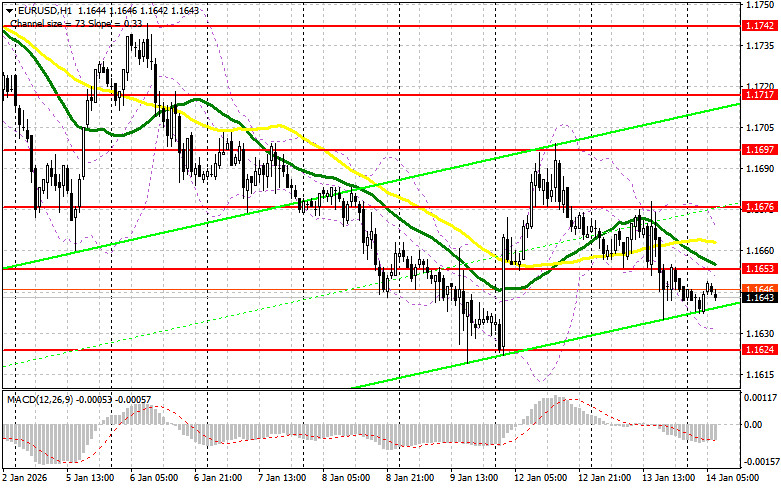

Several entry points into the market were formed yesterday. Let's look at the 5-minute chart and figure out what happened there. In my morning forecast, I highlighted the 1.1672 level and planned to make entry decisions based on it. The rise and formation of a false breakout around 1.1672 led to a short entry on the euro, but it did not trigger a major decline in the pair. In the second half of the day, the story around 1.1672 repeated, resulting in the pair falling by more than 40 pips.

The US inflation data for December once again provided direct evidence that the Federal Reserve will not be cutting interest rates in the near term, which led to a strengthening of the US dollar. Today, there are no eurozone data, so there are no significant reasons to buy the euro against the dollar. If the pair declines in line with the bearish trend, buyers' hopes will shift to the nearest support at 1.1624, formed last week. Only the formation of a false breakout there would give an entry point for counter-trend long positions aiming for a small recovery to 1.1653, where trading is currently taking place. A breakout and reversal test of that range would confirm the correct action to buy the euro with a view to a larger push to 1.1676, which would stop the development of the bear market. The most distant target will be the high at 1.1697, where I will take profit. In the event of a decline in EUR/USD and the absence of activity around 1.1624, pressure on the pair will increase significantly, potentially leading to a larger move down for the euro. In that case, bears will try to reach the next interesting level at 1.1591. Only the formation of a false breakout there would be a suitable condition to buy the euro. Opening longs immediately on the bounce will be from 1.1558 with a target of a 30–35 pip intraday upward correction.

Sellers became active after yesterday's data, fully betting on the market returning to their control today. In the case of a small euro recovery, the first sign of bear activity is expected around the nearest resistance at 1.1653. The formation of a false breakout there will give an entry point for short positions targeting a move to support at 1.1624. A breakout and consolidation below that range, plus a reversal from below to above, would be another scenario to open shorts on a move toward 1.1591, which would restore the bear market. The most distant target will be the 1.1558 area, where I will take profit. If EUR/USD moves up and bears are inactive around 1.1653 — where moving averages pass and favor sellers — buyers will get a good chance for a larger recovery of the pair. In that case, short positions are best postponed until the larger level 1.1676. Sell there only after a failed consolidation. I plan to open shorts immediately on the rebound from 1.1697, targeting a 30–35 pip downward correction.

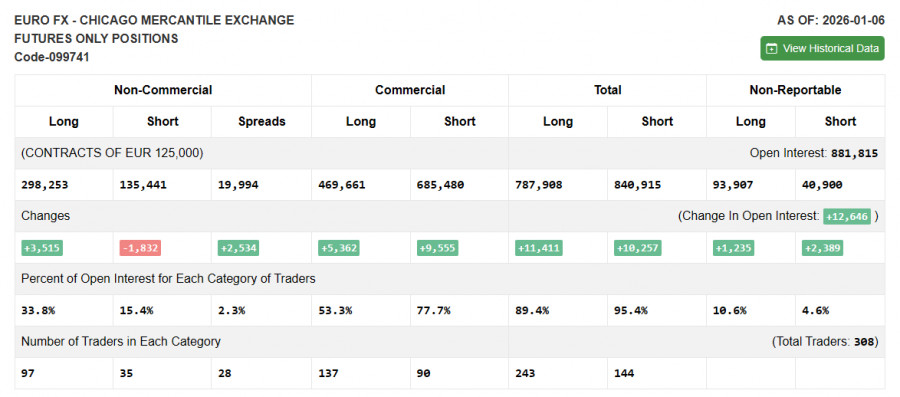

The COT report (Commitment of Traders) as of January 6 showed an increase in long positions and a reduction in shorts. Expectations of a pause in the Fed's rate-cutting cycle do not help the US dollar to strengthen. The main reason is the difficulties the Federal Reserve has begun facing again, along with the pressure exerted on it by the Trump administration. Until this issue is fully resolved, traders will prefer risk assets. The COT report indicates that non-commercial long positions rose by 3,515 to 298,253, while non-commercial short positions fell by 1,832 to 135,441. As a result, the spread between long and short positions widened by 2,534.

Moving averages

Trading is taking place below the 30- and 50-day moving averages, indicating a possible decline in the euro.

Note: the period and price basis of the moving averages are considered by the author on the hourly H1 chart and differ from the classical daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, support will be provided by the indicator's lower band around 1.1630.

PAUTAN SEGERA