Analisis Trading dan Kiat-kiat Trading untuk Yen Jepang

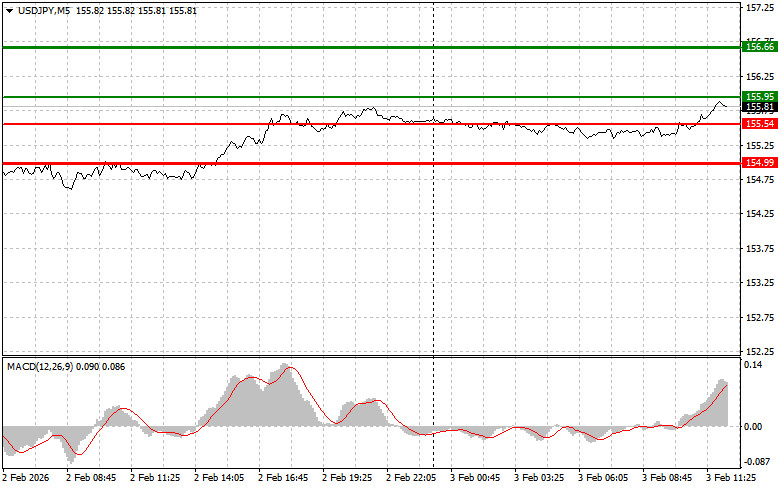

Pengujian level harga 155,58 terjadi saat indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli dolar. Akibatnya, pasangan ini naik lebih dari 30 poin.

Jelas bahwa perhatian para investor selanjutnya akan tertuju pada rilis laporan JOLTS pasar tenaga kerja AS, yang memungkinkan untuk menilai kesehatan pasar tenaga kerja dan dampaknya terhadap proses inflasi. Sejumlah besar lowongan kerja dapat menandakan kekurangan tenaga kerja di perusahaan, yang mengarah pada kenaikan upah dan, akibatnya, kenaikan inflasi. Sebaliknya, berkurangnya posisi kosong dapat menunjukkan pelemahan pasar tenaga kerja dan tekanan inflasi yang lebih rendah.

Namun, pendorong utama pertumbuhan dolar mungkin adalah pidato dari perwakilan FOMC Thomas Barkin dan Michelle Bowman. Perhatian khusus akan diberikan pada sinyal mengenai waktu penurunan suku bunga lebih lanjut dan faktor-faktor yang memandu keputusan tersebut oleh Federal Reserve. Pernyataan yang tidak terduga atau perubahan nada dapat memicu volatilitas di pasar keuangan.

Terkait strategi intraday, saya akan lebih mengandalkan pelaksanaan skenario No. 1 dan No. 2.

Sinyal Beli

Skenario No. 1: Hari ini, saya berencana membeli USD/JPY ketika titik masuk tercapai di sekitar 155,95 (garis hijau pada grafik), dengan target pertumbuhan di 156,66 (garis tebal hijau pada grafik). Di sekitar 156,66, saya akan keluar dari posisi beli dan membuka posisi jual ke arah sebaliknya (dengan target pergerakan 30–35 poin ke arah berlawanan dari level tersebut). Pertumbuhan USD/JPY hari ini dapat diantisipasi setelah rilis data AS yang kuat. Penting! Sebelum membeli, pastikan indikator MACD berada di atas garis nol dan baru mulai naik dari situ.

Skenario No. 2: Saya juga berencana membeli USD/JPY hari ini jika level 155,54 diuji dua kali berturut-turut ketika indikator MACD berada di area oversold. Ini akan membatasi potensi penurunan dan memicu reversal ke atas. Pertumbuhan menuju level sebaliknya 155,95 dan 156,66 dapat diantisipasi.

Sinyal Jual

Skenario No. 1: Hari ini, saya berencana menjual USD/JPY setelah level 155,54 ditembus (garis merah pada grafik), yang akan menyebabkan penurunan cepat pada pasangan ini. Target utama bagi penjual terletak di level 154,99, tempat saya berencana keluar dari posisi jual dan segera membuka posisi beli ke arah sebaliknya (dengan target pergerakan 20–25 poin ke arah berlawanan dari level tersebut). Tekanan pada pasangan ini akan kembali jika data ekonomi lemah. Penting! Sebelum menjual, pastikan indikator MACD berada di bawah garis nol dan baru mulai turun dari situ.

Skenario No. 2: Saya juga berencana menjual USD/JPY hari ini jika level 155,95 diuji dua kali berturut-turut ketika indikator MACD berada di area overbought. Ini akan membatasi potensi kenaikan dan memicu reversal ke bawah. Penurunan menuju level sebaliknya 155,54 dan 154,99 dapat diantisipasi.

Informasi di Grafik:

Catatan: Trader forex pemula harus sangat berhati-hati saat membuat keputusan masuk pasar. Sebelum rilis laporan fundamental utama, sebaiknya hindari pasar agar tidak terjebak fluktuasi harga yang tajam. Jika Anda memutuskan untuk trading selama rilis berita, selalu tempatkan stop order untuk meminimalkan kerugian. Tanpa stop order, Anda bisa kehilangan seluruh deposit Anda dengan sangat cepat, terutama jika Anda tidak menggunakan manajemen uang dan trading dalam volume besar.

Ingat bahwa trading yang sukses memerlukan rencana trading yang jelas, seperti yang disajikan di atas. Keputusan trading spontan berdasarkan situasi pasar saat ini adalah strategi yang merugikan bagi trader intraday.

TAUTAN CEPAT