The EUR/USD currency pair traded very calmly during most of Thursday—at least, up until the US inflation report came out, which is now much more important than the ECB meeting. But more on that later. Let's remember that volatility has noticeably declined over the last one and a half to two months, which, perhaps not coincidentally, matches the period when there's been no trending movement in the market. So, the market has effectively taken a pause and seems in no hurry to end it.

From our point of view, the US dollar still has plenty of fundamental reasons to keep falling—reasons we discuss constantly. Any strengthening of the dollar should be viewed as a normal correction; any US dollar decline is entirely logical. Yesterday, the European Central Bank left all three key rates unchanged for the second time in a row, which surprised absolutely no one. The ECB has achieved its goal of stabilizing inflation around 2%. And since Donald Trump is not the president of the European Union, there's no need to worry about runaway or unexpected price growth.

In America, Donald Trump ignores rising inflation. He doesn't seem to care how much consumer prices are rising. After all, American consumers will pay for all the import tariffs, not China or India. If Americans are willing to pay more for all imported goods in silence, then they'll also have to put up with inflation. Meanwhile, for public opinion and headlines, Trump will lower some taxes, primarily benefiting the wealthy.

In the Eurozone, the situation is totally different. The ECB consistently worked toward its 2% inflation goal and achieved it. At that point, the ECB's key interest rate was down to 2.15%, and the deposit rate to 2%. Since inflation isn't decreasing further, no additional monetary easing is needed. So, the ECB's rate decision came as no surprise.

In the second half of the day, the dollar, of course, crashed because of the US inflation data, although it did so for fairly formal reasons. We've said recently that any August inflation print in the US wouldn't affect the Fed's decision on September 17. The rise in inflation to 2.9% only means that the Fed will have to fight on two fronts: stimulating the labor market and fighting rising prices. But how can they achieve both goals simultaneously? The correct answer: they can't. The US central bank will have to balance between two fires, but in the end, it may "fail to achieve either goal."

Remember: with rising inflation, at a minimum, you shouldn't be cutting rates; at maximum, you should be raising them. In total, the Fed has implemented three phases of monetary easing, totaling a 1% rate cut so far. As we see, after Trump implemented tariffs, even a pretty "tight" Fed policy hasn't been able to curb rising prices. As we warned, inflation in the US will continue to rise. It has struggled to climb further recently because the key rate remains high—but starting September 17, the rate will begin to drop and the Fed will end up cutting to "save the labor market," which may further accelerate consumer price growth.

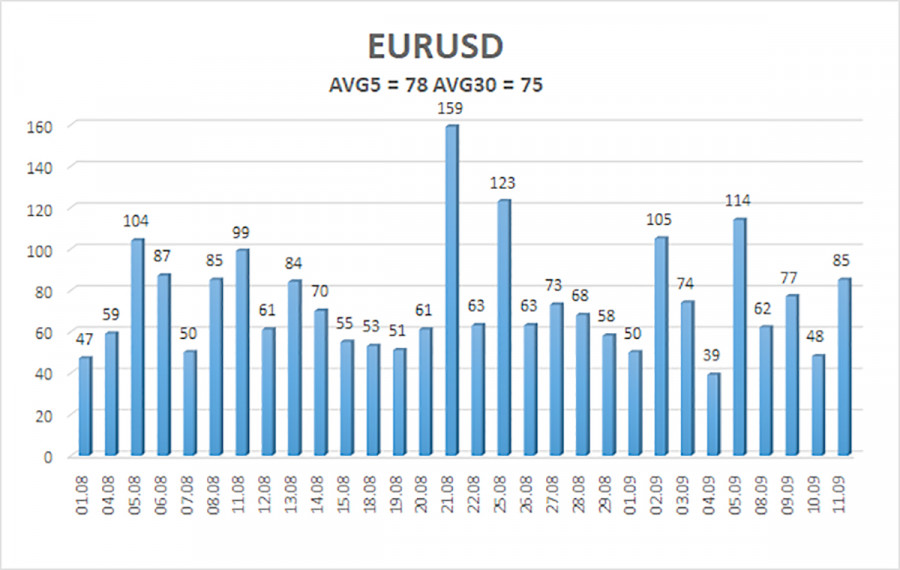

The average daily volatility for EUR/USD over the last five trading days as of September 12 is 78 pips, which is considered "average." We expect the pair to move between 1.1657 and 1.1813 on Friday. The linear regression channel's upper band is turned upward, still indicating an uptrend. The CCI indicator went into the oversold zone three times, warning of a trend resumption. There was also a bullish divergence, warning of an upcoming rally.

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

R1 – 1.1780

R2 – 1.1841

The EUR/USD pair may resume its uptrend. The US dollar remains under strong pressure from Trump's policies, and he's not going to "stop where he is." The dollar has rallied as much as it could, but now it seems a new round of prolonged decline is about to begin. If the price is below the moving average, consider modest shorts with a target of 1.1658. Long positions remain relevant above the MA, aiming for 1.1780 and 1.1813 to continue the trend.

LINKS RÁPIDOS