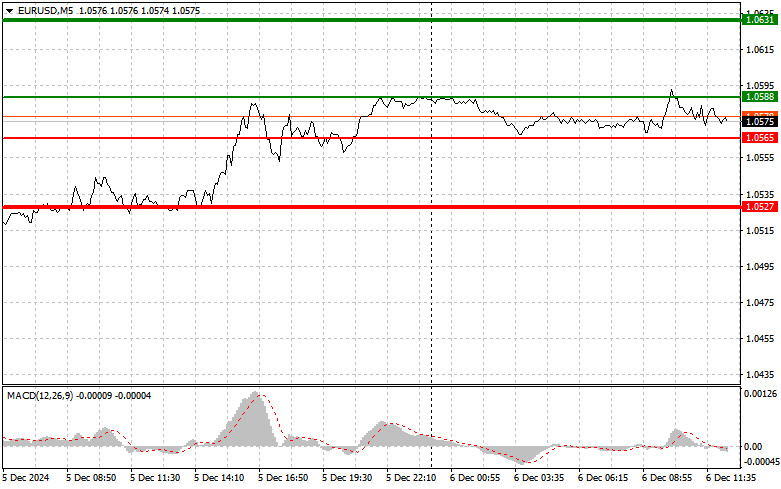

The test of the 1.0582 price level coincided with the MACD indicator beginning to rise from the zero mark. This confirmed a valid entry point for anticipating further euro growth. However, as shown on the chart, the bullish market failed to gain significant momentum, and there are clear reasons for this.

Upcoming data will be critical. A rise in unemployment, given the current state of the U.S. economy, could place significant pressure on the Federal Reserve. Traders are already pricing in potential monetary policy easing, which may cause short-term currency fluctuations. While lower rates typically stimulate economic activity, their effectiveness may be limited in the face of rising unemployment risks. Weak labor market data also raises concerns about consumer demand, as well as overall business conditions. Job cuts could lead to lower consumer spending, further worsening the economy.

Additionally, several Federal Reserve officials are expected to discuss the latest data, offering traders clearer insights into their next steps.

For intraday strategy, I will prioritize Scenario #1 despite the MACD indicator readings, as I anticipate strong and directional movements.

Today, buying the euro is possible at 1.0588 (green line on the chart), targeting a rise to 1.0631. At 1.0631, I plan to exit the market and open sell positions in anticipation of a 30–35 point pullback. A strong rise in the euro today is likely only after weak U.S. labor market data.Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

I also plan to buy the euro if there are two consecutive tests of 1.0565, with the MACD indicator in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Target levels will be 1.0588 and 1.0631.

I plan to sell the euro after it reaches 1.0565 (red line on the chart). The target is 1.0527, where I will exit the market and immediately buy in anticipation of a 20–25 point pullback. Pressure on the pair will persist if U.S. labor market data comes in stronger than expected.Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

I also plan to sell the euro if there are two consecutive tests of 1.0588, with the MACD indicator in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. Target levels will be 1.0565 and 1.0527.

Beginner Forex traders should approach market entry decisions with caution. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to protect your capital. Without stop-loss orders, you risk quickly losing your entire deposit, especially when trading large volumes without proper money management.

Remember that successful trading requires a clear trading plan, such as the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.

QUICK LINKS