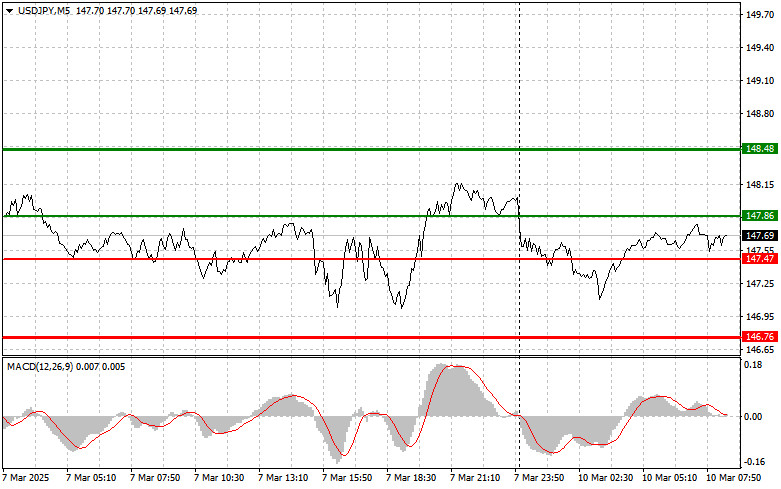

The first test of the 147.69 price level occurred when the MACD indicator had already risen significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the dollar. The second test of 147.69 shortly afterward coincided with MACD being in the overbought zone, allowing scenario #2 for selling to play out, leading to a 50-pip decline in the dollar.

The dollar is struggling against the yen, which remains in demand amid expectations of further interest rate hikes by the Bank of Japan. Today's economic data from Japan did not significantly change the balance of power. Wage growth figures were worse than economists had forecasted, while bank lending volumes exceeded expectations. The country's current account balance was close to economists' projections.

The impact of these figures on financial markets has been minimal. Investors appear to have already factored in the negative wage trends, while the positive credit data is viewed as a temporary situation that is unlikely to alter the overall outlook. Given the relative stability, analysts do not rule out the possibility of further adjustments to the BOJ's monetary policy in the near future. These decisions will depend on global economic trends and energy prices.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today if the entry point reaches around 147.86 (green line on the chart), with a target of 148.48 (thicker green line). At 148.48, I intend to exit buy positions and open sell positions in the opposite direction, expecting a 30-35 pip move downward from this level. It is best to return to buying the pair on corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 147.47 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward market reversal. A rise toward the opposite levels of 147.86 and 148.48 can be expected.

Scenario #1: I plan to sell USD/JPY today only after the price breaks below 147.47 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 146.76, where I plan to exit sell positions and immediately open buy positions in the opposite direction, expecting a 20-25 pip move upward. Selling pressure on the pair can return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 147.86 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 147.47 and 146.76 can be expected.