If Donald Trump was seen as one of the key drivers of the S&P 500 rally in 2025, the president is increasingly throwing a wrench into the broad stock index's progress in 2026. Indeed, last year the White House backed away from market-shocking tariffs, aimed to lower Treasury yields and pushed stimulus through a big, beautiful tax-cut law. Much has changed in the new year.

Trump's intention to cap banks' earnings from credit cards, block large investors from buying homes, impose limits on executive pay and curb stock buybacks is being viewed as command-and-control, not market-based, policy. It gives the impression that the president cares more about the midterm elections than about the S&P 500 rally — especially after his remark about working with Microsoft to probe whether the electricity costs of companies processing AI data are being passed on to American consumers.

US inflation dynamics

I don't think the man in the White House wants to break the back of the S&P 500 bulls. Even the lawsuit against Jerome Powell appears aimed at pushing interest rates lower than the Federal Reserve plans. In that sense, the president is trying to turbocharge the economy. He proclaimed victory over inflation after headline and core CPI slowed to 2.7% and 2.6%, respectively. However, the market digested this differently. Actual figures were close to Bloomberg's forecasts and did not move forward the expected restart of the Fed's easing cycle from June to April. It's no wonder the broad index did not want to continue the rally.

Pressure on the S&P 500 came from disappointing numbers at JPMorgan. Q4 results showed lower profits and an unexpected drop in investment banking fees. US banks kick off the corporate reporting season and serve as bellwethers for the stock market and the US economy.

US stock indices dynamics

Bank of America forecasts that S&P 500 companies' Q4 results could reverse the recent market rotation. The tech sector's earnings are expected to rise about 20%, while other sectors are projected to grow 1–9%. Bloomberg expects an even wider divergence — roughly 30% versus 9%.

Under such conditions, even elevated fundamental valuations of the Magnificent Seven will not deter investment in their shares. Moreover, the strength of the US economy allows a more optimistic view on the prospects for small-cap companies.

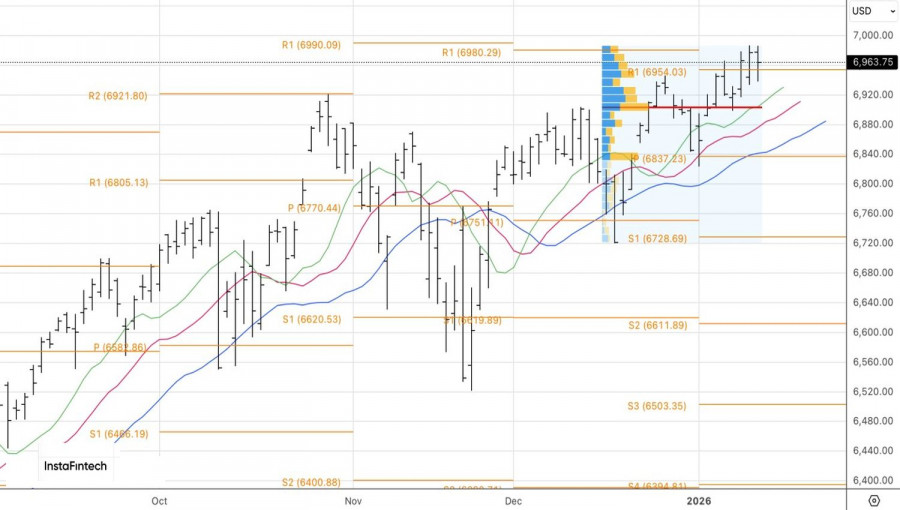

Technically, the daily S&P 500 chart shows a battle between bulls and bears over the pivot level at 6,955. If buyers can keep prices above it, the index should continue its rally toward 7,060 and 7,110. Maintain a focus on longs.