The first test of the 1.1635 price occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.1635, with the MACD in the oversold zone, confirmed the correct entry point for buying the euro under scenario No. 2, which resulted in a rise of more than 30 points.

Apart from the Friday speech by Federal Reserve representative Alberto Musalem, there was little else to focus on. However, due to his restrained comments on the next steps in monetary policy, it appears that investors are taking a more wait-and-see approach, looking for clearer signals from Fed Chair Jerome Powell himself. Musalem, in particular, pointed to persistent inflation and the need for a thorough review of economic data before making new decisions. This measured tone contained no revelations, leading to a fairly muted market reaction.

Today, Italy's foreign trade balance data is expected, and this sole event will certainly attract traders' attention. With reduced volatility in financial markets due to uncertainty surrounding European Central Bank and Fed monetary policy, any economic indicator gains significance. A positive Italian trade balance, reflecting exports exceeding imports, could be a bullish signal for the euro. It would indicate the competitiveness of the Italian economy and its ability to perform successfully under global competition. Investors would likely see this as confirmation of the eurozone's resilience and a reason for strengthening the single currency. However, one should not overestimate the impact of a single indicator. The trade balance is only part of the broader picture, and other factors—such as inflation, interest rates, political stability, and investor sentiment—must also be considered.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

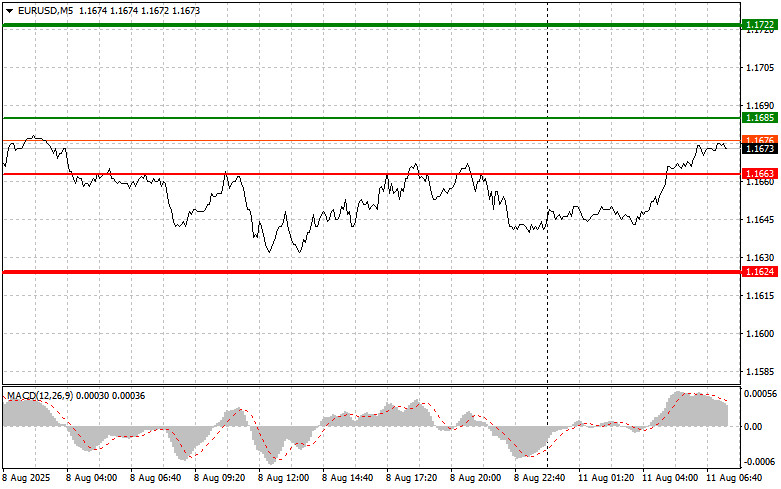

Scenario No. 1: Today, I plan to buy the euro if the price reaches around 1.1685 (green line on the chart) with the goal of rising to 1.1722. At 1.1722, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35-point move from the entry point. The expected rise in the euro would be within the current upward trend. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1663 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.1685 and 1.1722 can be expected.

Scenario No. 1: I plan to sell the euro after it reaches the 1.1663 level (red line on the chart). The target will be 1.1624, where I plan to exit the market and immediately buy in the opposite direction, aiming for a 20–25-point move from that level. Significant pressure on the pair is unlikely to return today. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1685 price level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1663 and 1.1624 can be expected.

QUICK LINKS