Rusko vyjádřilo podporu 30dennímu příměří v probíhajícím konfliktu na Ukrajině, ale s výhradou. Mluvčí Kremlu Dmitrij Peskov zdůraznil nutnost zohlednit určité „nuance“ války, která trvá již více než tři roky. Informoval o tom v pátek.

Myšlenka příměří je dlouhodobým návrhem ukrajinské strany. Další podporu získala, když ji navrhla americká administrativa Donalda Trumpa. Ruský prezident Vladimir Putin tuto myšlenku podpořil, ale vyjádřil výhrady. Podle Peskova Putin zdůraznil, že je obtížné zabývat se podrobnostmi takového příměří, aniž by se řešila řada nuancí souvisejících s tímto konceptem.

Rusko důsledně tvrdí, že úspěch dlouhodobého příměří závisí na zavedení mechanismů pro jeho monitorování a prosazování. Země vyjádřila ochotu příměří podpořit, pokud budou tyto podmínky splněny. Podrobnosti těchto „nuancí“ a mechanismů však nebyly výslovně definovány.

Those who fly too high fall the hardest. Gold nearly touched the $4,400 per ounce mark before it was caught in an avalanche of sell-offs. XAU/USD prices plummeted by 5.7% in a single day — the fastest percentage drop in nearly twelve years. In dollar terms, the $230 pullback marked the largest one-day loss in history. It is highly unlikely that such a dramatic collapse was caused solely by a de-escalation of trade tensions between the U.S. and China.

Recently, the precious metal had been climbing in a parabolic fashion with virtually no corrections — an extremely rare occurrence that almost always leads to bursting bubbles. That was the case with the U.S. NASDAQ in 1999 and China's Shanghai Composite in 2007. What defines aggressive bull markets is their instability in the final, euphoric phase.

The comparison to stock indices suggests that the XAU/USD rally may not be over — instead, it has run out of steam. The parabolic ascent is probably behind us. Gold may now enter a consolidation phase before a renewed upward trend begins. Citigroup seems to fully grasp this, forecasting that gold will move into a range-bound pattern around the psychologically important level of $4,000 per ounce. Yes, U.S. dollar weakness and foreign reserve diversification in favor of gold may return — but there's currently no urgency to start positioning for these factors.

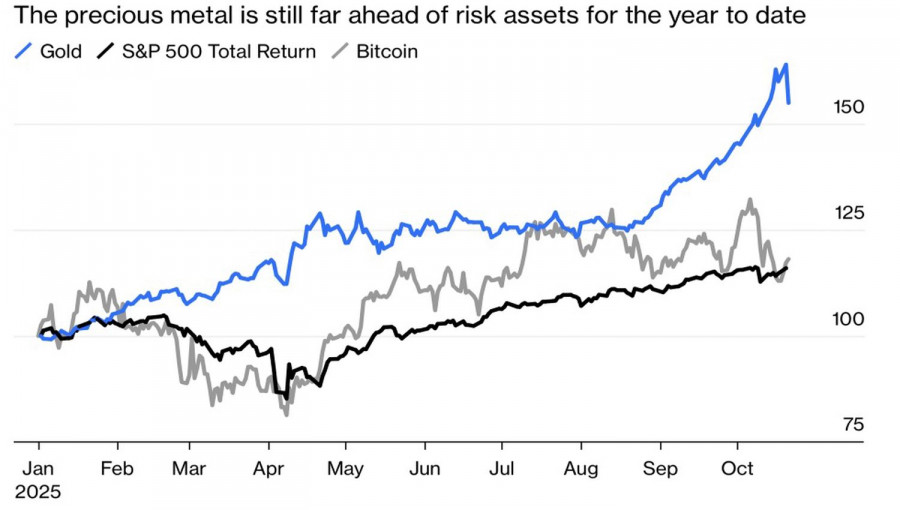

Despite the sharp decline, gold has still risen 55% since the beginning of the year, outperforming both U.S. stock indices and cryptocurrencies by a wide margin.

Naturally, the de-escalation of trade risks is a strong argument in favor of selling XAU/USD. However, negotiations between the U.S. and China are still ongoing, and their outcome is unknown. Meanwhile, strengthening of the U.S. dollar against major world currencies reduces the appeal of debasement-based trading — a strategy that thrives on distrust in government-issued bonds and state-controlled currencies.

Investors turn to assets that are free from the whims or missteps of politicians and central bankers. And while internal issues continue to plague Bitcoin and other digital assets, precious metals have continued to shine. But is that still the case?

In fact, gold's biggest fundamental tailwind — the geopolitical divide between the West and East caused by the war in Ukraine — remains in play. Countries defined as the "Eastern bloc" are actively diversifying their foreign reserves in favor of gold and reducing their reliance on the dollar. This process is ongoing. The problem now may be that XAU/USD prices rose too high, too fast.

From a technical standpoint, the daily chart shows a pullback within a broader uptrend. A conservative strategy suggests buying gold when it returns to the breakout bar's high near $4,160 per ounce, where the price previously crossed the moving average. A more aggressive entry would be a break below the $4,000 support level, followed by a return and consolidation above it.

LINKS RÁPIDOS