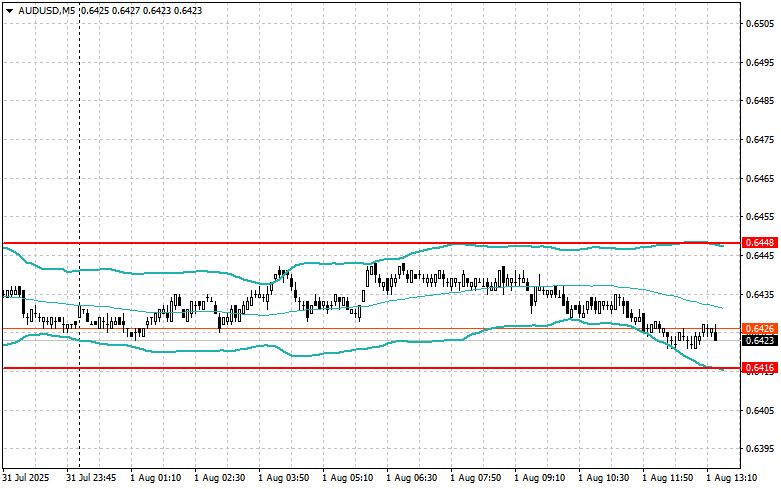

AUD/USD

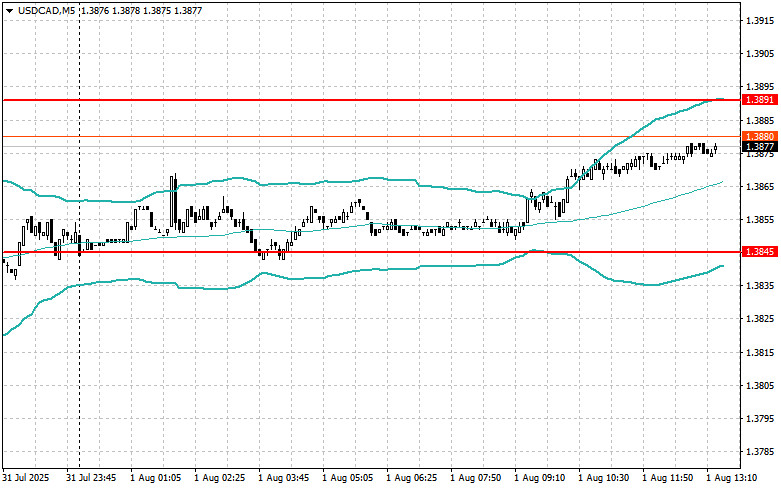

USD/CAD

TAUTAN CEPAT