You can't eat politics for breakfast. Following Shigeru Ishiba's unexpected resignation as Prime Minister, investors bet that USD/JPY would soon reach the 150 mark. The leading contender for prime minister, Sanae Takaichi, has repeatedly emphasized her support for Shinzo Abe's policies. This suggests large-scale fiscal stimulus and resistance to the Bank of Japan's attempts at monetary tightening. However, the yen hasn't been particularly spooked.

In theory, political uncertainty means a delay in the next overnight rate hike. The Prime Minister's resignation allowed Barclays to postpone its forecast for the next tightening from October to January. Nevertheless, 36% of Bloomberg's experts still expect tightening in mid-autumn—this is the most popular view, even though the share has fallen from 43%.

BoJ hawks argue for immediate rate hikes. This would strengthen the yen and lower import prices. Without such action, inflation will remain elevated and the trade deficit will grow—something the US does not want to see.

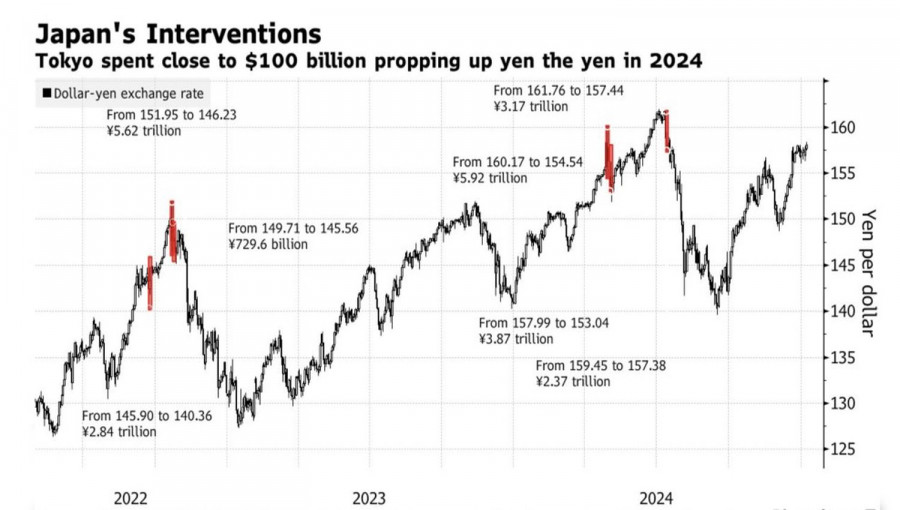

US Treasury Secretary Scott Bessent and Japan's Finance Minister Katsunobu Kato signed a joint statement affirming that the market should set exchange rates. Fiscal and monetary policies should have their own distinct goals. Still, Washington and Tokyo left themselves room for intervention, warning that disorderly movements and excessive volatility are unacceptable on the Forex. Japan has spent about $150 billion over the past three years to protect the yen from excessive weakening.

Interestingly, the finance ministers have tried to separate currency policy from Donald Trump's intentions to reduce the US-Japan trade imbalance. The markets interpreted this as a signal that there's no pressure from Washington on Tokyo to strengthen the yen against the dollar. This, combined with Ishiba's resignation, supports USD/JPY bulls.

Their rivals, however, have their own cards: they're counting on marked Fed easing after a series of disappointing US labor market reports and slow inflation. The chance of a 75-basis-point Fed rate cut in 2025 now exceeds 80%.

Thus, the current consolidation in USD/JPY makes sense. On the bulls' side: Japan's political crisis and the lack of pressure from Washington on Tokyo to strengthen the yen. The bears are betting on monetary policy divergence and hopes for a BoJ overnight rate hike in October.

Technical outlook: On the daily chart, USD/JPY continues to consolidate in the 146.5–148.5 range, with several false breakouts. Longs on a breakout above 148.5 and shorts if support at 146.5 fails are still relevant trading strategies.

TAUTAN CEPAT