Yesterday, stock indices closed lower. The S&P 500 fell by 0.43%, while the Nasdaq 100 dropped by 0.94%. The Dow Jones Industrial Average declined by 0.36%.

Gold and silver also continued to fall alongside equities, as the assets that outperformed in January came under heavy selling pressure after a sharp market reversal on Friday. The dollar gained the upper hand after Kevin Warsh was announced as a candidate for Fed chair.

On Monday, the price of the precious metal fell by 8.1%, briefly dipping below $4,500 per ounce after a rally in January that pushed it nearly to $5,600. Silver plunged by 15% following a record 26% drop on Friday. Asian equity markets suffered their largest two?day decline since early April.

Tech stocks dipped on worries about stretched valuations and large AI investments, triggering the sharpest drop in the Asian tech proxy MSCI since November. As risk sentiment deteriorated, Bitcoin briefly slipped below $75,000.

"Traders were spooked by the extreme volatility in the precious metals market on Friday," KCM Trade said. "With margin requirements raised, positions in precious metals were forced to be liquidated, triggering a chain reaction of selling across other assets. Consequently, the declines in gold and silver are creating a domino effect throughout the market."

Today's price action points to rising instability after an extended rally in precious metals and successive record highs on equity markets driven by billion?dollar AI investments. At the same time, investors are repricing and adjusting expectations around monetary policy in light of a potential Fed led by Warsh amid repeated calls from Trump for interest rate cuts. With Warsh, an economist known both for sharp criticism of the central bank and for his views on monetary policy, the debate has shifted sharply from short?term rate moves to the Fed's $6.6 trillion balance sheet. If confirmed by the Senate, the new Fed chair would replace Jerome Powell when his term expires in May.

The 55?year?old Warsh publicly supported Trump in 2025 and spoke in favor of rate cuts, a stance that contradicts his long?standing reputation as an inflation hawk. On Friday, the US president said he did not ask Warsh to guarantee rate cuts. Against this backdrop, investors clearly worry that high interest rates may remain in place for an extended period.

In other commodity markets, oil fell by 6.9%. However, the market's focus remained predominantly on gold and silver.

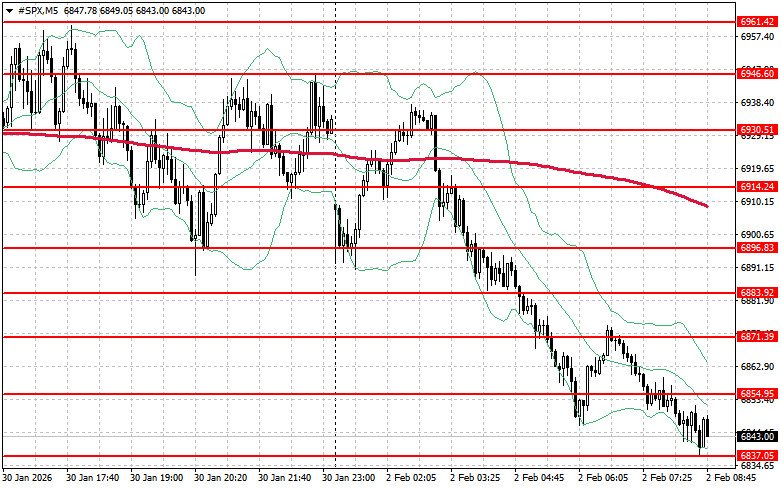

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,854. Breaking above that level would signal upside and open the path to $6,871. An equally important objective for bulls is to secure control above $6,883, which would strengthen buyers' positions. In case of a downside move amid waning risk appetite, buyers must assert themselves around $6,837. A break below that level could quickly push the instrument back to $6,819 and open the way to $6,801.

PAUTAN SEGERA