The test of the 150.12 price level occurred when the MACD indicator began its upward movement from the zero line, confirming a valid entry point for buying the dollar and supporting the ongoing uptrend. As a result, the pair rose by approximately 35 points, reaching the target level of 150.48.

Several critical U.S. economic reports are expected in the second half of the day, including unemployment rate data and nonfarm payrolls, followed by the University of Michigan Consumer Sentiment Index and inflation expectations. Strong data will likely boost interest in the U.S. dollar. This would reinforce the bullish momentum observed earlier in the day.

Additionally, FOMC members Michelle Bowman, Austan Goolsbee, and Mary Daly will deliver speeches. These remarks play a critical role in shaping market perceptions of U.S. monetary policy and economic outlooks. Michelle Bowman, known for her banking sector expertise, will likely discuss monetary policy trajectories and current economic conditions. Similarly, Mary Daly, President of the San Francisco Federal Reserve, is expected to highlight the social and economic costs of higher interest rates.

For intraday strategy, I will prioritize Scenario #1, as I expect strong directional movements despite the MACD readings.

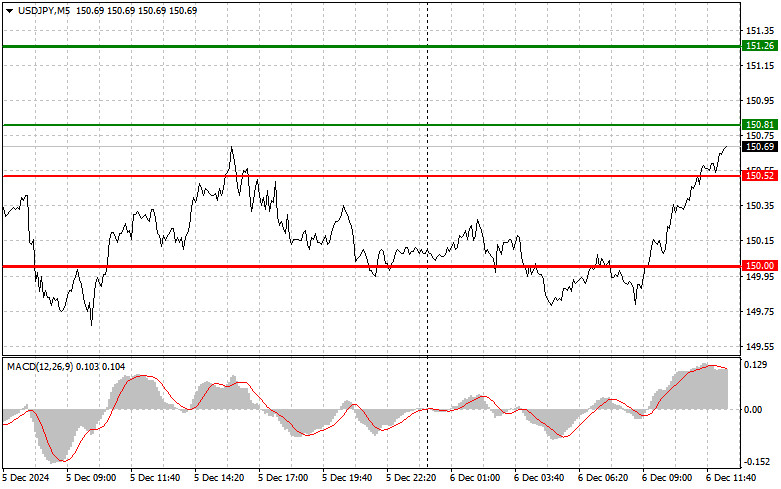

Today, I plan to buy USD/JPY at 150.81 (green line on the chart), targeting a rise to 151.26 (thicker green line on the chart). At 151.26, I will exit long positions and open short positions, anticipating a price retracement of 30–35 points from the entry point. A continued rise in the pair is expected if U.S. data are strong.Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

I also plan to buy USD/JPY after two consecutive tests of the 150.52 price level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and initiate a market reversal upwards. Short-term target levels are 150.81 and 151.26.

I plan to sell USD/JPY after breaking below 150.52 (red line on the chart), which could lead to a sharp decline in the pair. The key target for sellers will be 150.00, where I will exit short positions and immediately open long positions, anticipating a 20–25 point price retracement. Downward pressure on the dollar may emerge if U.S. data disappoint.Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

I also plan to sell USD/JPY after two consecutive tests of the 150.81 price level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Expected target levels are 150.52 and 150.00.

Chart Details

Beginner Forex traders should exercise extreme caution when making market entry decisions. Avoid trading before major fundamental reports to reduce the risk of sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to protect your capital. Without stop-loss orders, you could quickly lose your deposit, especially when trading large volumes without proper money management.

Remember: Successful trading requires a clear trading plan, like the one outlined above. Making impulsive decisions based on current market conditions is a fundamentally flawed strategy for intraday traders.

QUICK LINKS