The euro and the pound are continuing to trade within defined channels, which suggests that there are good opportunities for growth. However, it's surprising to see such strong demand for riskier currency assets given the current situation in the stock markets.

From a technical perspective, the EUR/USD pair remains in a period of consolidation within a narrow range, as it waits for new growth drivers. Traders are particularly focused on macroeconomic data, especially inflation, as this is a crucial factor influencing the decisions of central banks. The European Central Bank is expected to maintain its easing of monetary policy, although the pace of interest rate cuts may begin to slow.

In the United States, the situation is more complex. The Federal Reserve is also tackling inflation while considering the potential risks of a recession, which may arise from the trade war initiated by the new administration. In the near term, if the EUR/USD pair breaks above last week's high, it could pave the way for further growth. Conversely, a decline below recent lows might lead to a deeper correction.

Today, apart from the meeting of the EU finance ministers, there are no significant events in the first half of the day, making it unlikely that EUR/USD buyers will break out of the sideways channel. However, the situation may change after U.S. labor market data is released in the second half of the day. Traders should also pay attention to comments from Federal Reserve representatives, as any hints of possible monetary policy easing could put pressure on the dollar.

Given the lack of economic data, a volatile European trading session is not expected today. It's best to exercise caution and consider different scenarios.

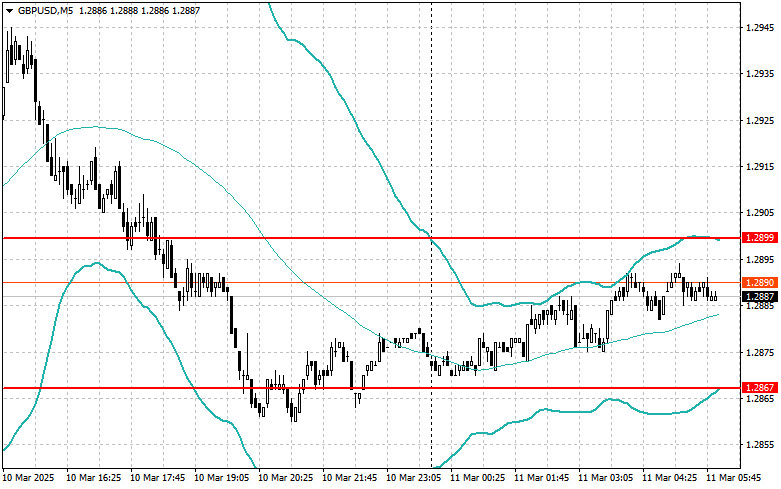

As for the pound, the pair may show a correction in the current environment with no significant macroeconomic data. Therefore, I wouldn't rush into buying just yet.

Buying on a breakout of 1.0886 could lead to a rise in the euro towards 1.0919 and 1.0952.

Selling on a breakout of 1.0847 could lead to a decline in the euro towards 1.0807 and 1.0770.

Buying on a breakout of 1.2908 could push the pound towards 1.2940 and 1.2972.

Selling on a breakout of 1.2876 could send the pound lower towards 1.2841 and 1.2804.

Buying on a breakout of 147.18 could push the dollar towards 147.52 and 147.84.

Selling on a breakout of 146.78 could lead to dollar sell-offs towards 146.49 and 146.22.

I will look for selling opportunities after an unsuccessful breakout above 1.0869, followed by a return below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.0832, followed by a return above this level.

I will look for selling opportunities after an unsuccessful breakout above 1.2899, followed by a return below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.2867, followed by a return above this level.

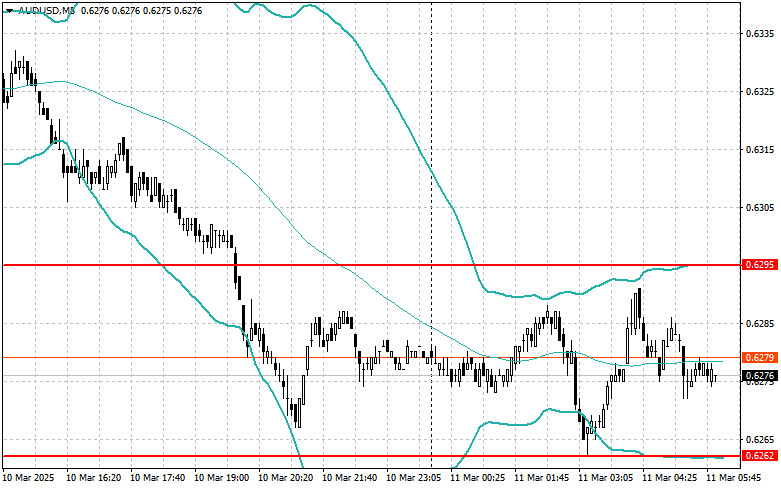

I will look for selling opportunities after an unsuccessful breakout above 0.6295, followed by a return below this level.

I will look for buying opportunities after an unsuccessful breakout below 0.6262, followed by a return above this level.

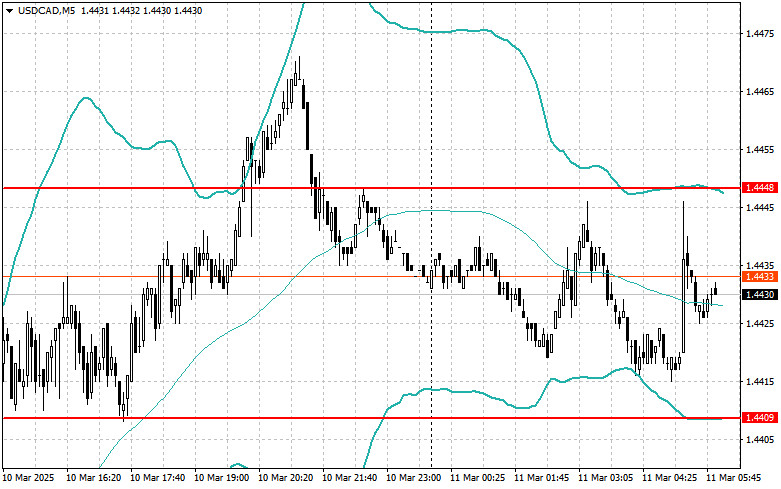

I will look for selling opportunities after an unsuccessful breakout above 1.4448, followed by a return below this level.

I will look for buying opportunities after an unsuccessful breakout below 1.4409, followed by a return above this level.

QUICK LINKS