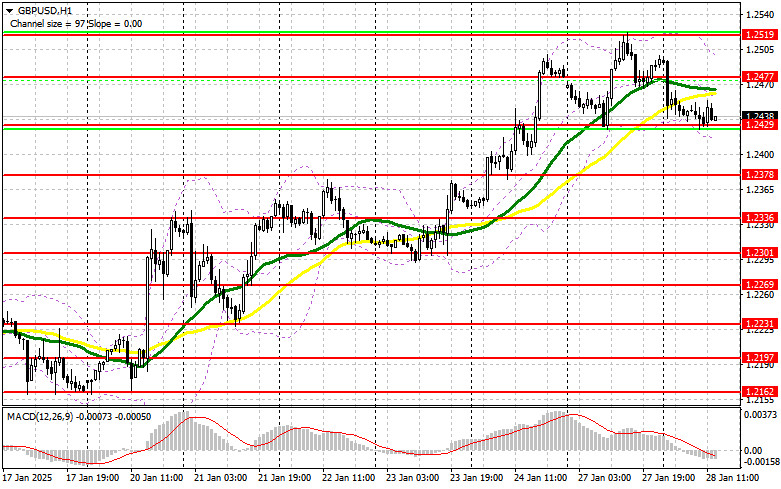

In my morning forecast, I focused on the 1.2429 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout near 1.2429 allowed the pound to recover by about 25 points, but the pair failed to achieve a more substantial rise. The technical outlook for the second half of the day remains unchanged.

The absence of UK statistics helped pound buyers protect the 1.2429 support, which remains crucial for maintaining the upward trend. Strong US data on consumer confidence, durable goods orders, and the Richmond Fed Manufacturing Index later today may lead to another test of 1.2429, presenting challenges for buyers. Only after forming a false breakout near 1.2429 will I open long positions, targeting a rise to 1.2477, where I expect the first significant selling activity. A breakout and retest of this range from top to bottom will create a new entry point for long positions, aiming to reach 1.2519, further reinforcing the bullish trend. The ultimate target will be the 1.2571 level, where I plan to take profits.

If GBP/USD declines and there is no bullish activity around 1.2429, the pressure on the pair will increase. In this case, only a false breakout near the 1.2378 low will provide a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2336, targeting an intraday correction of 30–35 points.

Sellers made an attempt, but it can hardly be called a serious effort to continue the downward correction—distinct from a bearish market, which is not yet forecast for the pound. If GBP/USD rises on weak US data, it's important not to overlook the 1.2477 resistance, where the moving averages are aligned in favor of bears. A false breakout at this level, after US statistics, will provide an entry point for short positions, aiming for a decline to 1.2429. A breakout and retest of this level from below will trigger stop-loss orders and open the path to 1.2378. The ultimate target will be the 1.2336 level, where I will take profits.

If demand for the pound returns in the second half of the day and bears fail to assert themselves near 1.2477, the bullish trend will continue. In this scenario, short positions should be delayed until a test of the 1.2519 resistance, coinciding with the weekly high. I will sell there only after a failed consolidation. If no downward movement occurs at this level either, I will look for short positions on a rebound from 1.2571, targeting an intraday correction of 30–35 points.

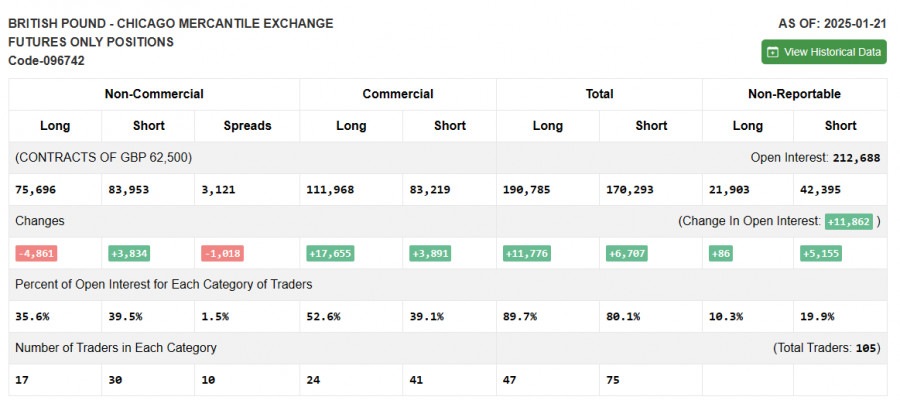

The January 21 COT report showed an increase in short positions and a decrease in long ones. The balance of power continues to shift toward sellers, which is unsurprising. UK economic data has been lackluster, and inflation is rising again, putting the Bank of England in a challenging position. The central bank will likely cut rates again at its next committee meeting, which is already priced into the pound. However, short-term movements will depend on decisions by Donald Trump's new administration, so don't underestimate the strength of the US dollar. The latest COT report indicated that long non-commercial positions decreased by 4,861 to 75,696, while short non-commercial positions increased by 3,834 to 83,953. As a result, the gap between long and short positions narrowed by 1,018.

Moving AveragesTrading below the 30- and 50-day moving averages, indicating further decline for the pound.Note: The period and prices of the moving averages are based on the H1 chart, differing from the conventional daily moving averages on the D1 chart.

Bollinger BandsIn case of a decline, the lower boundary of the indicator near 1.2405 will act as support.

Indicator Descriptions:

PAUTAN SEGERA