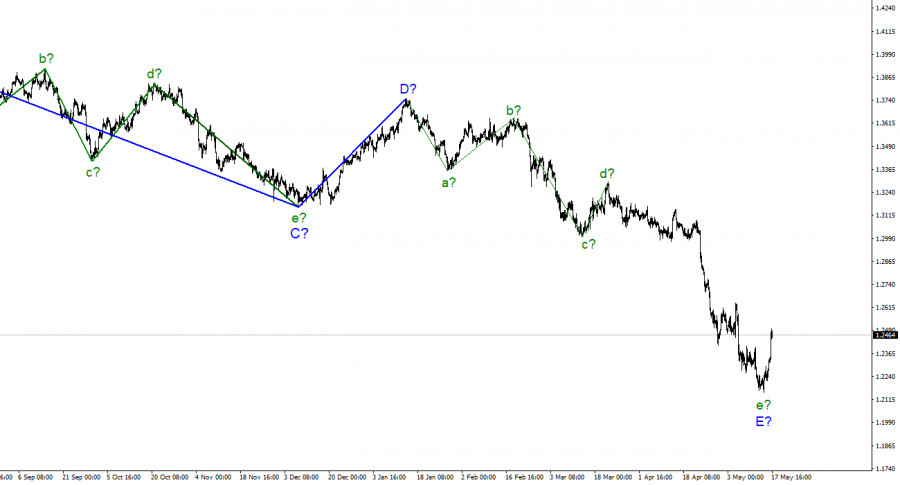

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend is presumably completed, and the wave e-E, although it has taken a rather complex form, however, is also a five-wave in the structure of the five-wave downward section of the trend, as well as for the euro/dollar instrument. Thus, both instruments can now complete the construction of downward trend sections, which will be very symbolic, given that they have been trading very similar in recent months. Of course, there is also a backup option, in which the descending section will complicate its internal wave structure. This may happen if the demand for the British begins to decline again. And it may start to decline due to the weak (for the British) news background. I suggest that at this time we start from the option that the downward section of the trend is completed, but at the same time closely monitor the news. The instrument's increase may continue with targets located near the 1.2672 mark, which corresponds to 100.0% Fibonacci.

Powell's speech and British statistics

The exchange rate of the pound/dollar instrument increased by 140 basis points on May 17. The amplitude during the day was even higher, but by the end of the day, the quotes began to move away from the reached highs. The news background for the Briton today was very positive. In the early morning, a report was released on unemployment (a decrease from 3.8% to 3.7%), wages (an increase of 7.0% with expectations of 4.2%), and applications for unemployment benefits (-56.9K with expectations of -42.3K). That is, the market received the values it needed in the morning to start increasing demand for the pound. But the US reports did not affect the market mood, as industrial production grew higher in April than the market expected, and retail trade turned out to be worse than expected. The Briton has already grown quite a lot in one day, so I don't expect any new strong movements for the rest of the day.

In a few hours, the speech of Fed President Jerome Powell will begin. Let me remind you that the Fed has recently taken a very tough stance on monetary policy, and every new speech by Powell is perceived by the market as a possible even stronger tightening of rhetoric. Some analysts believe that there is nowhere further to tighten the rhetoric since Powell cannot openly promise that the rate will be raised in June or July by 75 basis points at once. Therefore, I think that his rhetoric will not change and nothing important will be said today. If my assumption is correct, then the market will not react in any way to the speech of the Fed president. Now the Briton needs to hold on to the positions that he has achieved today. A quick pullback down will most likely indicate that the market is not ready for further purchases and will turn a potential upward trend segment into a corrective one. And after the completion of the corrective (three waves), the decline in the British dollar, which we have observed in the last year and a half, may resume.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E. As I said, a successful attempt to break through the 1.2246 mark from the bottom up will be a signal to close sales and open purchases with targets located near the estimated 1.2672 mark. This mark looks like a very confident goal. I do not think that the British, which has declined by more than 1,000 basis points in the last few weeks alone, will not be able to recover to this mark, which is near the peak of wave 4-e-E.

At the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is far from obvious. Wave E has taken a five-wave form and looks quite complete.

QUICK LINKS