The final word in the U.S.–China trade negotiations is expected from Donald Trump. Until that happens, the S&P 500 has decided to take a step back—especially with key U.S. data on GDP, inflation, and employment ahead, along with the Federal Reserve meeting and earnings reports from four of the Magnificent Seven companies. It's better not to rush in before the situation becomes clearer.

The U.S.–China trade truce is likely to be extended after August 12. The parties have reached an agreement, but the verdict from Trump is still pending. According to Scott Bessent, without a deal, tariffs could increase by 34% and potentially reach 80–85%. Beijing will continue supplying rare earth minerals to the U.S., but has been warned about purchasing oil from Russia and Iran.

According to HSBC, the expected weakness in corporate and macroeconomic reports will not be enough to trigger a correction in the S&P 500—even though the broad stock index has returned to extreme P/E ratio levels (price-to-forward-earnings). The last time this happened was in February, which was followed by a major sell-off.

In contrast, Morgan Stanley is forecasting a 5–10% pullback in the S&P 500, as tariffs finally begin to impact corporate earnings. However, the bank recommends buying the dip. It believes that within 12 months, the broad index will rise to 7200.

HSBC, Morgan Stanley, and UBS remain bullish on the U.S. stock market. They argue that strong corporate earnings and economic data, growing clarity around tariffs, and tailwinds from artificial intelligence could lift the S&P 500 even higher.

The rally in the broad index could be further fueled by upbeat earnings from Microsoft, Meta Platforms, Apple, and Amazon, as well as GDP growth expected at 2.9% in Q2, according to the Atlanta Fed's leading indicators. Additionally, there's the most significant split within the Fed since 1993. While the Fed is unlikely to cut rates, two dissenting FOMC members could raise expectations for a rate cut in September—great news for U.S. equities.

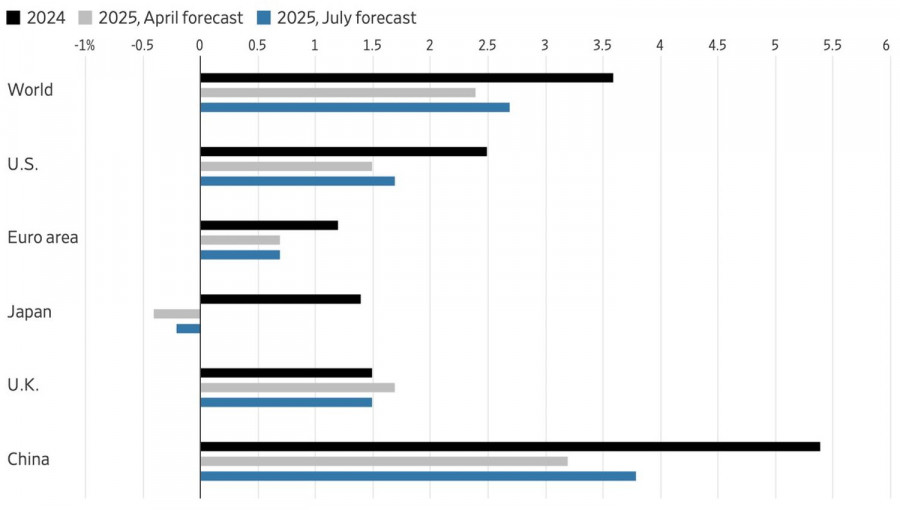

The IMF's optimism regarding the global economic outlook also plays a role. The organization now expects global GDP to grow by 2.7% in 2025 instead of the 2.4% forecast in April. This improvement will be supported by lower tariffs than those previously announced by Trump on America's Independence Day. The U.S. economy is projected to grow by 1.7%. A divergence with the eurozone could redirect capital flows from West to East in the opposite direction, which would support a continued rally in the S&P 500.

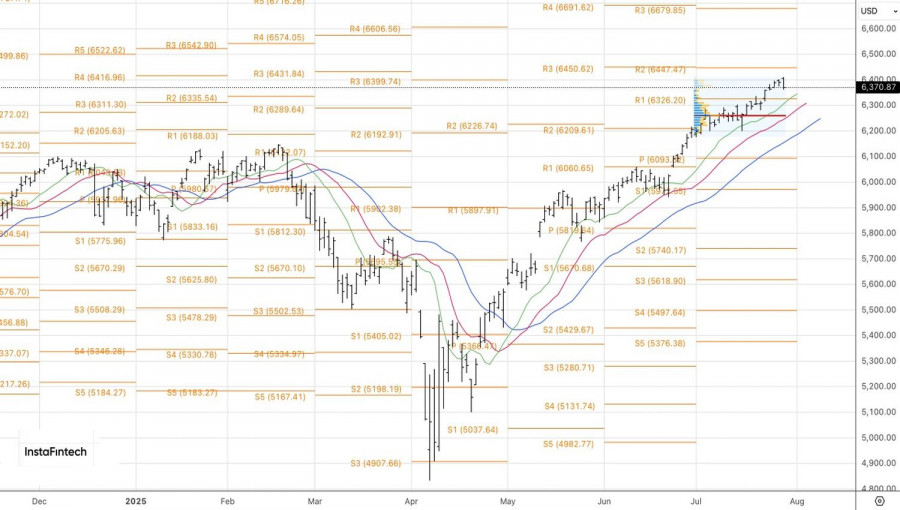

Technically, on the daily chart, the broad index is undergoing a pullback within an uptrend. However, the S&P 500 continues to trade above the pivot level at 6325 and its fair value at 6255. A rebound from these support levels could serve as a basis for opening long positions.

QUICK LINKS