Analysis of transactions in the EUR / USD pair

EUR/USD reaching 1.0417 led to a buy signal in the market, but having the MACD line far from zero limited the upside potential of the pair. Similarly, the downside potential was limited because the quote continued to rise even though the MACD line was in the overbought area when the pair retested 1.0417 and prompted a sell signal. No other signal appeared for the rest of the day.

Euro rose in price yesterday as the speeches of ECB members Fabio Panetta and Philip Lane called for more action in the fight against inflation. The statements made by FOMC member John Williams also did not help the dollar regain its position.

Most likely, the bullish trend will extend today as the upcoming 1st quarter GDP report for the EU will increase risk appetite. The speech of ECB head Christine Lagarde will also be of great interest, while Italy's foreign trade balance and consumer price index are unlikely to have a strong impact on the market. In the afternoon, the US will release data on retail sales, which, if shows a drop in value, will lead to a further decrease in dollar and accordingly, another rise in euro. A softer position of Fed members will put even more pressure on USD.

For long positions:

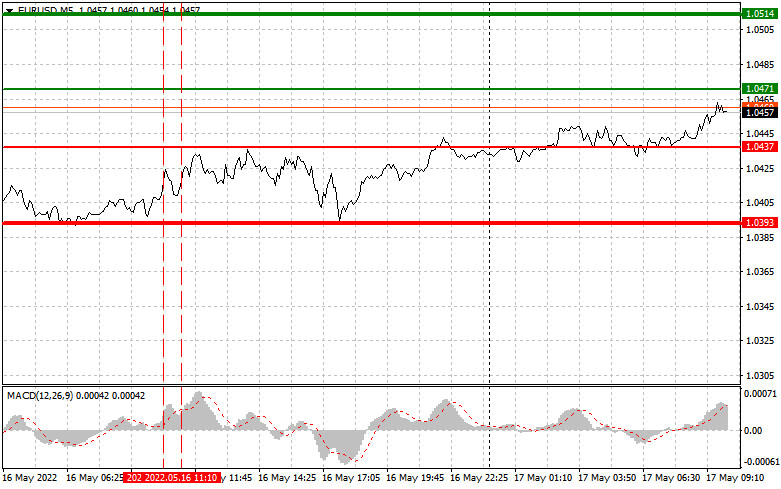

Buy euro when the quote reaches 1.0471 (green line on the chart) and take profit at the price of 1.0514 (thicker green line on the chart). There is a chance for a rally today, but only in the morning and along the newly formed trend. Nevertheless, when buying, make sure that the MACD line is above zero or is starting to rise from it. It is also possible to buy at 1.0437, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0471 and 1.0514.

For short positions:

Sell euro when the quote reaches 1.0437 (red line on the chart) and take profit at the price of 1.0393. Pressure will return after the release of strong US data in the afternoon. But note that when selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.0471, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.0437 and 1.0393.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

QUICK LINKS