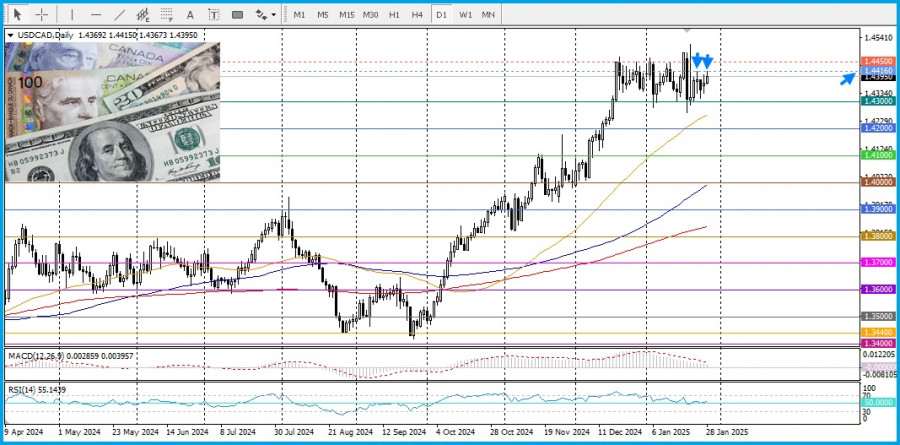

The USD/CAD pair is showing signs of recovery today, reaching a more-than-week high at approximately 1.4416 during the European session.

However, despite this recovery, the pair remains within its familiar range established over the past month, as traders anticipate upcoming events related to monetary policy decisions by the central banks of the two countries.

It is anticipated that the Bank of Canada will decide to cut interest rates by 25 basis points during its meeting on Wednesday, which could provide support for the USD/CAD pair. This diverges from the general market consensus that the Federal Reserve will leave its interest rates unchanged at its meeting on the same day. This divergence in central bank policies creates additional optimism for the US dollar's growth against the Canadian dollar.

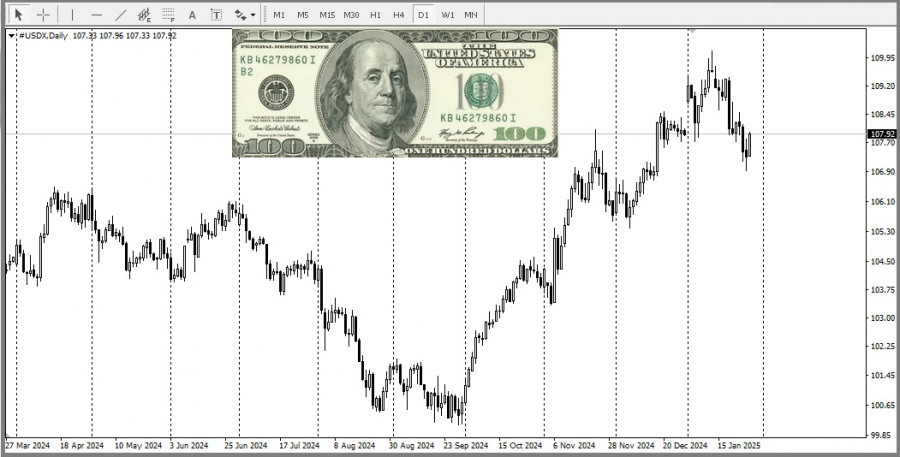

Additionally, the US dollar is recovering from its recent decline, which further supports the USD/CAD pair.

Concerns about the inflationary pressures caused by the protectionist policies of President Donald Trump's administration are driving up the yields on Treasury bonds, which, in turn, strongly support demand for the dollar.

Meanwhile, a slight recovery in oil prices after their recent drop is helping to limit losses for the Canadian dollar, which is closely tied to commodity prices and sensitive to fluctuations in oil prices. This also acts as a cap on the USD/CAD pair's upward movement.

Key Focus for Traders Today:Traders should pay attention to the publication of US Consumer Confidence Index data, which may offer trading opportunities.

Technical Outlook:

PAUTAN SEGERA