The European Central Bank has tamed inflation. This is evidenced by the slowdown in consumer prices in the eurozone in September from 5.2% to 4.3%, the base indicator – from 5.3% to 4.5%. The actual figures turned out to be lower than anticipated, which supports expectations that the ECB has ended its monetary tightening cycle and this in turn, has exerted downward pressure on the EUR/USD. However, thanks to the massive profit-taking on short positions, stopping the euro bulls is not an easy feat.

The Bloomberg model, which correctly predicted European inflation in September, signals its slowdown to 3.5% in October. The ECB's forecasts call for the HCPI to return to its 2% target in the second half of 2024, although this could happen sooner due to the weak economy. At the same time, the futures market has adjusted expectations of the first rate cut from its current level of 4% to the second quarter of 2024.

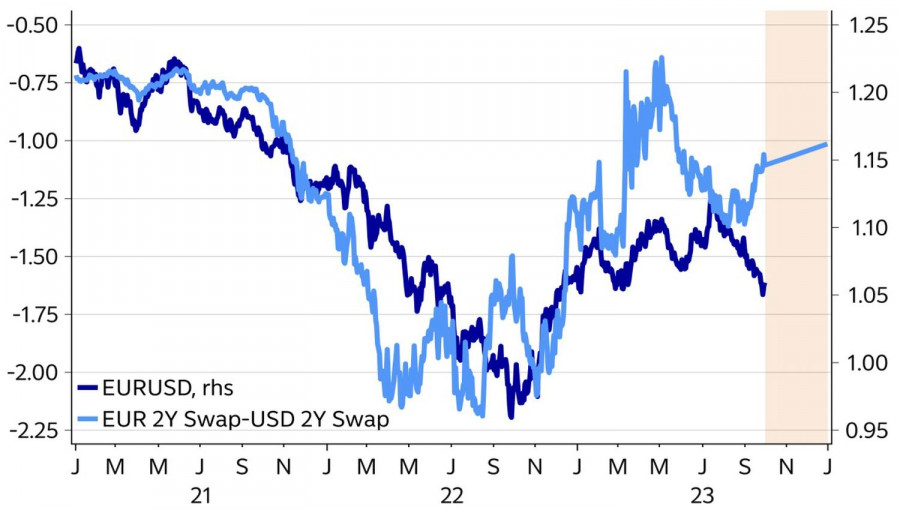

Let me remind you that the Federal Reserve does not expect the PCE to return to the 2% target earlier than 2025. FOMC officials are wavering between keeping borrowing costs high and raising them further. Thus, divergence in monetary policy plays into the bears' hands. However, you need to understand that this has already been factored in the quotes of the main currency pair. As a result, the euro looks oversold and uses any form of positive news to counterattack. A correction is clearly overdue.

What could go wrong with the central banks' plan? On paper, rising oil prices will affect the entire economy. It will slow down GDP and accelerate inflation expectations and consumer prices. In practice, the potential of a Brent rally appears limited. To continue the uptrend, the North Sea Brent Crude needs either an improvement in global demand or a reduction in supply.

The first problem is due to the aggressive tightening of monetary policy by the Fed and other central banks. Yes, China may accelerate, but this is clearly not enough against the background of a cooling US economy and the eurozone teetering on the brink of stagflation and recession. As for the voluntary crude oil output cuts by Saudi Arabia and Russia, OPEC+ is well aware that it is losing its market share. It is doubtful that the group will keep production at a low level for a long time.

The combination of limited growth in supply and demand suggests that oil will not soar from current levels. Consequently, neither the Fed nor the ECB should be afraid about renewed price pressures. It seems that the cycles of monetary tightening have been completed both in Europe and in the United States. If so, then the dynamics of EUR/USD will be determined by such factors as the cooling of the American economy and the recovery of the European one.

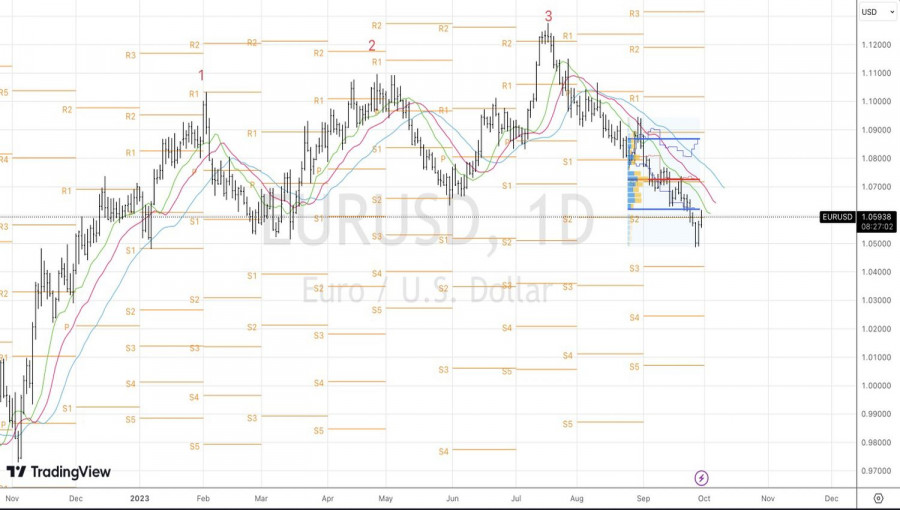

Technically, on the daily chart, traders eye an important level like 1.059. Closing above it will increase the risks of correction in the direction of 1.062, 1.0655 and 1.0715, where it makes sense to use a rebound to sell EUR/USD.

QUICK LINKS