The nationwide Consumer Price Index published last week showed accelerated core inflation in March—from 2.6% to 2.9%. Inflationary pressure is increasing, supporting the case for further interest rate hikes by the Bank of Japan.

The goods sector largely drives the rise in inflation, and according to Mizuho analysts, it is unlikely to slow down in the near term. The growth in the services sector is more modest, but this is precisely where price acceleration is expected. The Consumer Price Index (CPI) for April in the Tokyo area will be released late Thursday evening. It will reflect the development of the current trend and could trigger increased demand for the yen if it also shows growth.

At the moment, the BOJ sees no particular need to change its gradual rate-hike strategy, given the high uncertainty surrounding new U.S. tariffs. There is a risk of a downward revision of GDP forecasts, which would support a slower pace of rate increases. Therefore, clarity on the tariff situation and its economic impact is needed before further rate hikes can be considered.

Markets, however, anticipate a continued strengthening of the yen, as it is once again becoming the main safe-haven asset amid evident weakness in the U.S. dollar. With gold reaching 3,500 per ounce—signaling a decline in confidence toward the dollar—the yen maintains solid upside potential, even against the BOJ's extremely cautious stance.

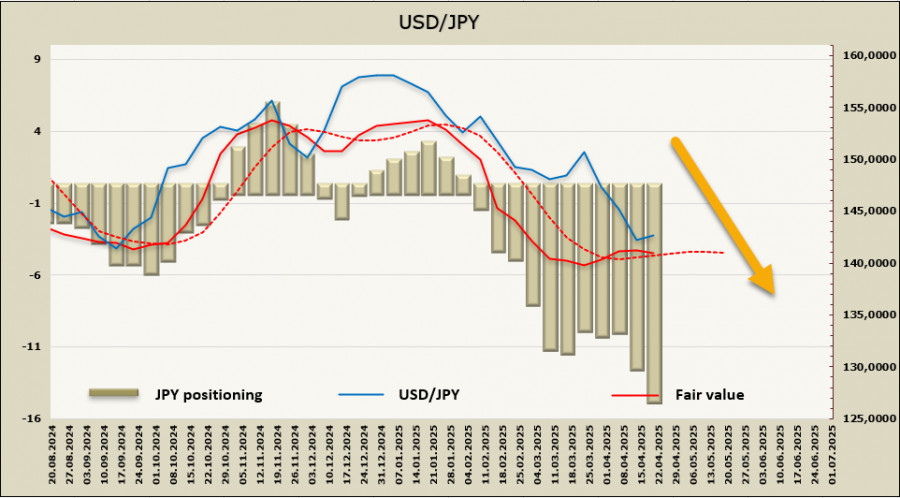

The yen has once again emerged as a leader among major currencies. The net long position against the U.S. dollar rose by 2.43 billion to 15.00 billion over the past week—a significant advantage and the trend remains strong. After a brief uptick, mainly due to the lack of new rate signals from the BOJ, the estimated fair value is again turning south.

The yen reached a new high on Tuesday, climbing to 139.90—shy of the 139.59 target we've considered key in recent weeks. The upward rebound is purely corrective and not a sign of a reversal. On the contrary, signs are emerging that a move below 140 in USD/JPY is far from the limit, and the pair could continue downward toward the support zone of 127–129.

The yen's rapid strengthening increases the likelihood of a short-term correction. The nearest resistance lies at 144.20/40, and if the yen pulls back to this level, another downward impulse may follow after a period of consolidation. A deeper correction to the 146.50/147.10 zone is possible, but under current conditions, it appears unlikely.

QUICK LINKS