Fame does not last forever. What seems perfect today becomes ordinary tomorrow. Any sign of weakness from a favorite transforms into a catastrophe. As we approach the end of 2025, there is a reevaluation of views on artificial intelligence and related technology stocks in the US equity market. The mixed dynamics of stock indices suggest that investors have stopped buying dips, an alarming sign for the bull market.

The Dow Jones Index set its 17th record in 2025 on news of the government resuming operations, while the S&P 500 barely rose, and the NASDAQ 100 declined. Portfolio diversification is taking place in the market. Due to hopes of accelerating economic growth, stocks of major banks, airlines, and consumer goods manufacturers are being actively bought. The technology sector, however, is in the red.

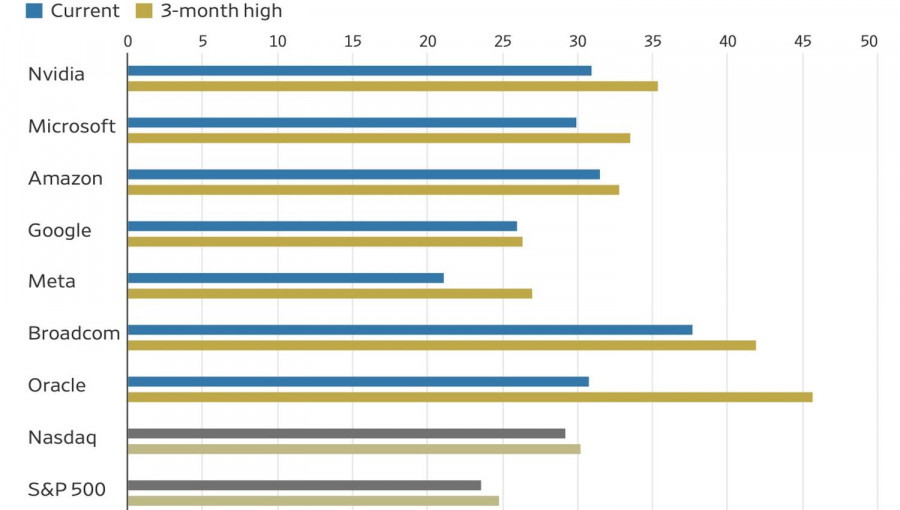

Doubts regarding the effectiveness of colossal investments in artificial intelligence and the inflated fundamental valuation of the Magnificent Seven stocks are causing traders to redistribute assets in their portfolios. Shares of NVIDIA, Microsoft, and Amazon are trading at 30 times or more above projected earnings for the next 12 months. OpenAI plans to invest approximately $1.4 trillion in AI over the next eight years, while its revenues are only $20 billion.

The requirements for artificial intelligence involve massive data centers, modern chips, and server racks, which are not expected to be built quickly. OpenAI intends to increase revenue through new consumer devices, robotics, and cloud computing, but none of this is currently available. It is not surprising that investors are doubtful about the prospects and are departing from the tech sector.

The corporate earnings season is nearing its end, and investor focus is shifting to the Federal Reserve's monetary policy. The shutdown forced the central bank to operate in a fog. Its conclusion will lead to a mass release of reports. However, not all of them will be available. The White House has stated that the October employment and inflation data have been permanently lost.

A significant setback for bulls in the S&P 500 has come from Susan Collins, President of the Boston Fed. She stated that the bar for continuing with monetary expansion in December is high. She voted for a rate cut in October due to a significant cooling in the labor market, but since then, the situation has stabilized. A lower borrowing cost will delay the timeline for returning inflation to target.

The hawkish rhetoric has lowered the derivatives' expectations for the Fed's easing of monetary policy at the end of the year to 55% and cooled the bullish enthusiasm for American stocks.

Technically, on the daily chart, the S&P 500 is battling for fair value at 6850. A victory for buyers will allow them to build upon previously established long positions, while a defeat will provide grounds for selling.

LINKS RÁPIDOS