Only one Canadian dollar trade was executed today using the Mean Reversion strategy, but even there, a strong reversal movement never materialized. I did not trade anything using the Momentum strategy.

The demand for the euro and pound, which was observed at the end of last week, has not returned. The U.S. eased pressure on China, which increased the likelihood of reaching a compromise. This, in turn, supported the U.S. dollar. Traders shifted from fears of escalating trade tensions to a more optimistic scenario, which triggered a capital inflow into dollar-denominated assets. However, this positive move is not supported by solid macroeconomic data — with publications complicated by the ongoing government shutdown, so the minor strengthening of the dollar may prove temporary.

In the second half of the day, there are no U.S. economic reports scheduled, nor any interviews with Federal Reserve officials. This means the foreign exchange market will face a period of relative calm, where price movements will be shaped mainly by accumulated momentum and trader sentiment. After the volatile Friday session, driven by news of a potential new trade war, a position consolidation is being observed. Most traders are taking a wait-and-see stance, assessing the sustainability of the dollar's recent strength and the potential for a trend reversal. Technically, a sideways channel has formed, and the lack of fresh economic data or regulator comments reduces the likelihood of sharp market fluctuations.

In case of strong statistical data, I will rely on the Momentum strategy. If there is no market reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

For EUR/USD:

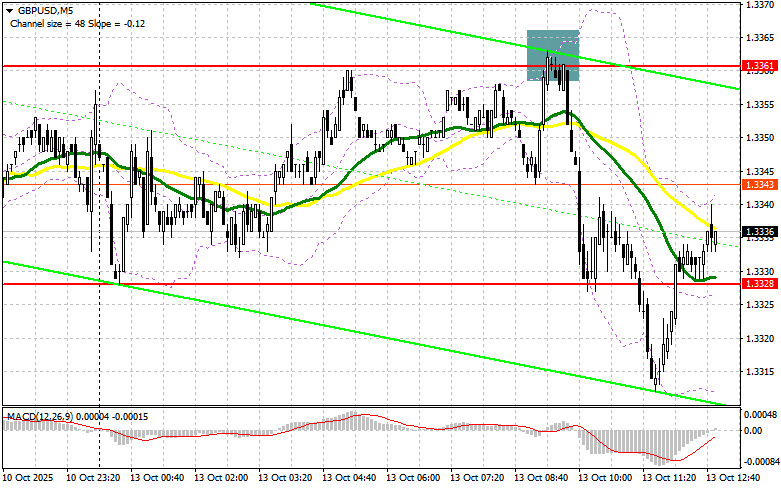

For GBP/USD:

For USD/JPY:

Mean Reversion Strategy (Reversal) for the Second Half of the Day:

For EUR/USD:

For GBP/USD:

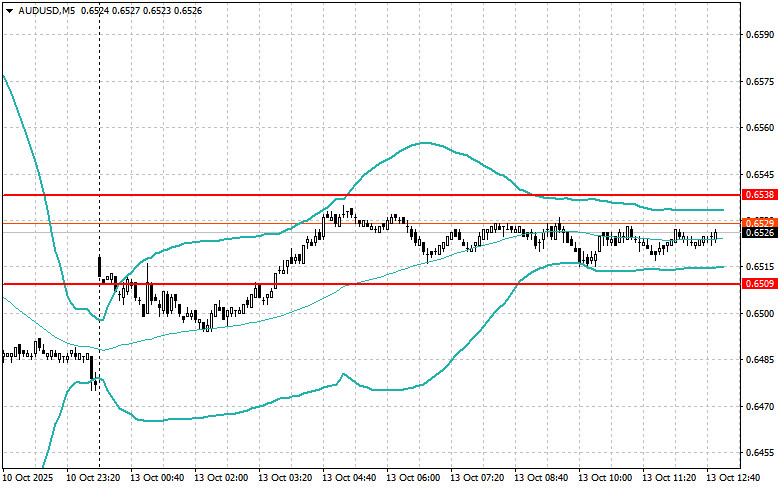

For AUD/USD:

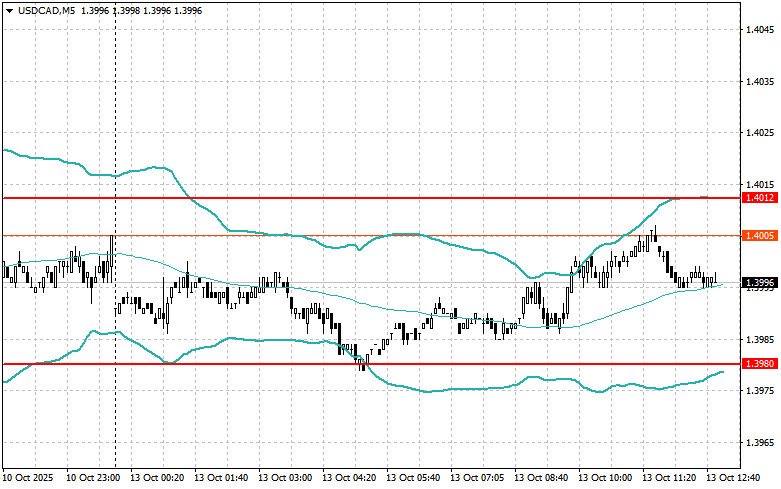

For USD/CAD:

TAUTAN CEPAT