Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

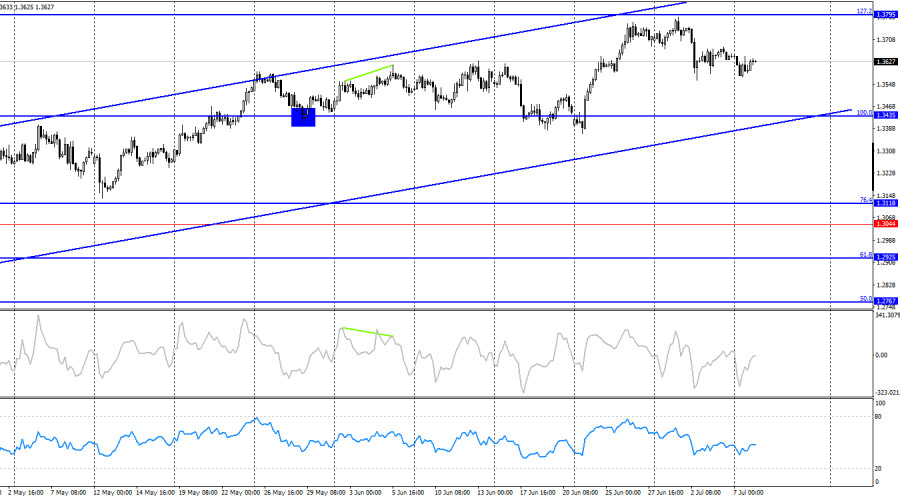

On the hourly chart, the GBP/USD pair traded sideways on Monday, and traders began to ignore the 1.3611–1.3633 level. At the moment, we cannot say whether the price is rebounding from this level or consolidating above or below it. This chart pattern is typical for a sideways market. Therefore, today the 1.3611–1.3633 level can still be used to look for entry points, but caution is advised.

The wave situation indicates that the "bullish" trend is intact. The last completed upward wave broke above the previous wave's peak, and the new downward wave did not even come close to the last low. Bearish traders still see no reason to establish their own trend, while the dollar lacks meaningful support factors. Trump's trade war continues to have a damaging effect on the U.S. currency.

On Monday, there were no important reports from either the U.S. or the UK, but the market still has some points of interest. This morning, it became known that Donald Trump decided to raise tariffs for 15 countries, and the list may be expanded in the coming days. Let me remind you that Trump has only managed to sign trade agreements with the UK, China, and Vietnam. All other countries remain at risk. As of Tuesday morning, traders have not reacted to the tariff increase. However, the European session has only just opened, and any market reaction is more likely during the U.S. session. Since the list of countries facing tariff hikes from August 1 does not include any major economies, traders may ignore the news. Nevertheless, the overall tone and stance of the U.S. President are abundantly clear: escalation, escalation, and more escalation. In my view, Donald Trump can raise tariffs to any level, but we must remember that tariffs work both ways. In the U.S., Elon Musk is already planning to form a new party—something unlikely to happen if Trump's policies weren't facing significant criticism.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar, missing the 127.2% retracement level at 1.3795 by just a few points. Since the decline was unexpected and may end quickly, I believe it is better to focus on the hourly chart for now. No divergence is forming on any indicator. The "bullish" trend remains intact.

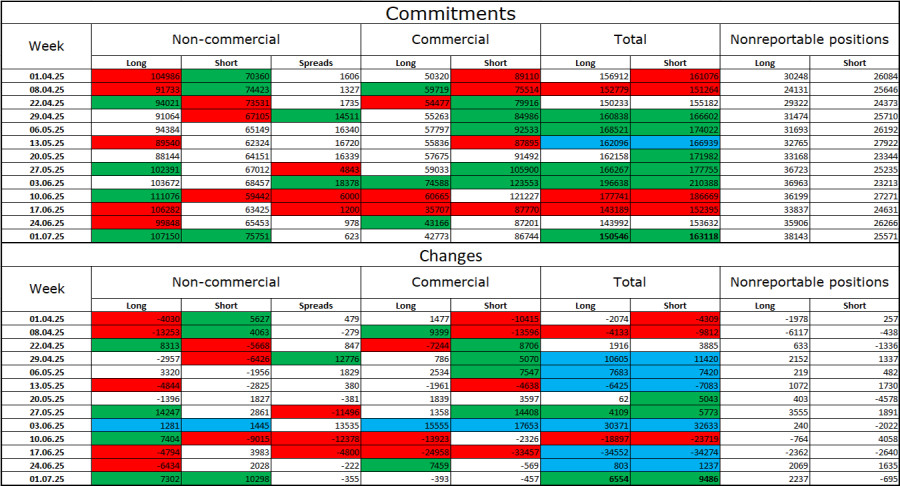

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders became slightly less bullish in the latest reporting week. The number of long positions held by speculators increased by 7,302, while the number of short positions rose by 10,298. However, the bears have long lost their advantage in the market and currently stand no chance of success. The gap between long and short positions is 32,000 in favor of the bulls: 107,000 versus 75,000.

In my opinion, the British pound still has downward potential, but the events of 2025 have fundamentally shifted the market in the long term. Over the past four months, the number of long positions has risen from 65,000 to 107,000, while short positions have decreased from 76,000 to 75,000. Under Donald Trump, confidence in the dollar has weakened, and the COT reports show that traders have little desire to buy the U.S. currency. Thus, regardless of the general news background, the dollar continues to decline due to developments surrounding Donald Trump.

Economic Calendar for the U.S. and UK:

On Tuesday, the economic calendar contains no notable entries. As such, the news background will not influence trader sentiment today.

GBP/USD Forecast and Trader Recommendations:

Selling the pair was possible following a rebound from the 1.3749 level with a target of 1.3611–1.3633. This target has been reached. I do not recommend considering new short positions today. Long positions can be opened if the price closes above the 1.3611–1.3633 level on the hourly chart, targeting 1.3749.

Fibonacci levels are drawn from 1.3446–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

QUICK LINKS