The wave pattern of the pound and the market's interest in the news currently reflect those of the euro. Last week, the market had a chance to reduce demand for the GBP/USD instrument, which wouldn't have been surprising even considering Trump's trade war. However, by the end of the week, the U.S. dollar failed to gain even 50 basis points. On the contrary, the pound appreciated again, despite the Bank of England cutting rates and Jerome Powell once more dashing the market's dovish expectations.

In the upcoming week, the market is expected to continue avoiding increased demand for the dollar, with a probability of about 90%. Regardless of economic news emerging from the U.S. or the UK, the market anticipates political, not economic, developments. Trump has started negotiations with many countries and has even reached a deal with the UK, but he has little to boast about for now. One deal out of 75 is hardly a reason to celebrate.

Reports on unemployment, wages, a speech by the BoE's chief economist, the Q1 GDP report, and industrial production are certainly interesting. But if the market had wanted to invest in the dollar, it could have done so last week, when the news flow fully favored dollar growth. Therefore, the pair will remain under Trump's influence—and his alone. The dollar still has limited potential for gains, and only in the absence of positive news from trade negotiations. Even then, gains are uncertain.

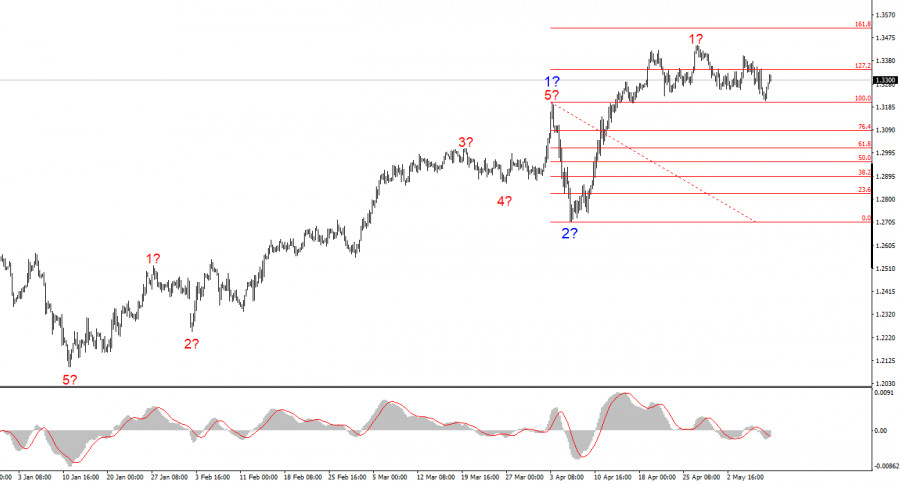

By the way, the GBP/USD instrument recently failed to break through the 1.3205 level, which also corresponds to the 100.0% Fibonacci level. As a result, a renewed upward movement in GBP/USD and EUR/USD is very likely, despite the monetary policies of the European Central Bank, BoE, and Federal Reserve, and the state of any given economy.

Based on the analysis of EUR/USD, the instrument is continuing to build an upward trend segment. In the near term, the wave structure will entirely depend on the stance and actions of the U.S. president. This should be kept in mind at all times. The formation of wave 3 of the upward trend has begun, and its targets may stretch as far as the 1.25 area. Reaching those levels depends solely on Trump's policies. At the moment, wave 2 within wave 3 appears near completion. Therefore, I am considering long positions with targets above 1.1572, corresponding to the 423.6% Fibonacci level.

The wave pattern of GBP/USD has transformed. We are now dealing with a bullish, impulsive section of the trend. Unfortunately, under Trump, the markets may face many shocks and reversals that defy wave structure and any form of technical analysis. The formation of upward wave 3 continues with nearby targets at 1.3541 and 1.3714. Ideally, we would like to see a solid corrective wave 2 within wave 3, but it seems the dollar cannot afford such a luxury right now.

Core Principles of My Analysis:

QUICK LINKS