Everything new is well-forgotten old. At the turn of 2025 and 2026, the US stock market saw a rotation. The strength of the American economy provided a basis for moving away from tech stocks toward small-cap companies. The Russell 2000 outperformed the S&P 500 in its longest winning streak since the 1990s. However, with the upcoming corporate earnings reports from the Magnificent Seven, investors were forced to reassess their positions. If profits prove impressive, perhaps it is time to return to the previous leaders?

Dynamics of Equal-Weighted and Market-Weighted S&P 500

A handful of issuers account for more than 30% of the S&P 500's market capitalization. The equal-weighted equivalent of the broad stock index has outperformed the standard one since the beginning of the year, thanks to small-cap companies. But what if members of the Magnificent Seven manage to surprise with the high efficiency of their colossal investments in artificial intelligence technologies? If so, renewed interest in the former leaders could trigger FOMO (Fear of Missing Out).

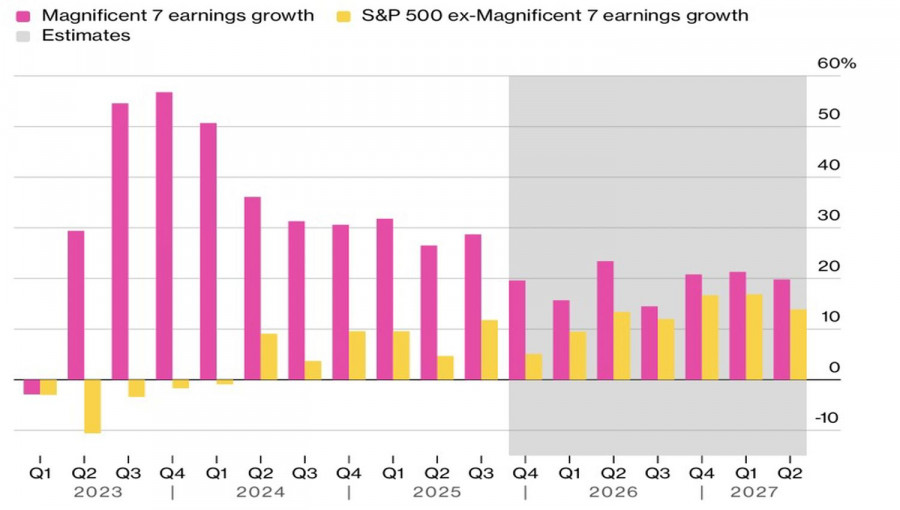

At the dawn of AI, the return on investment in tech giants was enormous, which was the foundation of their leadership. Gradually, these metrics declined, while small-cap companies saw growth. This dynamic, amid improving macroeconomic data, sparked the rotation process.

Profit Dynamics of Magnificent Seven and Other S&P 500 Companies

Interest in the earnings season of tech giants is so high that the S&P 500 is overlooking much of the negativity. After the killings and protests in Minnesota, the specter of a new government shutdown looms over the US. Democrats are not ready to support funding for Donald Trump's anti-immigration policies, and after January 31, the government may enter yet another forced vacation. Polymarket estimates the likelihood of this outcome at 78%.

If the shutdown happens, it could slow US economic growth and put pressure on the stock market, similar to the rotation in favor of non-American assets amid the uncertainty surrounding Trump's policies.

The S&P 500 bulls were not deterred by the Intel issue. When the White House promised the company $9 billion, it seemed like the beginning of a new era. Investors expected these funds to boost shares by 120% over 5 months due to increased chip production volumes. In reality, Intel was unprepared for the surge in AI data center processor orders. Investor disappointment resulted in a sharp drop in the company's stock price.

If something similar happens with larger issuers, including NVIDIA, the broad stock index could face a significant correction.

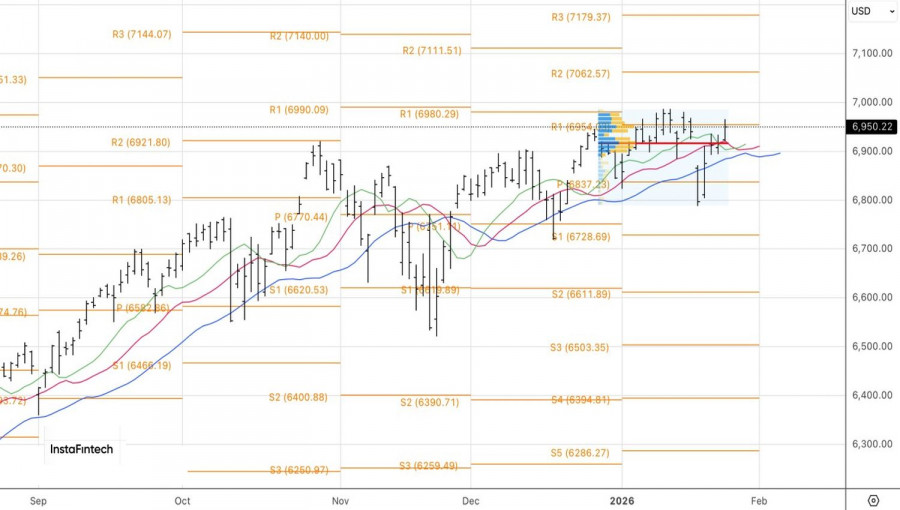

Technically, the daily chart of the S&P 500 shows a combination of two doji bars. Long positions formed at 6,935 can be increased if the resistance levels at 6,965 and 6,985 are successfully breached.